Answered step by step

Verified Expert Solution

Question

1 Approved Answer

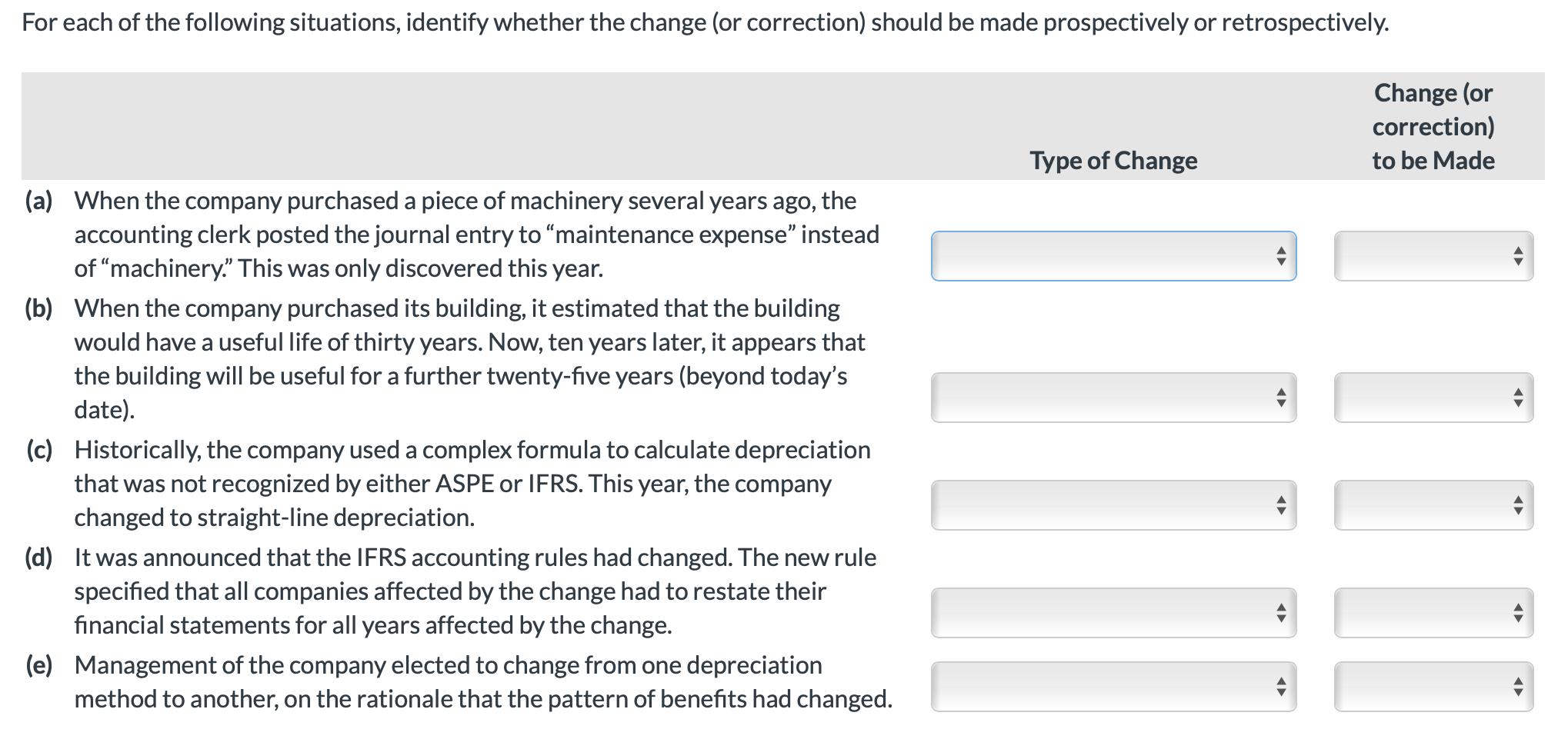

OPTIONS Type of Change : Correction of a Prior Period Error, Change in Accounting Estimate, Change in Accounting Policy Change (or correction) to be Made

OPTIONS

Type of Change: Correction of a Prior Period Error, Change in Accounting Estimate, Change in Accounting Policy

Change (or correction) to be Made: Prospectively, Retrospectively

Please help thanks so much

For each of the following situations, identify whether the change (or correction) should be made prospectively or retrospectively. Change (or correction) Type of Change to be Made (a) When the company purchased a piece of machinery several years ago, the accounting clerk posted the journal entry to "maintenance expense" instead of "machinery." This was only discovered this year. (b) When the company purchased its building, it estimated that the building would have a useful life of thirty years. Now, ten years later, it appears that the building will be useful for a further twenty-five years (beyond today's date). (c) Historically, the company used a complex formula to calculate depreciation that was not recognized by either ASPE or IFRS. This year, the company changed to straight-line depreciation. (d) It was announced that the IFRS accounting rules had changed. The new rule specified that all companies affected by the change had to restate their financial statements for all years affected by the change. (e) Management of the company elected to change from one depreciation method to another, on the rationale that the pattern of benefits had changed.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started