Answered step by step

Verified Expert Solution

Question

1 Approved Answer

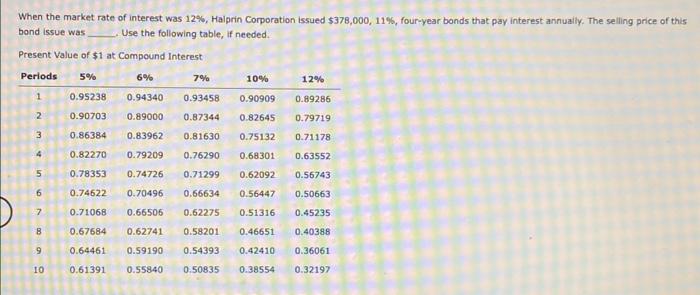

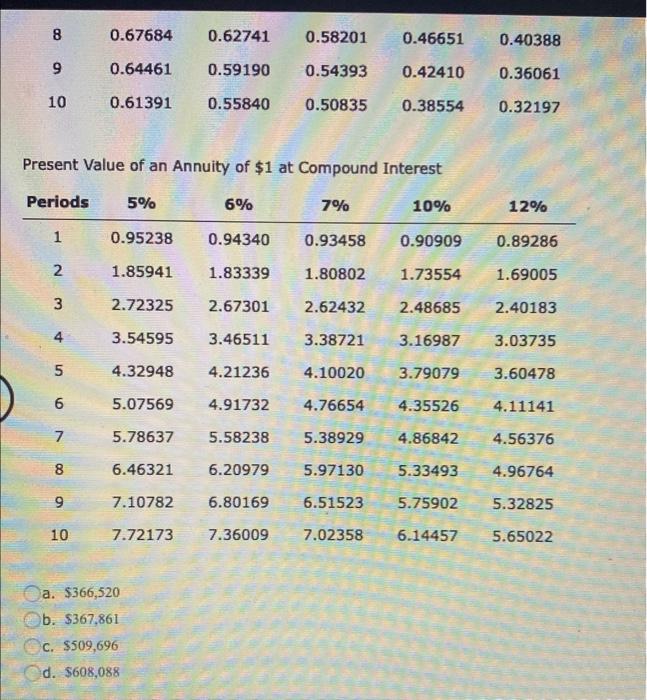

When the market rate of interest was 12%, Halprin Corporation issued $378,000, 11%, four-year bonds that pay interest annually. The selling price of this

When the market rate of interest was 12%, Halprin Corporation issued $378,000, 11%, four-year bonds that pay interest annually. The selling price of this bond issue was Use the following table, if needed. Present Value of $1 at Compound Interest Periods 5% 1 2 3 4 5 6 7 8 9 10 6% 7% 0.95238 0.94340 0.93458 0.90703 0.89000 0.87344 0.86384 0.83962 0.81630 0.82270 0.79209 0.76290 0.78353 0.74726 0.71299 0.74622 0.70496 0.66634 0.56447 0.50663 0.71068 0.66506 0.62275 0.51316 0.45235 0.58201 0.46651 0.40388 0.54393 0.42410 0.36061 0.32197 0.6 0.64461 0.59190 0.61391 10% 0.90909 0.82645 0.75132 12% 0.89286 0.79719 0.71178 0.68301 0.63552 0.62092 0.56743 0.55840 0.50835 0.38554 8 9 10 2 3 4 Present Value of an Annuity of $1 at Compound Interest Periods 5% 1 5 6 7 8 9 0.67684 10 0.62741 0.58201 0.46651 0.54393 0.42410 0.50835 0.38554 0.64461 0.59190 0.61391 0.55840 a. $366,520 b. $367,861 C. $509,696 d. $608,088 6% 7% 0.95238 0.94340 1.85941 1.83339 2.72325 2.67301 2.62432 3.54595 3.46511 3.38721 4.32948 4.21236 5.07569 4.91732 4.76654 5.78637 5.58238 5.38929 4.86842 6.46321 6.20979 5.97130 5.33493 7.10782 6.80169 6.51523 5.75902 7.72173 7.36009 7.02358 6.14457 10% 0.93458 0.90909 1.80802 1.73554 2.48685 3.16987 3.79079 4.10020 4.35526 0.40388 0.36061 0.32197 12% 0.89286 1.69005 2.40183 3.03735 3.60478 4.11141 4.56376 4.96764 5.32825 5.65022

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the selling price of the bond issue we need to use the present value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started