Which Is DIRECT LABOR and which is DIRECT MATIERALS? How were the funds allocated?

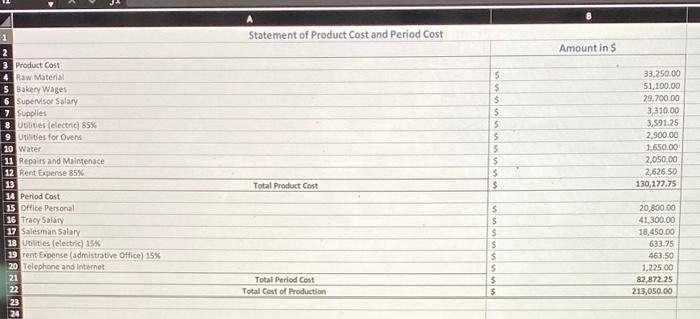

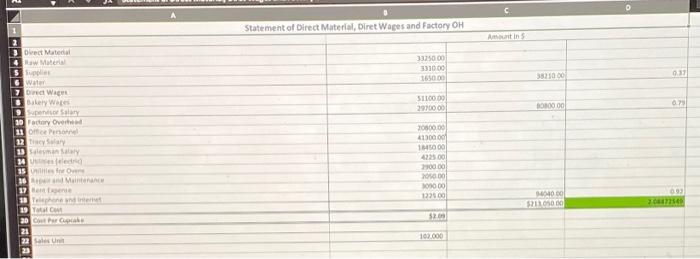

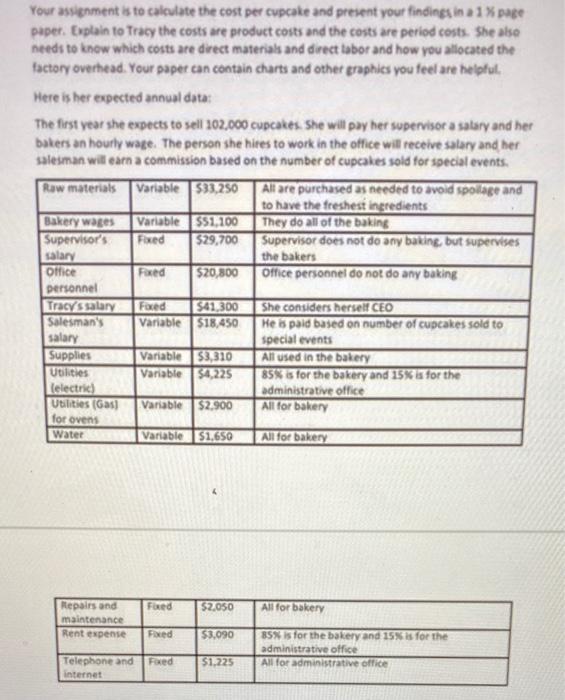

1 Statement of Product Cost and Period Cost Amount in $ S $ 2 3 Product Cost Raw Material 5 Bakery Wages 6 Supervisor Salary 7 Supplies & Utilities (electric 85% 9 Utilities for Ovens 10 Water 11 Repairs and Maintenace 12 Rent Expense 85% 13 14 Period Cost 15 Office Personal 16 Tracy Salary 17 Salesman Salary 18 Utilities (electric) 15% 19 rent Expense (admistrative Office) 15% 20 Telephone and Internet 21 22 5 $ 5 $ s $ $ 33,250.00 51,100.00 29,700.00 3,310.00 3,591.25 2.900.00 1,650.00 2,050.00 2,626.50 130,177.75 Total Product Cost $ $ $ $ $ $ $ $ 20,800.00 41,300.00 18,450.00 633.75 463.50 1.225.00 82,872.25 213,050.00 Total Period Cost Total Cost of Production 24 O C Statement of Direct Material, Diret Wapes and Factory OH Amin Direct Material 4 w Me 33250.00 331000 165000 38210.00 0.31 51100.00 29700,00 07 000 water Dr W Dery Wate 9 10 Factory Over 11 12 Seminary 24 de 35 O 26 Mai 27 20 19 Total 20 C G 2000.00 413000 140 400 00 DOLE 00 9000) 1225.00 03 40.00 S2000 50 100.000 22 S Unit Your assignment is to calculate the cost per cupcake and present your findings in a 1% page paper. Explain to Tracy the costs are product costs and the costs are period costs. She also needs to know which costs are direct materials and direct labor and how you allocated the factory overhead. Your paper can contain charts and other graphies you feel are helpful Here is her expected annual data: The first year she expects to sell 102,000 cupcakes. She will pay her supervisor a salary and her bakers an hourly wage. The person she hires to work in the office will receive salary and her salesman will earn a commission based on the number of cupcakes sold for special events. Raw materials Variable 533,250 All are purchased as needed to avoid spolage and to have the freshest ingredients Bakery wages Variable 551,100 They do all of the baking Supervisor's Foxed $29,700 Supervisor does not do any baking, but supervises salary the bakers Office Faxed $20,800 Office personnel do not do any baking personnel Tracy's salary Foxed $41.300 She considers herself CEO Salesman's Variable $18.450 He is paid based on number of cupcakes sold to salary special events Supplies Variable 53,310 An used in the bakery Utilities Variable 34,225 85% is for the bakery and 15% is for the Kelectric) administrative office Utilities (Gas) Variable $2.900 All for bakery for ovens Water Variable $1,650 All for bakery Fored $2,050 All for bakery Repairs and maintenance Rent expense Foxed $3.090 85% is for the bakery