Answered step by step

Verified Expert Solution

Question

1 Approved Answer

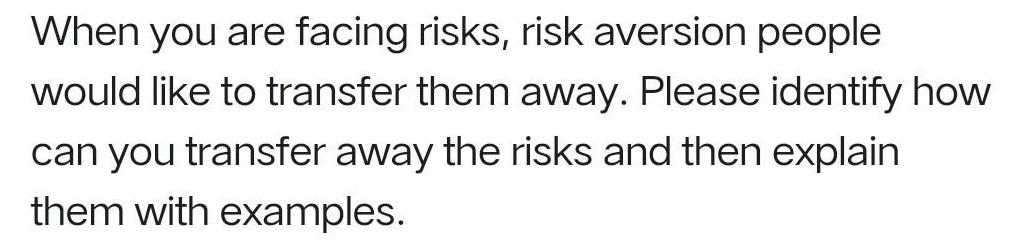

When you are facing risks, risk aversion people would like to transfer them away. Please identify how can you transfer away the risks and

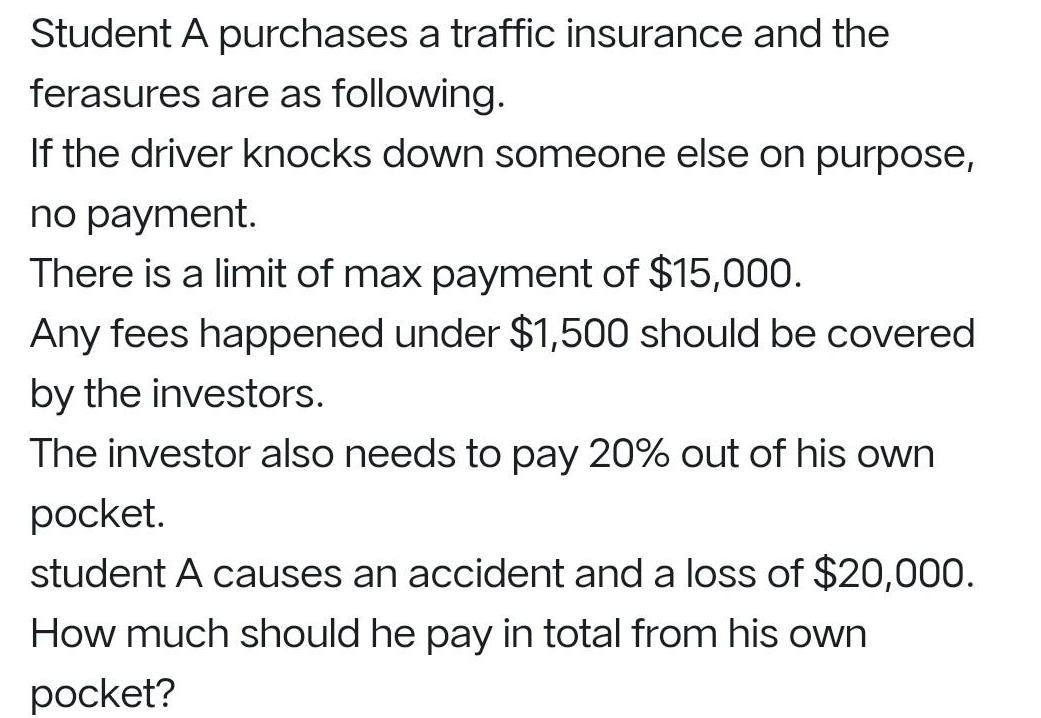

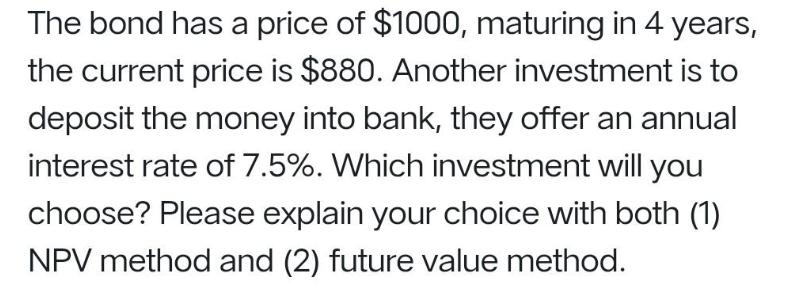

When you are facing risks, risk aversion people would like to transfer them away. Please identify how can you transfer away the risks and then explain them with examples. Student A purchases a traffic insurance and the ferasures are as following. If the driver knocks down someone else on purpose, no payment. There is a limit of max payment of $15,000. Any fees happened under $1,500 should be covered. by the investors. The investor also needs to pay 20% out of his own pocket. student A causes an accident and a loss of $20,000. How much should he pay in total from his own pocket? The bond has a price of $1000, maturing in 4 years, the current price is $880. Another investment is to deposit the money into bank, they offer an annual interest rate of 7.5%. Which investment will you choose? Please explain your choice with both (1) NPV method and (2) future value method. If you have USD 4 million on hand and facing the exchange rates as following. How much profit can you earn with arbitrage?

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer Here are the answers to your questions 1 Risk aversion people may transfer away risks through various means such as a Diversification Spreading investments across different asset classes or ind...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started