Question

Yellowknife Mining has 80 million shares that are currently trading for $4 per share and $110 million worth of debt. The debt is risk

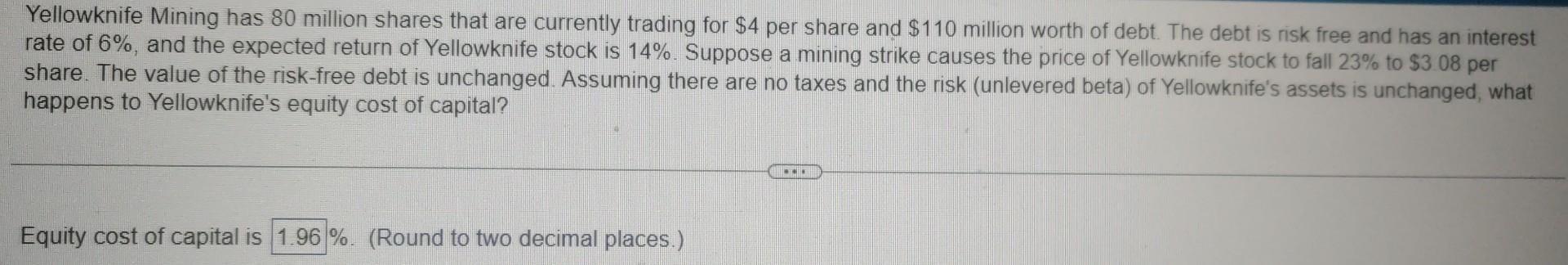

Yellowknife Mining has 80 million shares that are currently trading for $4 per share and $110 million worth of debt. The debt is risk free and has an interest rate of 6%, and the expected return of Yellowknife stock is 14%. Suppose a mining strike causes the price of Yellowknife stock to fall 23% to $3.08 per share. The value of the risk-free debt is unchanged. Assuming there are no taxes and the risk (unlevered beta) of Yellowknife's assets is unchanged, what happens to Yellowknife's equity cost of capital? Equity cost of capital is 1.96 %. (Round to two decimal places.) www

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Debt D 80 million Equity E 80 4 320 weight of debt ud we...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Algebra and Trigonometry

Authors: Ron Larson

10th edition

9781337514255, 1337271179, 133751425X, 978-1337271172

Students also viewed these Physics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App