Question

Where to start? Part 1: Work the following requirements from P5-13 on page 288 from your book. Part 1 Part 2a Part 2b Part 3a

Where to start?

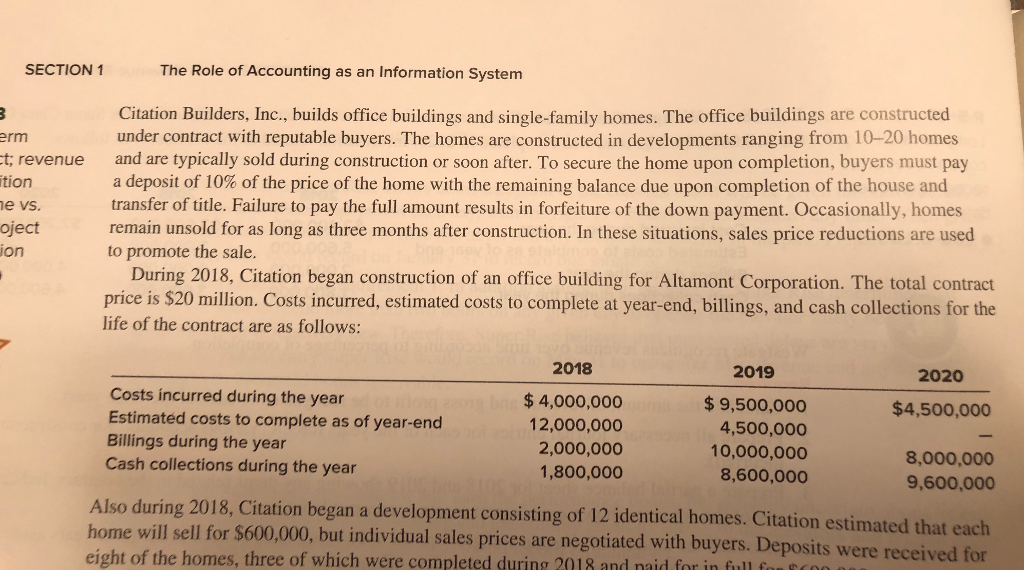

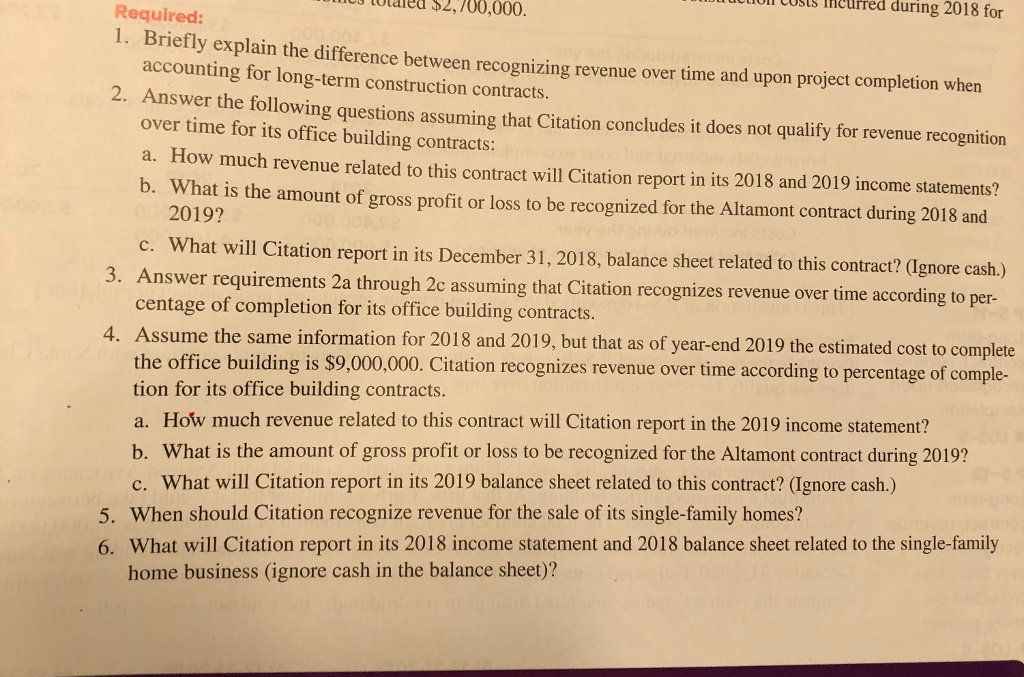

Part 1: Work the following requirements from P5-13 on page 288 from your book. Part 1 Part 2a Part 2b Part 3a (revenue for the contract from 2018 and 2019) Part 3b (gross profit for the contract from 2018 and 2019) Part 2: Baker, a consulting firm, enters into a contract to help a small family owned business design a marketing strategy to compete with other companies in the region.. The contract spans eight months. Bakers client promises to pay $93,000 at the beginning of each month. At the end of the contract, Baker either will give their client a refund of $31,000 or will be entitled to an additional $31,000 bonus, depending on whether sales at Burger Boy at year-end have increased to a target level. At the inception of the contract, Baker estimates an 80% chance that it will earn the $31,000 bonus and calculates the contract price based on the expected value of future payments to be received. At the end of the contract, Baker receives the additional consideration of $31,000. Required: 1. Prepare the journal entry to record revenue for each of the first four months of the contract. 2. Prepare the journal entry that Baker would record after eight months to record the receipt of the $31,000 bonus.

Part 1: Work the following requirements from P5-13 on page 288 from your book. Part 1 Part 2a Part 2b Part 3a (revenue for the contract from 2018 and 2019) Part 3b (gross profit for the contract from 2018 and 2019) Part 2: Baker, a consulting firm, enters into a contract to help a small family owned business design a marketing strategy to compete with other companies in the region.. The contract spans eight months. Bakers client promises to pay $93,000 at the beginning of each month. At the end of the contract, Baker either will give their client a refund of $31,000 or will be entitled to an additional $31,000 bonus, depending on whether sales at Burger Boy at year-end have increased to a target level. At the inception of the contract, Baker estimates an 80% chance that it will earn the $31,000 bonus and calculates the contract price based on the expected value of future payments to be received. At the end of the contract, Baker receives the additional consideration of $31,000. Required: 1. Prepare the journal entry to record revenue for each of the first four months of the contract. 2. Prepare the journal entry that Baker would record after eight months to record the receipt of the $31,000 bonus.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started