Question

When the stock ends up at $38 two weeks from now, the call will be worth $....... One week from now with the stock at

When the stock ends up at $38 two weeks from now, the call will be worth $.......

One week from now with the stock at 44 and the possibility of going up to 50 or down to 38 over the following week, the call is worth $................

What is the price of the call today? Call = $ ........................

You sold a call on one share. Your delta hedge will cause you to borrow $..................... net of the premium you received.

One period later when the stock drops to $44, you adjust your delta hedge. After the re-hedging, your net borrowing is $...........................

One period later, the stock goes up to $56 instead. At that time, your delta will change. To cover the change in the delta, you will borrow additional $ ................. to spend it on buying more shares.

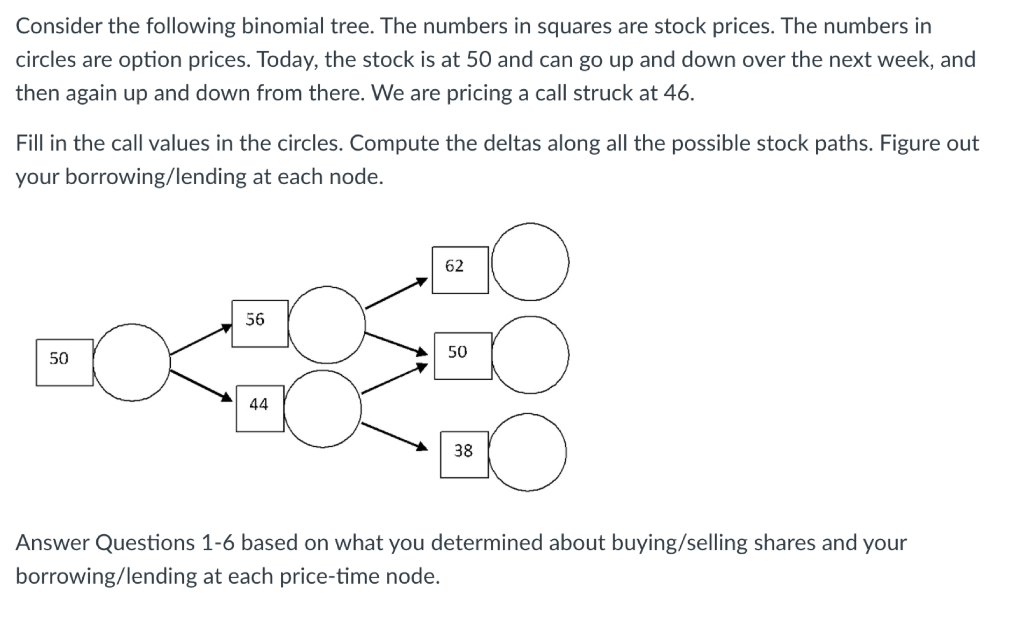

Consider the following binomial tree. The numbers in squares are stock prices. The numbers in circles are option prices. Today, the stock is at 50 and can go up and down over the next week, and then again up and down from there. We are pricing a call struck at 46. Fill in the call values in the circles. Compute the deltas along all the possible stock paths. Figure out your borrowing/lending at each node. 62 56 2005 50 50 44 38 Answer Questions 1-6 based on what you determined about buying/selling shares and your borrowing/lending at each price-time node. Consider the following binomial tree. The numbers in squares are stock prices. The numbers in circles are option prices. Today, the stock is at 50 and can go up and down over the next week, and then again up and down from there. We are pricing a call struck at 46. Fill in the call values in the circles. Compute the deltas along all the possible stock paths. Figure out your borrowing/lending at each node. 62 56 2005 50 50 44 38 Answer Questions 1-6 based on what you determined about buying/selling shares and your borrowing/lending at each price-time nodeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started