Answered step by step

Verified Expert Solution

Question

1 Approved Answer

When you retire, you want to have a monthly income of $6,000. Your current salary is $75,008 and your employer offers a pension plan

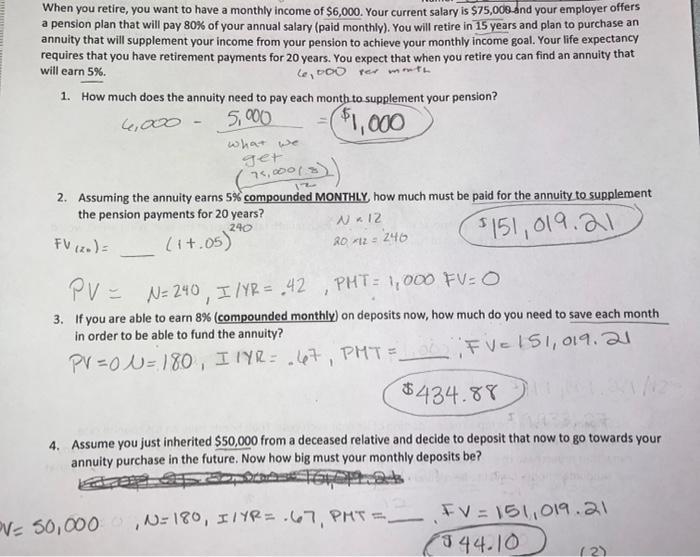

When you retire, you want to have a monthly income of $6,000. Your current salary is $75,008 and your employer offers a pension plan that will pay 80% of your annual salary (paid monthly). You will retire in 15 years and plan to purchase an annuity that will supplement your income from your pension to achieve your monthly income goal. Your life expectancy requires that you have retirement payments for 20 years. You expect that when you retire you can find an annuity that 6e,000 per month will earn 5%. 1. How much does the annuity need to pay each month to supplement your pension? 4,000 5,000 $1,000 what we get 75,000 17 2. Assuming the annuity earns 5% compounded MONTHLY, how much must be paid for the annuity to supplement the pension payments for 20 years? N = 12 240 FV (z=) = (17.05)4 $151, 019.21 2012 = 246 PV = N= 240, I/YR = 42, PMT= 1,000 FV=O 3. If you are able to earn 8% (compounded monthly) on deposits now, how much do you need to save each month in order to be able to fund the annuity? PV =0 U=180, I TYR = 67, PMT=FV= 151, 019.21 $434.88 VISAT 4. Assume you just inherited $50,000 from a deceased relative and decide to deposit that now to go towards your annuity purchase in the future. Now how big must your monthly deposits be? V= 50,000, N=180, I/YR = .67, PMT=FV = 151,019.21 $44.10 (2)

Step by Step Solution

★★★★★

3.64 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Amount to be paid from annuity Amount Monthly pension required Paid by empl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started