Where did 15000 units come from?

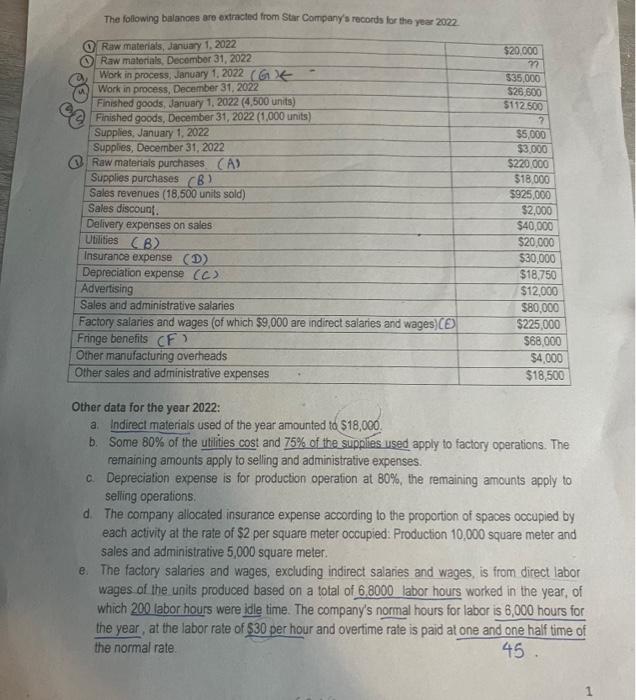

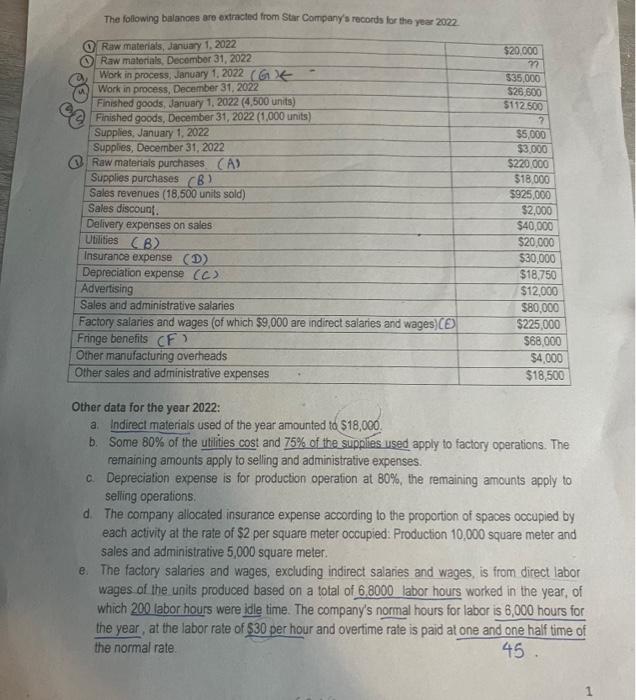

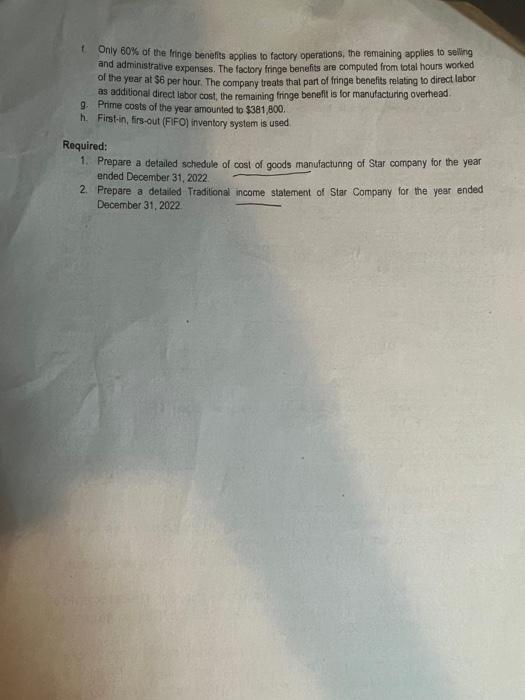

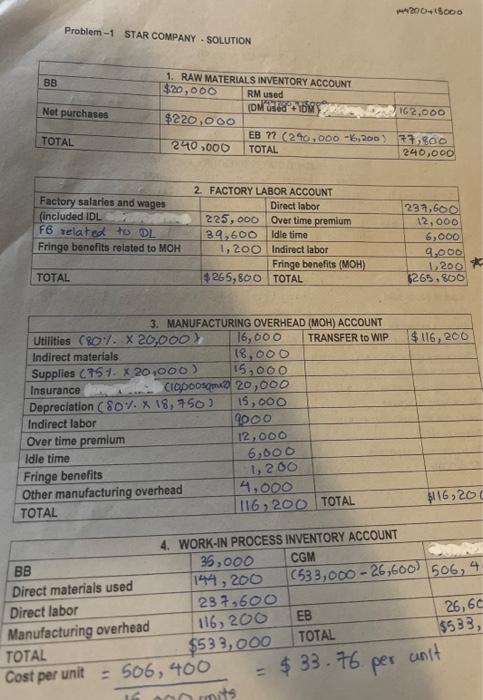

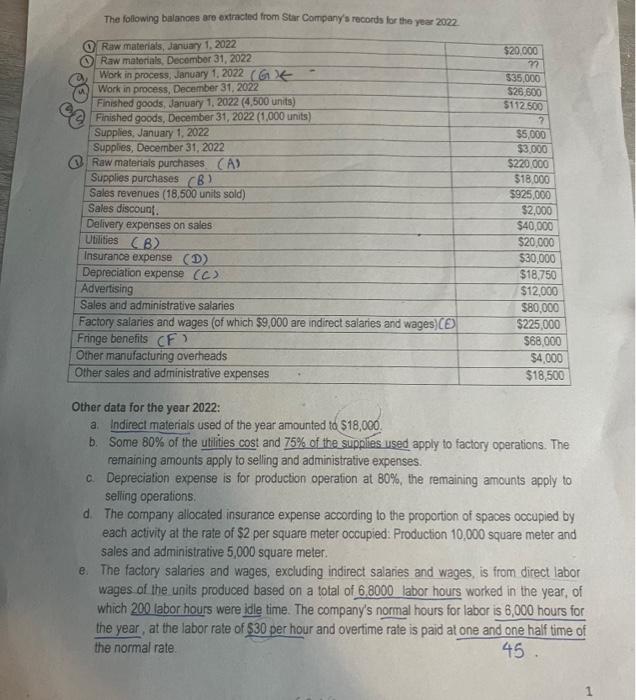

The following balances are extracted from Star Company's records for the year 2022. Other data for the year 2022 : a. Indirect materials used of the year amounted to $18,000. b. Some 80% of the utilities cost and 75% of the supplies used apply to factory operations. The remaining amounts apply to selling and administrative expenses. c. Depreciation expense is for production operation at 80%, the remaining amounts apply to selling operations. d. The company allocated insurance expense according to the proportion of spaces occupied by each activity at the rate of $2 per square meter occupied: Production 10,000 square meter and sales and administrative 5,000 square meter: e. The factory salaries and wages, excluding indirect salaries and wages, is from direct labor wages of the units produced based on a total of 6.8000 labor hours worked in the year, of which 200 labor hours were idle time. The company's normal hours for labor is 6,000 hours for the year, at the labor rate of $30 per hour and overtime rate is paid at one and one half time of the normal rate. 1. Only 60% of the lfinge beneifis applies to factory operations, the remaining applies to selling and administrative expenses. The factory fringe benefits are computed from total hours worked of the year at $6 per hour. The company treats that part of fringe benefits relating to direct labor as additional direct labor cost, the remaining fringe benefit is for manufacturing overhead. 