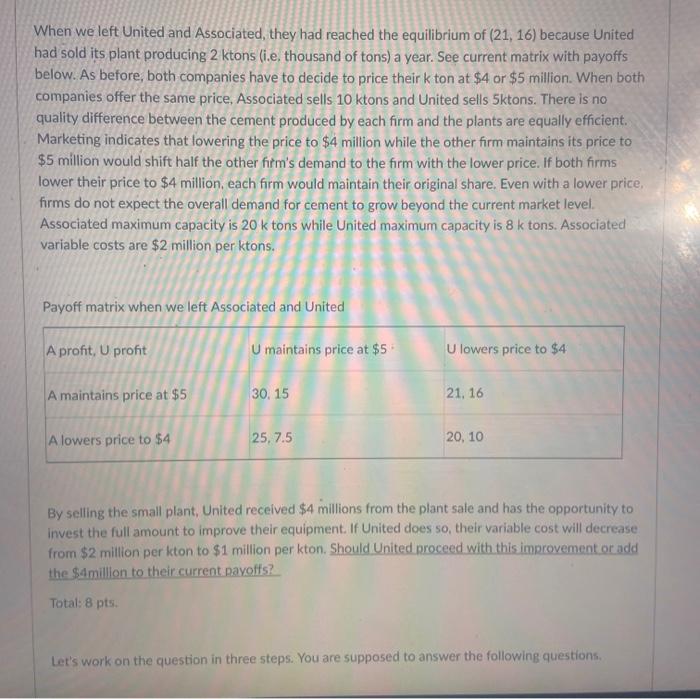

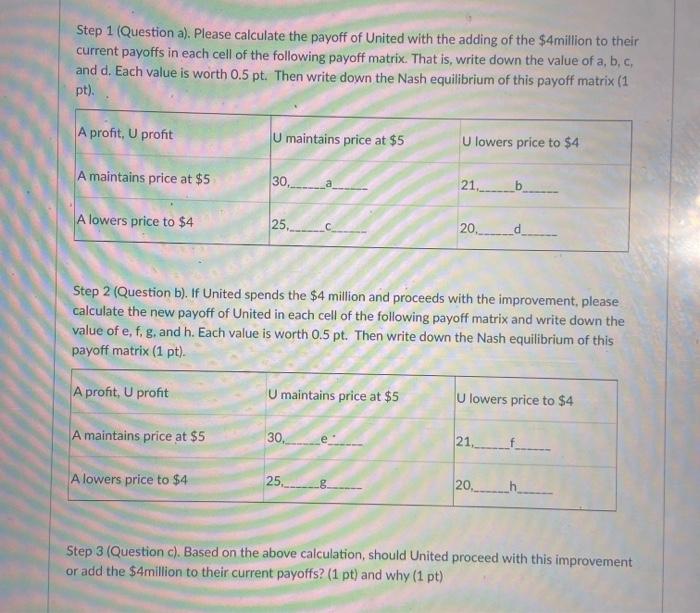

When we left United and Associated, they had reached the equilibrium of (21. 16) because United had sold its plant producing 2 ktons (i.e. thousand of tons) a year. See current matrix with payoffs below. As before, both companies have to decide to price their k ton at $4 or $5 million. When both companies offer the same price, Associated sells 10 ktons and United sells 5ktons. There is no quality difference between the cement produced by each firm and the plants are equally efficient Marketing indicates that lowering the price to $4 million while the other form maintains its price to $5 million would shift half the other film's demand to the firm with the lower price. If both firms lower their price to $4 million, each firm would maintain their original share. Even with a lower price, firms do not expect the overall demand for cement to grow beyond the current market level. Associated maximum capacity is 20 k tons while United maximum capacity is 8 k tons. Associated variable costs are $2 million per ktons. Payoff matrix when we left Associated and United A profit, U profit U maintains price at $5 U lowers price to $4 A maintains price at $5 30, 15 21.16 A lowers price to $4 25, 7.5 20, 10 By selling the small plant, United received $4 millions from the plant sale and has the opportunity to Invest the full amount to improve their equipment. If United does so, their variable cost will decrease from $2 million per kton to $1 million per kton. Should United proceed with this improvement or add the $4million to their current payoffs? Total: 8 pts. Let's work on the question in three steps. You are supposed to answer the following questions, Step 1 (Question a). Please calculate the payoff of United with the adding of the $4million to their current payoffs in each cell of the following payoff matrix. That is, write down the value of a, b, c, and d. Each value is worth 0.5 pt. Then write down the Nash equilibrium of this payoff matrix (1 pt). A profit. U profit U maintains price at $5 U lowers price to $4 A maintains price at $5 30, 21. b A lowers price to $4 25.____ 20. d Step 2 (Question b). If United spends the $4 million and proceeds with the improvement, please calculate the new payoff of United in each cell of the following payoff matrix and write down the value of e, f, g, and h. Each value is worth 0.5 pt. Then write down the Nash equilibrium of this payoff matrix (1 pt). A profit, U profit U maintains price at $5 U lowers price to $4 A maintains price at $5 30, 21, Alowers price to $4 25.______ 20. Step 3 (Question c). Based on the above calculation, should United proceed with this improvement or add the $4million to their current payoffs? (1 pt) and why (1 pt) When we left United and Associated, they had reached the equilibrium of (21. 16) because United had sold its plant producing 2 ktons (i.e. thousand of tons) a year. See current matrix with payoffs below. As before, both companies have to decide to price their k ton at $4 or $5 million. When both companies offer the same price, Associated sells 10 ktons and United sells 5ktons. There is no quality difference between the cement produced by each firm and the plants are equally efficient Marketing indicates that lowering the price to $4 million while the other form maintains its price to $5 million would shift half the other film's demand to the firm with the lower price. If both firms lower their price to $4 million, each firm would maintain their original share. Even with a lower price, firms do not expect the overall demand for cement to grow beyond the current market level. Associated maximum capacity is 20 k tons while United maximum capacity is 8 k tons. Associated variable costs are $2 million per ktons. Payoff matrix when we left Associated and United A profit, U profit U maintains price at $5 U lowers price to $4 A maintains price at $5 30, 15 21.16 A lowers price to $4 25, 7.5 20, 10 By selling the small plant, United received $4 millions from the plant sale and has the opportunity to Invest the full amount to improve their equipment. If United does so, their variable cost will decrease from $2 million per kton to $1 million per kton. Should United proceed with this improvement or add the $4million to their current payoffs? Total: 8 pts. Let's work on the question in three steps. You are supposed to answer the following questions, Step 1 (Question a). Please calculate the payoff of United with the adding of the $4million to their current payoffs in each cell of the following payoff matrix. That is, write down the value of a, b, c, and d. Each value is worth 0.5 pt. Then write down the Nash equilibrium of this payoff matrix (1 pt). A profit. U profit U maintains price at $5 U lowers price to $4 A maintains price at $5 30, 21. b A lowers price to $4 25.____ 20. d Step 2 (Question b). If United spends the $4 million and proceeds with the improvement, please calculate the new payoff of United in each cell of the following payoff matrix and write down the value of e, f, g, and h. Each value is worth 0.5 pt. Then write down the Nash equilibrium of this payoff matrix (1 pt). A profit, U profit U maintains price at $5 U lowers price to $4 A maintains price at $5 30, 21, Alowers price to $4 25.______ 20. Step 3 (Question c). Based on the above calculation, should United proceed with this improvement or add the $4million to their current payoffs? (1 pt) and why (1 pt)