Answered step by step

Verified Expert Solution

Question

1 Approved Answer

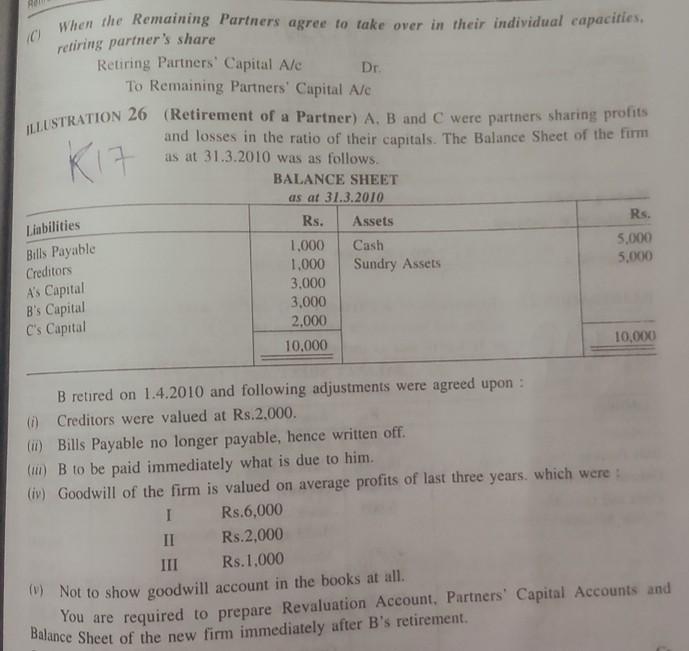

when the Remaining Partners agree to take over in their individual capacities. retiring partner's share Retiring Partners Capital Ale Dr. To Remaining Partners' Capital Ale

when the Remaining Partners agree to take over in their individual capacities. retiring partner's share Retiring Partners Capital Ale Dr. To Remaining Partners' Capital Ale ILLUSTRATION 26 (Retirement of a Partner) A. B and C were partners sharing profits and losses in the ratio of their capitals. The Balance Sheet of the firm as at 31.3.2010 was as follows. BALANCE SHEET as at 31.3.2010 Rs. Assets Rs. 1,000 Cash 5.000 1,000 Sundry Assets 5.000 3.000 B's Capital 3.000 C's Capital 2.000 10,000 10,000 K Liabilities Bills Payable Creditors A's Capital B retired on 1.4.2010 and following adjustments were agreed upon : (1) Creditors were valued at Rs.2.000. (in) Bills Payable no longer payable, hence written off. (in) B to be paid immediately what is due to him. (iv) Goodwill of the firm is valued on average profits of last three years, which were: I Rs.6,000 II Rs.2.000 III Rs.1,000 Not to show goodwill account in the books at all. You are required to prepare Revaluation Account, Partners' Capital Accounts and Balance Sheet of the new firm immediately after B's retirement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started