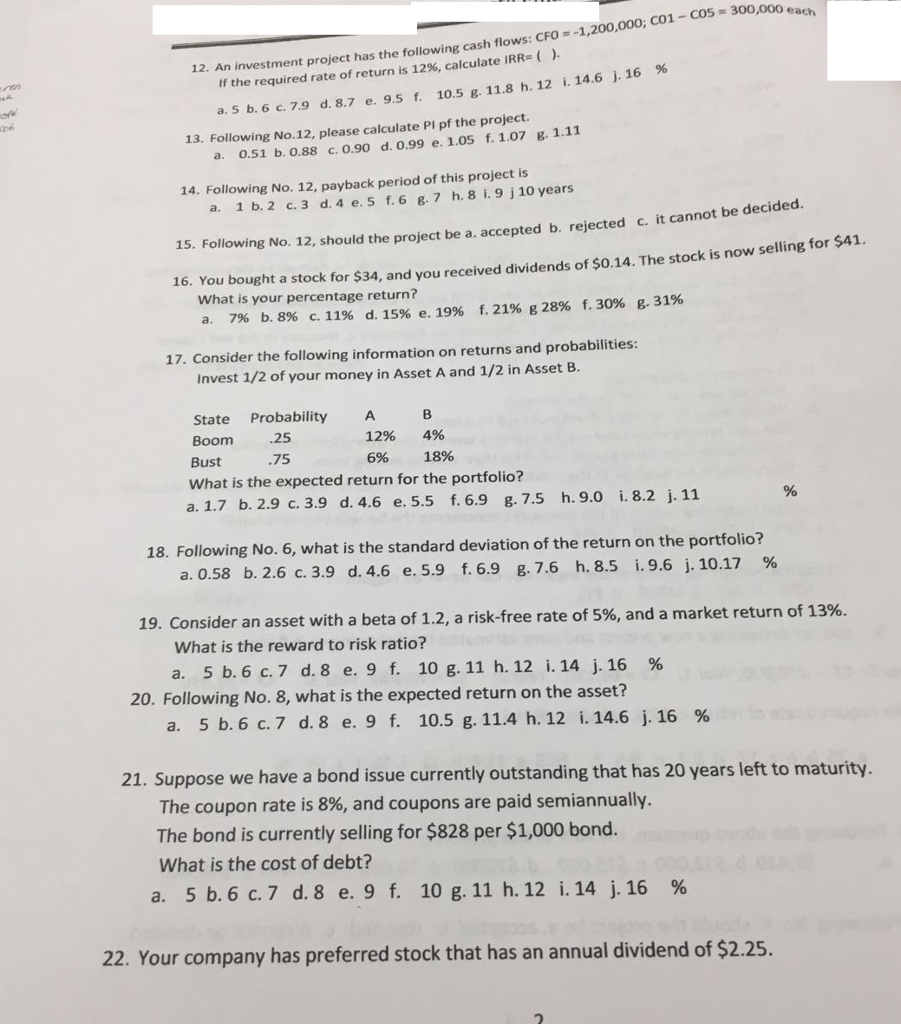

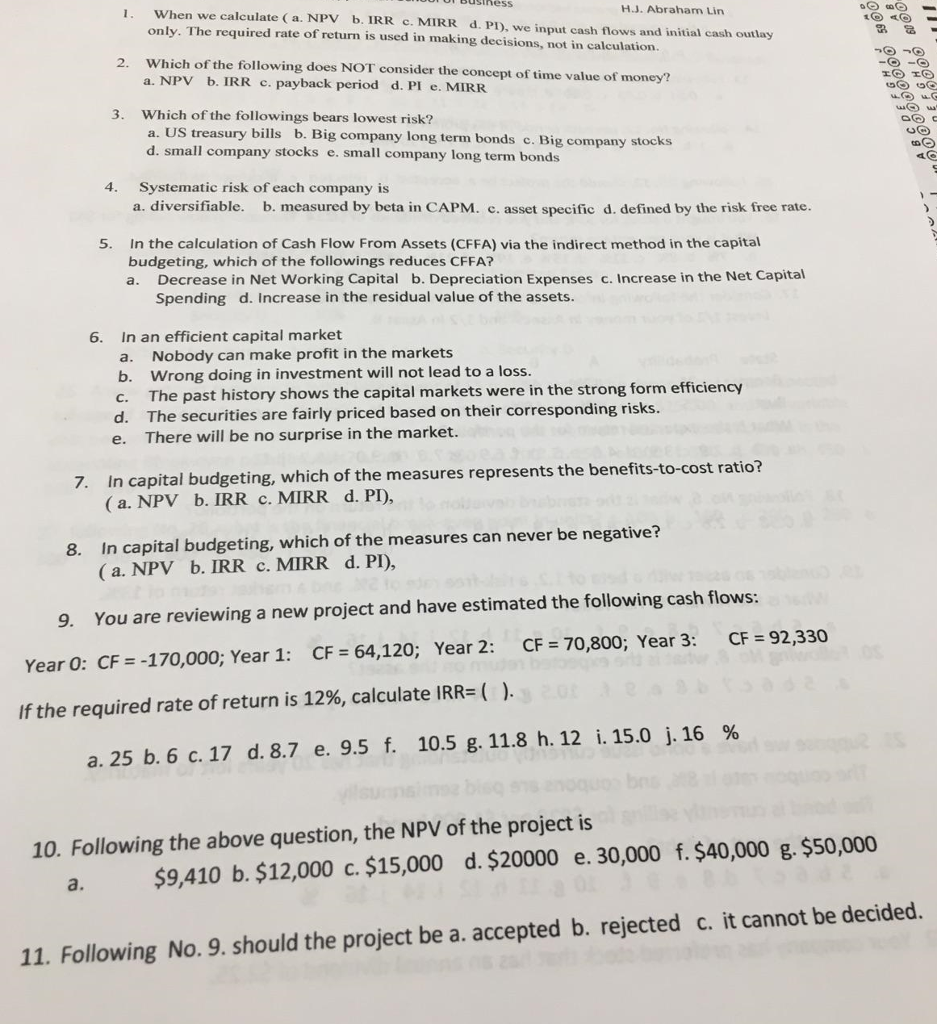

When we calculate (a. NPV b. IRR c. MIRR d. PI), we input cash flows and initial cash outlay only. The required rate of return is used in making decision, not in calculation. Which of the following does NOT consider the concept of the time value of money? A. NPV b. IRR c. payback period d PI e. MIRR Which of the followings bears lowest risk? A. Use treasury bills b. Big company long term bonds c. Big company stocks d. small company stocks e. small company long term bonds System risk of each company is a. diverifiable. B. measured by beat in CAPM. C. asset specific d. defined by the risk free rate. In the calculation of Cash Flow From Assets (CFFA) via the indirect method in the capital budgeting, which of the following reduces CFFA? A. Decrease in Net Working Capital b. Depreciation Expenses c. Increase in the Net Capital Spending d. Increase in the residual value of the assets. In an efficient capital market a. Nobody can make profit in the markets b. Wrong doing in investment will not lead ti a loss. C. The past history shows the capital markets were in the strong from efficiency d. The securities are fairly priced based on their corresponding risks. E. There will be no surprise in the market. In capital budgeting, which of the measures represents the benefits-to-cost ratio? (a. NPV b. IRR c. MIRR d. PI), You are reviewing a new project and have estimated the following cash flows: Year 0: CF = -170,000; Year 1: CF = 64, 120; Year 2: CF = 70, 800; Year 3: CF = 92, 330 If the required rate of return is 12%, calculate IRR = (). A. 25 b. 6 c. 17 d. 9.5 f. 10.5 g. 11.8 h. 12 i. 15.0 j. 16% Following the above question, the NPV of the project is a. $9, 410 b. $12,000 c. $15,000 