Answered step by step

Verified Expert Solution

Question

1 Approved Answer

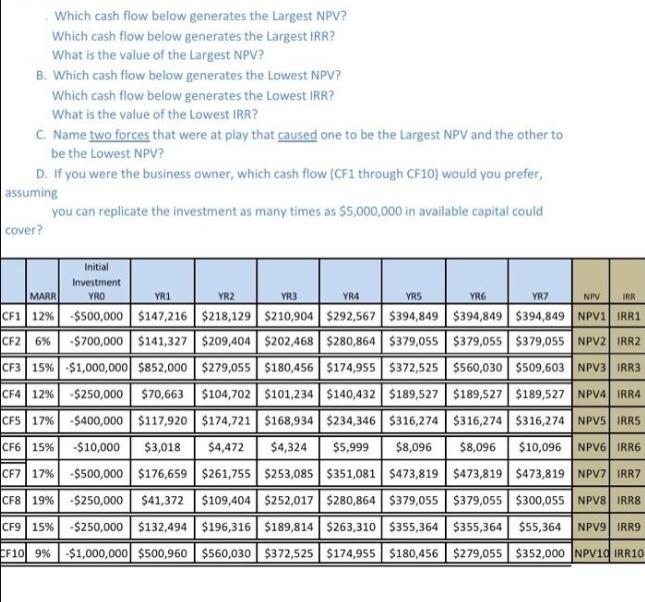

Which cash flow below generates the Largest NPV? Which cash flow below generates the Largest IRR? What is the value of the Largest NPV?

Which cash flow below generates the Largest NPV? Which cash flow below generates the Largest IRR? What is the value of the Largest NPV? B. Which cash flow below generates the Lowest NPV? Which cash flow below generates the Lowest IRR? What is the value of the Lowest IRR? C. Name two forces that were at play that caused one to be the Largest NPV and the other to be the Lowest NPV? D. If you were the business owner, which cash flow (CF1 through CF10) would you prefer, assuming you can replicate the investment as many times as $5,000,000 in available capital could cover? Initial Investment YRO MARR YR1 YR2 YR3 YR4 YR5 YR6 YR7 NPV IRR CF1 12% -$500,000 $147,216 $218,129 $210,904 $292,567 $394,849 $394,849 $394,849 NPV1 IRR1 CF2 6% -$700,000 $141,327 $209,404 $202,468 $280,864 $379,055 $379,055 $379,055 NPV2 IRR2 CF3 15% $1,000,000 $852,000 $279,055 $180,456 $174,955 $372,525 $560,030 $509,603 NPV3 IRR3 CF4 12% -$250,000 $70,663 $104,702 $101,234 $140,432 $189,527 $189,527 $189,527 NPV4 IRR4 CF5 17% -$400,000 $117,920 $174,721 $168,934 $234,346 $316,274 $316,274 $316,274 NPV5 IRRS CF6 15% -$10,000 $3,018 $4,472 $4,324 $5,999 $8,096 $8,096 $10,096 NPV6 IRR6 CF7 17% -$500,000 $176,659 $261,755 $253,085 $351,081 $473,819 $473,819 $473,819 NPV7 IRR7 CF8 19% -$250,000 $41,372 $109,404 $252,017 $280,864 $379,055 $379,055 $300,055 NPV8 IRR8 CF9 15% -$250,000 $132,494 $196,316 $189,814 $263,310 $355,364 $355,364 $55,364 NPV9 IRR9 CF10 9 % -$1,000,000 $500,960 $560,030 $372,525 $174,955 $180,456 $279,055 $352,000 NPV10 IRR10

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solution A Which cash flow generates the largest NPV CF1 generates the largest NPV of 394...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started