Question

- Which accounts should be credited or debited using journal entries? REVENUE ACCOUNT 401 Custom Fence and Gate Sales 711 Interest Earned 713 Dividends Earned

- Which accounts should be credited or debited using journal entries?

REVENUE ACCOUNT

401 Custom Fence and Gate Sales 711 Interest Earned 713 Dividends Earned 721 Gain on Sale of Assets 731 Gain on Short-Term Investments 741 Miscellaneous Revenue

OPERATING EXPENSES 601 Office Salaries and Wages Expense 602 Office Supplies Expense 603 Truck Operating Expense 604 Advertising Expense 607 Credit Card Expense 611 Depreciation Expense, Office Equipment 615 Depreciation Expense, Trucks 621 Rent Expense - General 622 Insurance Expense - General 623 Bad Debt Expense 624 Property Tax Expense - General 625 Utilities Expense - General 626 Telephone Expense - General 627 Bank Service Charges 628 License Expense 629 Professional Services Expense 631 Miscellaneous Expense

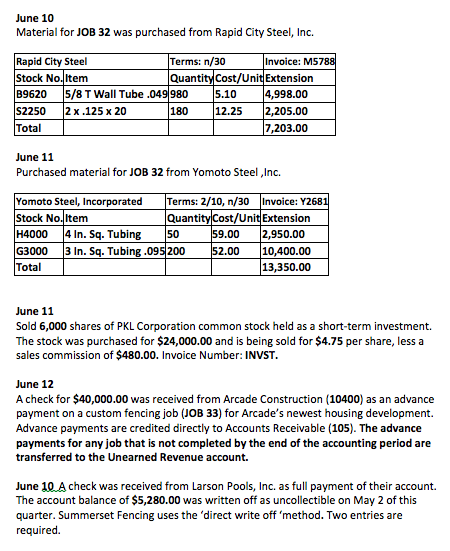

une 10 Material for JOB 32 was purchased from Rapid City Steel, Inc. erms: n/30 Quantity Cost/Unit Extension Rapid City Steel Stock No.ltem B9620 5/8 T Wall Tube .049980 5.10 4,998.00 S2250 2x.125 x 20 Invoice: M57 180 12.252,205.00 7,203.00 otal une 11 Purchased material for JOB 32 from Yomoto Steel ,Inc. Terms: 2/10, n/30 Invoice: Y268 Quantity Cost/UnitExtension Yomoto Steel, Incorporated Stock No.ltem H4000 14 In. Sq. Tubing | 50 G3000 3 In. Sq. Tubing.095200 9.00 2,950.00 52.00 10,400.00 otal 13,350.00 une 11 Sold 6,000 shares of PKL Corporation common stock held as a short-term investment. The stock was purchased for $24,000.00 and is being sold for $4.75 per share, lessa sales commission of $480.00. Invoice Number: INVST une 12 A check for $40,000.00 was received from Arcade Construction (10400) as an advance payment on a custom fencing job (JOB 33) for Arcade's newest housing development. Advance payments are credited directly to Accounts Receivable (105). The advance payments for any job that is not completed by the end of the accounting period are transferred to the Unearned Revenue account. June 10 A check was received from Larson Pools, Inc. as full payment of their account. The account balance of $5,280.00 was written off as uncollectible on May 2 of this quarter. Summerset Fencing uses the 'direct write off 'method. Two entries are requiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started