d. $20000 e. 30,000 f. $40,000 g. $50,000 Following No. 9. Should the project be a. accepted b. rejected c. it cannot be decided. An investment project has the following cash flows: CFO = -1, 200,000; C01 - C05 = 300,000 each If the required rate of return is 12%, calculate IRR = (). a. 5 b. 6 c. 7.9 d. 8.7 e. 9.5 f 10.5 g. 11.8 h. 12 i. 14.6 j.16% Following No.12, please calculate PI pf the project. a. 0.15 b. 0.88 c. 0.90 d. 0.99 e. 1.05 f, 1.07 g.1.11 Following No. 12, payback period of this project is years a. 1 b. 2 c. 3 d. 4 e. 5 f. 6 g. 7 h. 8 i. 9 j 10 years Following No. 12, should the project be a. accepted b. rejected it cannot be decided. What is your percentage return? a. 7% b. 8% c. 11% d. 15% e. 19% f. 21% g. 28% f. 30% g. 31% Consider the following information on returns and probabilities: Invest 1/2 of your money in Asset A and 1/2 in Asset B What is the expected return for the portfolio? a. 1.7 b. 2.9 c. 3.9 d. 4.6 e. 5.5 f. 6.9 g. 7.5 h. 9.0 i. 8.2 j.11 Following No. 6, what is the standard deviation of the return on the portfolio? a. 0.58 b. 2.6 c. 3.9 d. 4.6 e. 5.9 f. 6.9 g. 7.6 h. 8.5 i. 9.6 j. 10.17 Consider an asset with a beta of 1.2, a risk-free rate of 5%, and a market return of 13%. hat is the reward to risk ratio? a. 5 b. 6 c. 7 d. 8 e. 9 f. 10 g. 11 h. 12 i 14 j. 16% Following No. 8, what is the expected return on the asset? a. 5 b. 6 c. 7 d. 8 e. 9 f. 10.5 g. 11.4 h. 12 i. 14.6 j. 16% Suppose we have a bond issue currently outstanding that has 20 years left to maturity. The coupon rate is 8%, and coupons are paid semiannually. The bond is currently selling for $828 per $1,000 bond. What is the cost of debt? a. 5 b. 6 c. 7 d. 8 e. 9 f. 10 g. 11 h. 12 i 14 j. 16 % Your company has preferred stock that has an annual dividend of $2.25