and 15% is for the administrative office All for administrative office Faxed $1,225 Telephone and internet 1 Statement of Product Cost and Period Cost Amount in $ S $ 2 3 Product Cost Raw Material 5 Bakery Wages 6 Supervisor Salary 7 Supplies & Utilities (electric 85% 9 Utilities for Ovens 10 Water 11 Repairs and Maintenace 12 Rent Expense 85% 13 14 Period Cost 15 Office Personal 16 Tracy Salary 17 Salesman Salary 18 Utilities (electric) 15% 19 rent Expense (admistrative Office) 15% 20 Telephone and Internet 21 22 5 $ 5 $ s $ $ 33,250.00 51,100.00 29,700.00 3,310.00 3,591.25 2.900.00 1,650.00 2,050.00 2,626.50 130,177.75 Total Product Cost $ $ $ $ $ $ $ $ 20,800.00 41,300.00 18,450.00 633.75 463.50 1.225.00 82,872.25 213,050.00 Total Period Cost Total Cost of Production 24 O C Statement of Direct Material, Diret Wapes and Factory OH Amin Direct Material 4 w Me 33250.00 331000 165000 38210.00 0.31 51100.00 29700,00 07 000 water Dr W Dery Wate 9 10 Factory Over 11 12 Seminary 24 de 35 O 26 Mai 27 20 19 Total 20 C G 2000.00 413000 140 400 00 DOLE 00 9000) 1225.00 03 40.00 S2000 50 100.000 22 S Unit Your assignment is to calculate the cost per cupcake and present your findings in a 1% page paper. Explain to Tracy the costs are product costs and the costs are period costs. She also needs to know which costs are direct materials and direct labor and how you allocated the factory overhead. Your paper can contain charts and other graphies you feel are helpful Here is her expected annual data: The first year she expects to sell 102,000 cupcakes. She will pay her supervisor a salary and her bakers an hourly wage. The person she hires to work in the office will receive salary and her salesman will earn a commission based on the number of cupcakes sold for special events. Raw materials Variable 533,250 All are purchased as needed to avoid spolage and to have the freshest ingredients Bakery wages Variable 551,100 They do all of the baking Supervisor's Foxed $29,700 Supervisor does not do any baking, but supervises salary the bakers Office Faxed $20,800 Office personnel do not do any baking personnel Tracy's salary Foxed $41.300 She considers herself CEO Salesman's Variable $18.450 He is paid based on number of cupcakes sold to salary special events Supplies Variable 53,310 An used in the bakery Utilities Variable 34,225 85% is for the bakery and 15% is for the Kelectric) administrative office Utilities (Gas) Variable $2.900 All for bakery for ovens Water Variable $1,650 All for bakery Fored $2,050 All for bakery Repairs and maintenance Rent expense Foxed $3.090 85% is for the bakery and 15% is for the administrative office All for administrative office Faxed $1,225 Telephone and internet