Question

The taxpayer, a corporation with an April 30 fiscal year, mails its return for the April 30, 20X0 year to the Service Center on

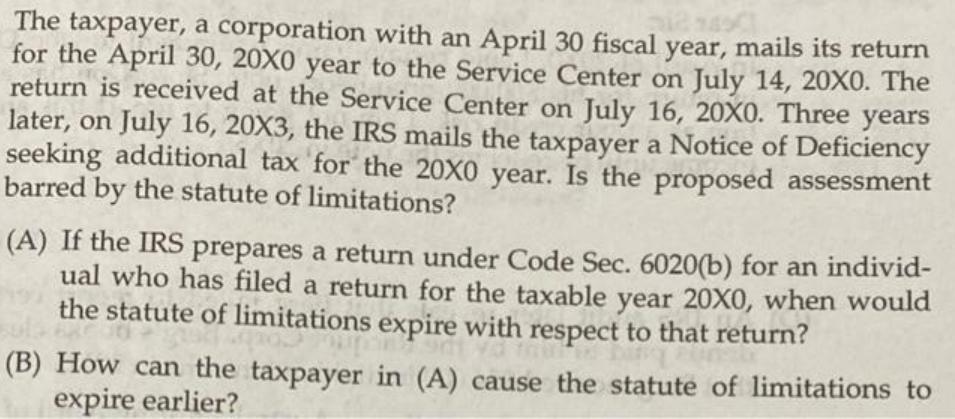

The taxpayer, a corporation with an April 30 fiscal year, mails its return for the April 30, 20X0 year to the Service Center on July 14, 20X0. The return is received at the Service Center on July 16, 20X0. Three years later, on July 16, 20X3, the IRS mails the taxpayer a Notice of Deficiency seeking additional tax for the 20X0 year. Is the proposed assessment barred by the statute of limitations? (A) If the IRS prepares a return under Code Sec. 6020(b) for an individ- ual who has filed a return for the taxable year 20X0, when would the statute of limitations expire with respect to that return? (B) How can the taxpayer in (A) cause the statute of limitations to expire earlier?

Step by Step Solution

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

A Yes the proposed assessment is barred by the statute of limitations B The taxpaye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Financial Accounting

Authors: Charles Horngren, Gary Sundem, John Elliott, Donna Philbrick

11th edition

978-0133251111, 013325111X, 0133251039, 978-0133251036

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App