Question

When trying to calculate step 2 and step 3 in the table 6.2 below (see the pic below), if I convert the %'s to decimals

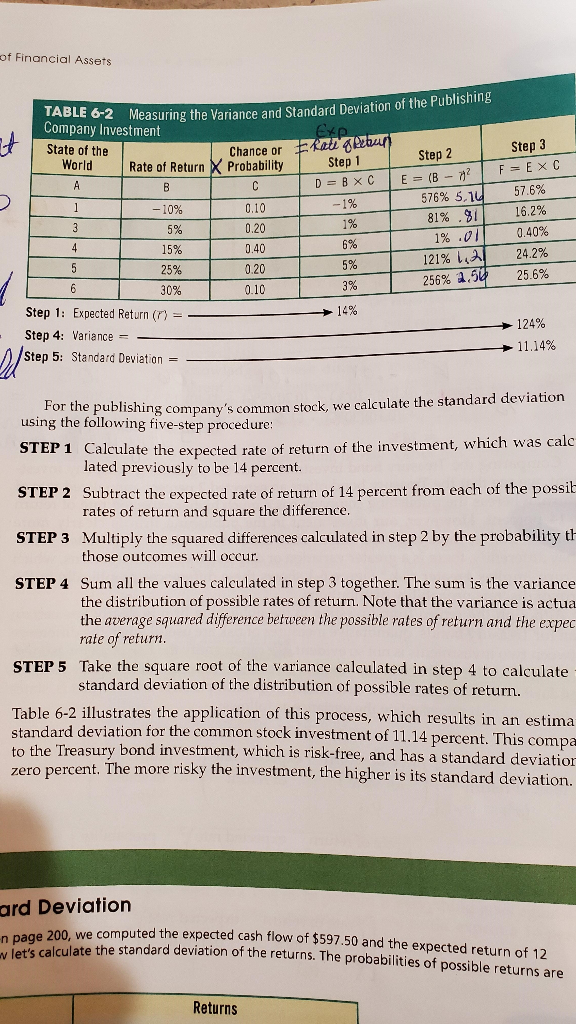

When trying to calculate step 2 and step 3 in the table 6.2 below (see the pic below), if I convert the %'s to decimals or leave them as %'s why are my numbers so far off? When calculating variances should I not convert to the percentages to decimals?. For example - when I calculate the variance for state 1 if r = 14%. This is how I would calculate it and it doesn't even work in Excel. Also, is there a formula in Excel to calculate these variances? I cannot seem to find one.

-10%-14%= -24%

-24% squared = 5.76% variance. (The book has the variance as 576%)

If I instead perform the same calculations and convert everything to decimals in my calculations, here is what I get:

-.10-.14= -0.24

-0.24 squared = .0576 or 5.76% variance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started