Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following are tax benefits of the 529 Plan in Illinois, Bright Start? Select each correct answer. A. Contributions and any earnings grow

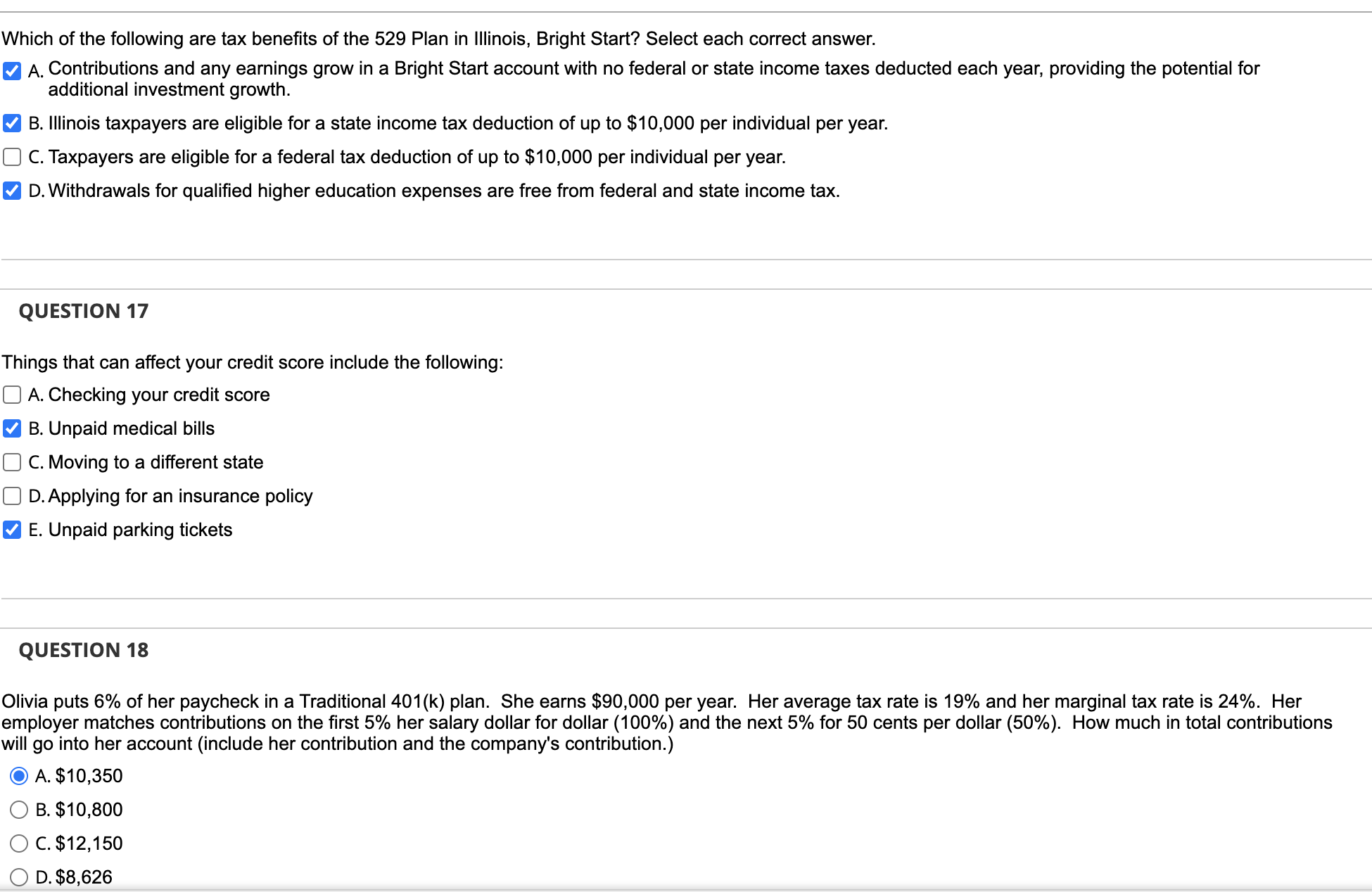

Which of the following are tax benefits of the 529 Plan in Illinois, Bright Start? Select each correct answer. A. Contributions and any earnings grow in a Bright Start account with no federal or state income taxes deducted each year, providing the potential for additional investment growth. B. Illinois taxpayers are eligible for a state income tax deduction of up to $10,000 per individual per year. C. Taxpayers are eligible for a federal tax deduction of up to $10,000 per individual per year. D. Withdrawals for qualified higher education expenses are free from federal and state income tax. QUESTION 17 Things that can affect your credit score include the following: A. Checking your credit score B. Unpaid medical bills C. Moving to a different state D. Applying for an insurance policy E. Unpaid parking tickets QUESTION 18 Olivia puts 6% of her paycheck in a Traditional 401(k) plan. She earns $90,000 per year. Her average tax rate is 19% and her marginal tax rate is 24%. Her employer matches contributions on the first 5% her salary dollar for dollar (100\%) and the next 5% for 50 cents per dollar (50\%). How much in total contributions will go into her account (include her contribution and the company's contribution.) A. $10,350 B. $10,800 C. $12,150 D. $8,626

Which of the following are tax benefits of the 529 Plan in Illinois, Bright Start? Select each correct answer. A. Contributions and any earnings grow in a Bright Start account with no federal or state income taxes deducted each year, providing the potential for additional investment growth. B. Illinois taxpayers are eligible for a state income tax deduction of up to $10,000 per individual per year. C. Taxpayers are eligible for a federal tax deduction of up to $10,000 per individual per year. D. Withdrawals for qualified higher education expenses are free from federal and state income tax. QUESTION 17 Things that can affect your credit score include the following: A. Checking your credit score B. Unpaid medical bills C. Moving to a different state D. Applying for an insurance policy E. Unpaid parking tickets QUESTION 18 Olivia puts 6% of her paycheck in a Traditional 401(k) plan. She earns $90,000 per year. Her average tax rate is 19% and her marginal tax rate is 24%. Her employer matches contributions on the first 5% her salary dollar for dollar (100\%) and the next 5% for 50 cents per dollar (50\%). How much in total contributions will go into her account (include her contribution and the company's contribution.) A. $10,350 B. $10,800 C. $12,150 D. $8,626 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started