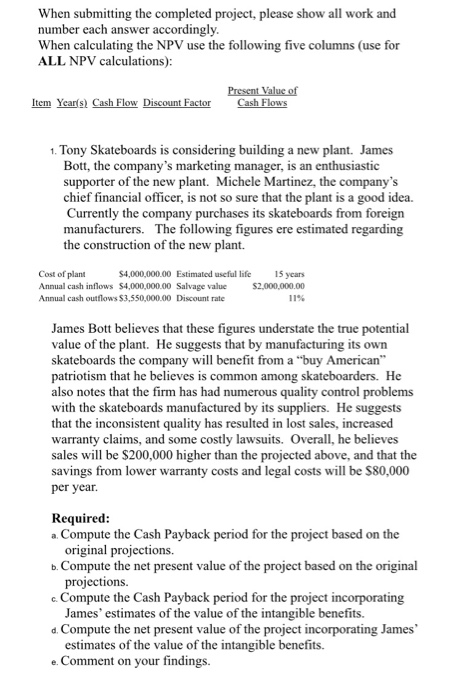

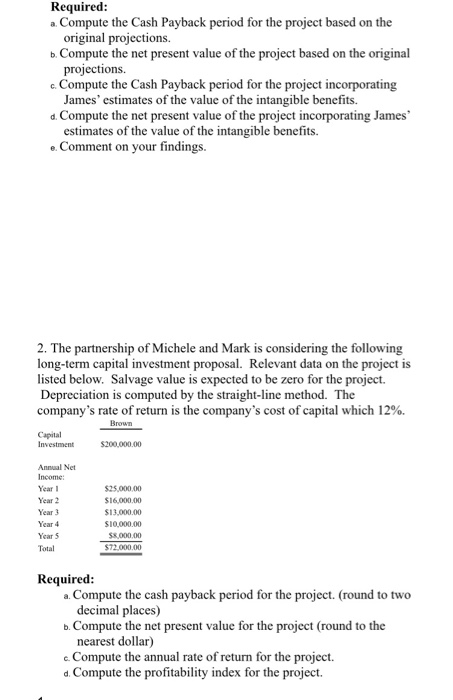

When submitting the completed project, please show all work and number each answer accordingly. When calculating the NPV use the following five columns (use for ALL NPV calculations): Item Year(s) Cash Flow Discount Factor Present Value of Cash Flows 1. Tony Skateboards is considering building a new plant. James Bott, the company's marketing manager, is an enthusiastic supporter of the new plant. Michele Martinez, the company's chief financial officer, is not so sure that the plant is a good idea. Currently the company purchases its skateboards from foreign manufacturers. The following figures ere estimated regarding the construction of the new plant. Cost of plant $4,000,000.00 Estimated useful life 15 years Annual cash inflows $4,000,000.00 Salvage value $2,000,000.00 Annual cash outflows $3.550,000.00 Discount rate 11% James Bott believes that these figures understate the true potential value of the plant. He suggests that by manufacturing its own skateboards the company will benefit from a "buy American patriotism that he believes is common among skateboarders. He also notes that the firm has had numerous quality control problems with the skateboards manufactured by its suppliers. He suggests that the inconsistent quality has resulted in lost sales, increased warranty claims, and some costly lawsuits. Overall, he believes sales will be $200,000 higher than the projected above, and that the savings from lower warranty costs and legal costs will be $80,000 per year. Required: a Compute the Cash Payback period for the project based on the original projections. b. Compute the net present value of the project based on the original projections. o. Compute the Cash Payback period for the project incorporating James' estimates of the value of the intangible benefits. d. Compute the net present value of the project incorporating James estimates of the value of the intangible benefits. e. Comment on your findings. Required: a Compute the Cash Payback period for the project based on the original projections. b. Compute the net present value of the project based on the original projections. c. Compute the Cash Payback period for the project incorporating James' estimates of the value of the intangible benefits. d. Compute the net present value of the project incorporating James estimates of the value of the intangible benefits. e. Comment on your findings. 2. The partnership of Michele and Mark is considering the following long-term capital investment proposal. Relevant data on the project is listed below. Salvage value is expected to be zero for the project. Depreciation is computed by the straight-line method. The company's rate of return is the company's cost of capital which 12%. Brown Capital Investment $200,000.00 Annual Net Income Year 1 Year 2 Year 3 Year 4 Year 5 Total $25,000.00 $16.000.00 $13.000.00 S10.000,00 S000.00 $72,000.00 Required: Compute the cash payback period for the project. (round to two decimal places) b. Compute the net present value for the project (round to the nearest dollar) e. Compute the annual rate of return for the project. d. Compute the profitability index for the project