when these figures were published, what was the founder stake worth to the nearest million?

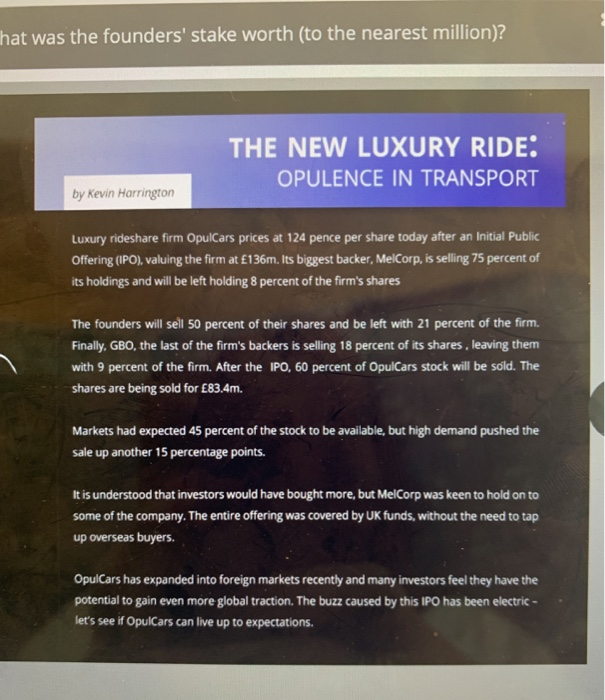

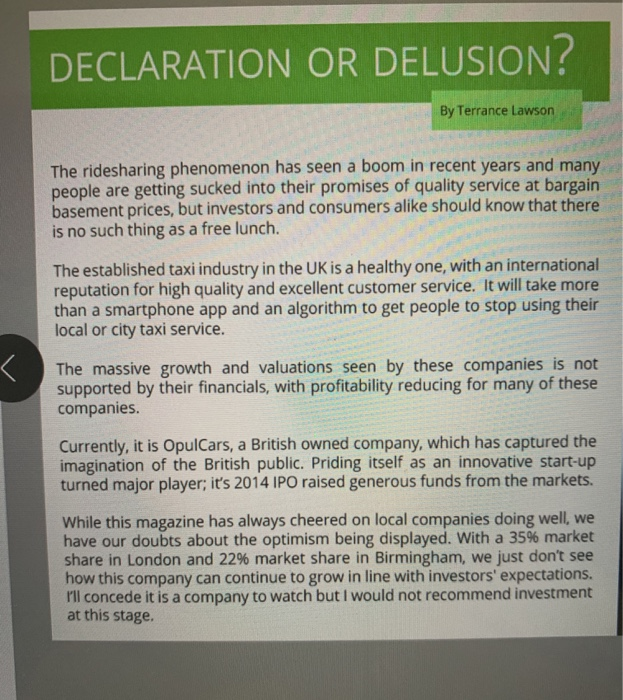

(Question 3 of 26) When these figures were published, what was the founders' stake worth (to the nearest million)? OpulCars is a small luxury ridershare company. We were founded in 2010 by a team of data scientists from the United Kingdom. Our mission is to change people's experience of transport moving away from mere convenience and practicality into a luxurious and unforgettable experience, allowing everyday individuals to arrive at their destination in style. We began life as a small start-up and have grown into a publicly traded company, after our Initial Public Offering in 2014. After our floatation, we have continued to grow in the U.K., and our current share price is 152 pence at time of publication. Close hat was the founders' stake worth (to the nearest million)? THE NEW LUXURY RIDE: OPULENCE IN TRANSPORT by Kevin Harrington Luxury rideshare firm OpulCars prices at 124 pence per share today after an Initial Public Offering (IPO), valuing the firm at 136m. Its biggest backer, MelCorp, is selling 75 percent of its holdings and will be left holding 8 percent of the firm's shares The founders will sell 50 percent of their shares and be left with 21 percent of the firm. Finally, GBO, the last of the firm's backers is selling 18 percent of its shares , leaving them with 9 percent of the firm. After the IPO, 60 percent of OpulCars stock will be sold. The shares are being sold for 83.4m. Markets had expected 45 percent of the stock to be available, but high demand pushed the sale up another 15 percentage points. It is understood that investors would have bought more, but MelCorp was keen to hold on to some of the company. The entire offering was covered by UK funds, without the need to tap up overseas buyers. OpulCars has expanded into foreign markets recently and many investors feel they have the potential to gain even more global traction. The buzz caused by this IPO has been electric - let's see if OpulCars can live up to expectations. DECLARATION OR DELUSION? By Terrance Lawson The ridesharing phenomenon has seen a boom in recent years and many people are getting sucked into their promises of quality service at bargain basement prices, but investors and consumers alike should know that there is no such thing as a free lunch. The established taxi industry in the UK is a healthy one, with an international reputation for high quality and excellent customer service. It will take more than a smartphone app and an algorithm to get people to stop using their local or city taxi service. The massive growth and valuations seen by these companies is not supported by their financials, with profitability reducing for many of these companies. Currently, it is OpulCars, a British owned company, which has captured the imagination of the British public. Priding itself as an innovative start-up turned major player; it's 2014 IPO raised generous funds from the markets. While this magazine has always cheered on local companies doing well, we have our doubts about the optimism being displayed. With a 35% market share in London and 22% market share in Birmingham, we just don't see how this company can continue to grow in line with investors' expectations. rll concede it is a company to watch but I would not recommend investment at this stage. (Question 3 of 26) When these figures were published, what was the founders' stake worth (to the nearest million)? Please select the correct answer from the options available below. Please note, there are multiple sources of information, which you can scroll through. Click on the images to enlarge them. 13 million 16 million 29 million 31 million None of the above