Answered step by step

Verified Expert Solution

Question

1 Approved Answer

which method would I use for this problem? I have used sales revenue minus fixed costs and variable costs to get an operating income of

which method would I use for this problem? I have used sales revenue minus fixed costs and variable costs to get an operating income of 33,795.

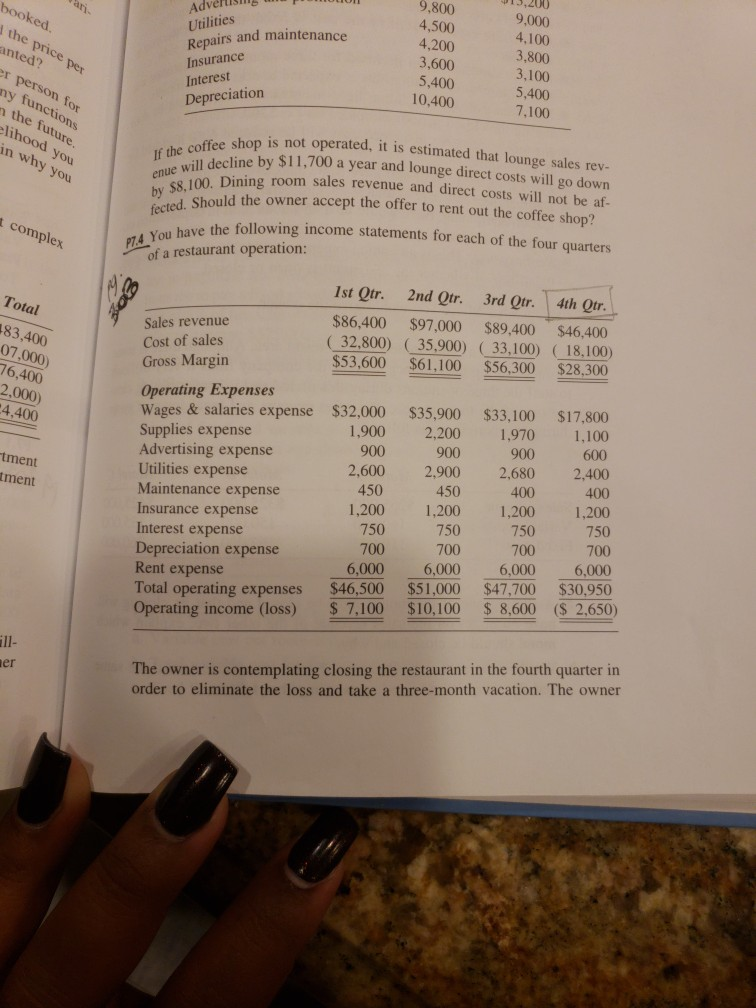

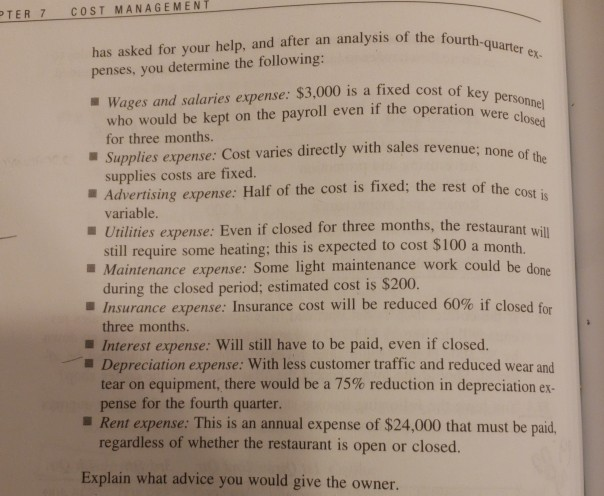

9,800 4,500 4,200 3,600 5,400 10,400 D13,200 9,000 4,100 3,800 3,100 5,400 7.100 dvris Repairs and maintenance hop is not operated, it is estimated that lounge sales rev- eby $11,700 a year and lounge direct costs will go down Dining room sales revenue and direct costs will not be af- the co by ed. Should the owner accept the offer to rent out the coffee shop? have the following income statements for each of the four quarters of a restaurant operation: Sales revenue Cost of sales Gross Margin Ist Qtr. 2nd Qtr. 3rd Qtr. 4th Otr $86,400 $97,000 $89,400 $46,400 32.800) 35,900) 33,100) 18,100) $53,600 $61,100 $56,300 $28,300 83 Operating Expenses Wages & salaries expense $32,000 $35,900 $33,100 $17,800 Supplies expense Advertising expense Utilities expense Maintenance expense Insurance expense Interest expense Depreciation expense Rent expense Total operating expenses $46,500 $51,000 $47,700 $30,950 Operating income (loss) 7,100 $10,100 $ 8,600 (S 2,650) 900 900 600 900 450 750 tment 2,600 2,900 2,680 2.400 400 1,200 1,200 1,200 1,200 700 6,000 6,000 6,000 6,000 ment 450 400 750 700 The owner is contemplating closing the restaurant in the fourth quarter in order to eliminate the loss and take a three-month vacation. The owner erStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started