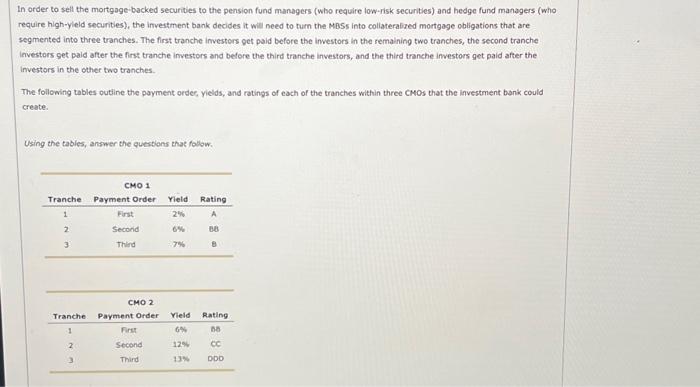

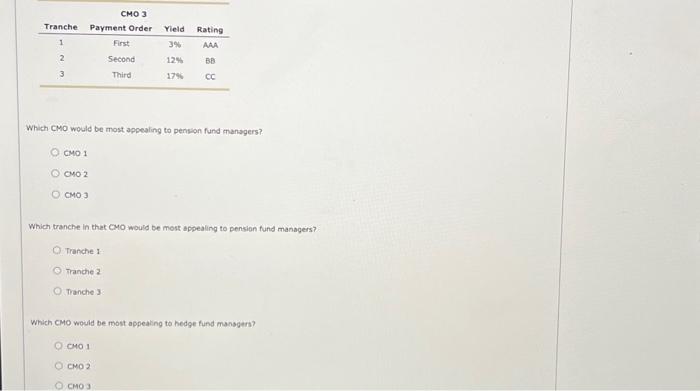

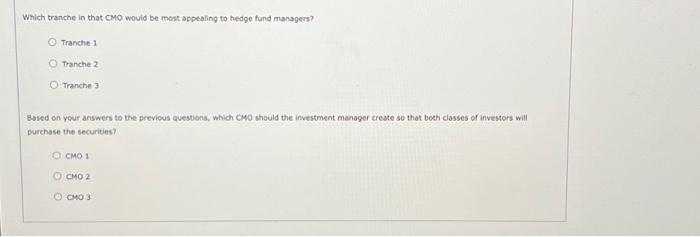

Which CMO would be most appealing to pension fund managers? CMO1 0902 CMO3 Which tranche in that CMO would be most appealing to pension fund managers? Tranche 1 Tranche 2 Tranche 3 Which CMO would be most appealing to hedge fund mansgers? Which of the following types of securities are backed by conventional mortgages that are insured through private insurance companies? Federal National Mortgage Association (Fannie Mae) mortgage-backed securities Private-label pass-through securities Federal Home Loan Mortgage Association (Freddie Mac) participation certificates Government National Mortgage Association (Ginnie Mae) mortgage-backed securities step2 Suppose an investment bank is trying to sell BBB rated mortgage-backed securities, with an 8% yield, to two elasses of investors: (1) pension fund managers and (2) hedge fund managers. However, neither dass of imvestors wants to purchase the securities. Pension fund managers think the securities are too risicy for their low-risk portfolios; and hedge fund managers are willing to take the risk on the securities, but they feel that the yieid is too low for their portiolios. What is one way that the investment bank could sell the securities to both classes of investors? Sell the securities as collateralized mortgage obligations Decrease the vield on the securities to 5% Sell the secunties as participation certificates Increase the yield on the securities to 12% In order to sell the mortgage-backed securities to the pension fund managers (who require low-risk securities) and hedge fund managers (who require high-yield securities), the investment bank decides it will need to turn the MBSs into collaterabied mortgage obligations that are segmented into three tranches. The first tranche investors get paid before the inwestors in the remalning two tranches, the second tranche investors get paid after the first tranche investors and before the third tranche investors, and the third tranche imvestors get paid after the investors in the other two tranches. The following tables outiline the payment order, yields, and ratings of each of the tranches within three cMos that the investment bank could create. Using the tables, answer the questions that follow. Which tranche in that CMO would be most appealing to hedge fund managers? Tranche 1 Tranche 2 Tranchen 3 Based on your answers to the previous questions, which CMO sheuld the investment manager create so that both classes of investors will purchase the securities? CMO1 CMO2