Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When should a transfer of receivables be recorded as a sale? The transferred assets are isolated from the transferor. The transferor maintains effective control over

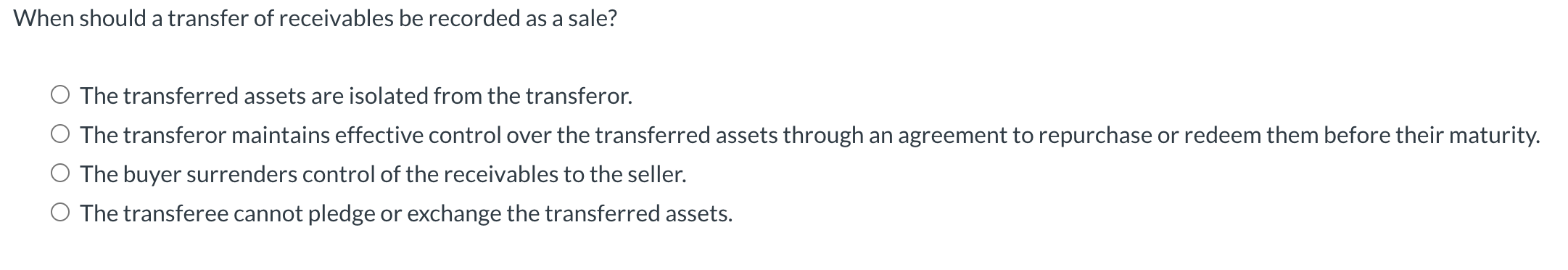

When should a transfer of receivables be recorded as a sale?

The transferred assets are isolated from the transferor.

The transferor maintains effective control over the transferred assets through an agreement to repurchase or redeem them before their maturity.

The buyer surrenders control of the receivables to the seller.

The transferee cannot pledge or exchange the transferred assets.Why would a company sell receivables to another company?

To comply with customer agreements.

To limit its legal liability.

To improve the quality of its creditgranting process.

To accelerate access to amounts collected.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started