9. Prime costs of the year amounted to $381,800. h. First-in, firs-out (FIFO) inventory system is used Required: 1. Prepare a detailed schedule of cost of goods manufactunng of Star company for the year ended December 31,2022 2. Prepare a detalled Tradilonal income statement of Star Company for the year ended Decernber 31,2022 Problem-1 STAR COMPANY - SOLUTION The following balances are extracted from Star Company's records for the year 2022. Other data for the year 2022 : a. Indirect materials used of the year amounted to $18,000. b. Some 80% of the utilities cost and 75% of the supplies used apply to factory operations. The remaining amounts apply to selling and administrative expenses. c. Depreciation expense is for production operation at 80%, the remaining amounts apply to selling operations. d. The company allocated insurance expense according to the proportion of spaces occupied by each activity at the rate of $2 per square meter occupied: Production 10,000 square meter and sales and administrative 5,000 square meter: e. The factory salaries and wages, excluding indirect salaries and wages, is from direct labor wages of the units produced based on a total of 6.8000 labor hours worked in the year, of which 200 labor hours were idle time. The company's normal hours for labor is 6,000 hours for the year, at the labor rate of $30 per hour and overtime rate is paid at one and one half time of the normal rate. 1. Only 60% of the lfinge beneifis applies to factory operations, the remaining applies to selling and administrative expenses. The factory fringe benefits are computed from total hours worked of the year at $6 per hour. The company treats that part of fringe benefits relating to direct labor as additional direct labor cost, the remaining fringe benefit is for manufacturing overhead. 9. Prime costs of the year amounted to $381,800. h. First-in, firs-out (FIFO) inventory system is used Required: 1. Prepare a detailed schedule of cost of goods manufactunng of Star company for the year ended December 31,2022 2. Prepare a detalled Tradilonal income statement of Star Company for the year ended Decernber 31,2022 Problem-1 STAR COMPANY - SOLUTION