Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When you borrow money to buy a house or a car, you pay off the loan in monthly payments, but the interest is always accruing

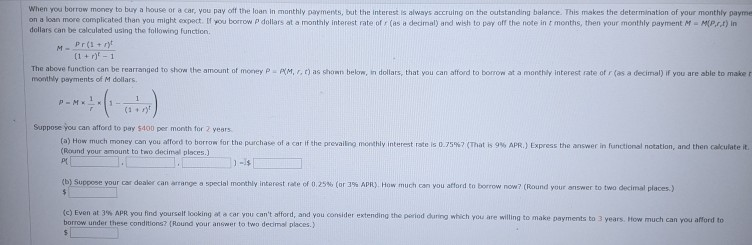

When you borrow money to buy a house or a car, you pay off the loan in monthly payments, but the interest is always accruing on the outstanding balance. This makes the determination of your monthly payme on a loan more complicated than you might expect. If you borrow P dollars at a monthly interest rate ofras decimal) and wish to pay off the note in months, then your monthly payment M = M(Prt) in dollars can be calculated using the following function Pr(+) ( 11 The above function can be rearranged to show the amount of moneyPAM b i n dollars that you can afford to borrow at a monthly interest rate of r a decimal of you are able to make monthly payments of dollars M Suppose you can afford to pay $400 per month for 2 years (a) How much money can you afford to borrow for the purchase of a car if the prevailing monthly interest rates 0.75% (Round your amount to two decimal places) (That is 9 APR) Express the answer in functional notation, and then calculate it (6) Suce your chi del canang i s monthly interested 25 APR). How much you ford to borrow now? (Round your answer to two decimal places) (c) Even at 3 APR you find yourself looking a car you can't afford, and you consider extending the period during which you are willing to make payments to 3 years. How much can you afford to borrow under these conditions (Round your answer to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started