Answered step by step

Verified Expert Solution

Question

1 Approved Answer

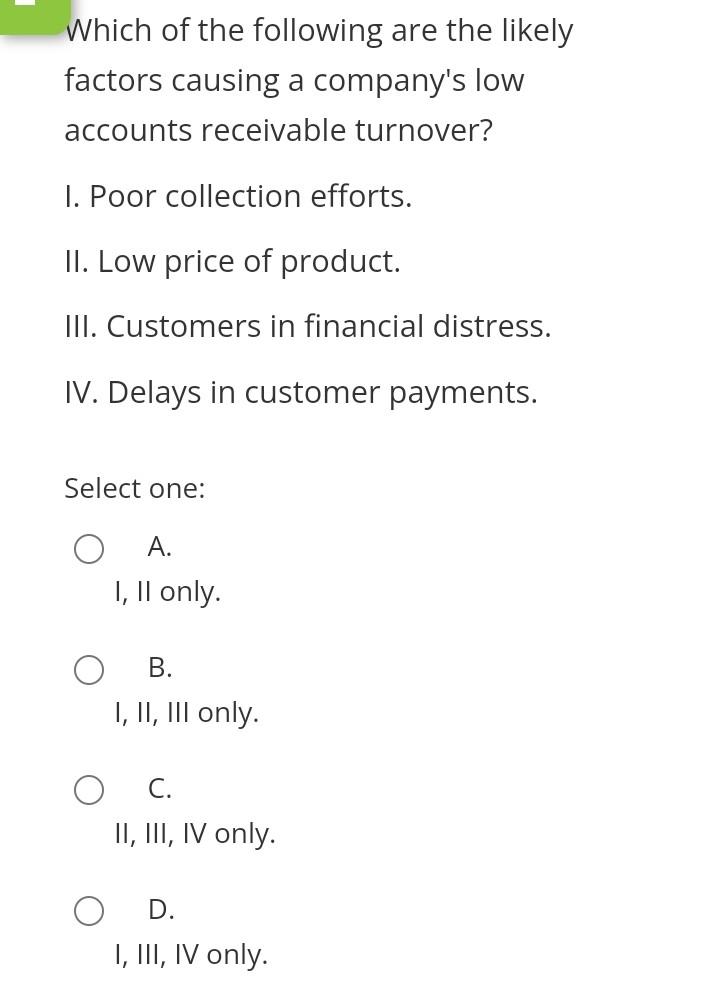

Which of the following are the likely factors causing a company's low accounts receivable turnover? I. Poor collection efforts. II. Low price of product. III.

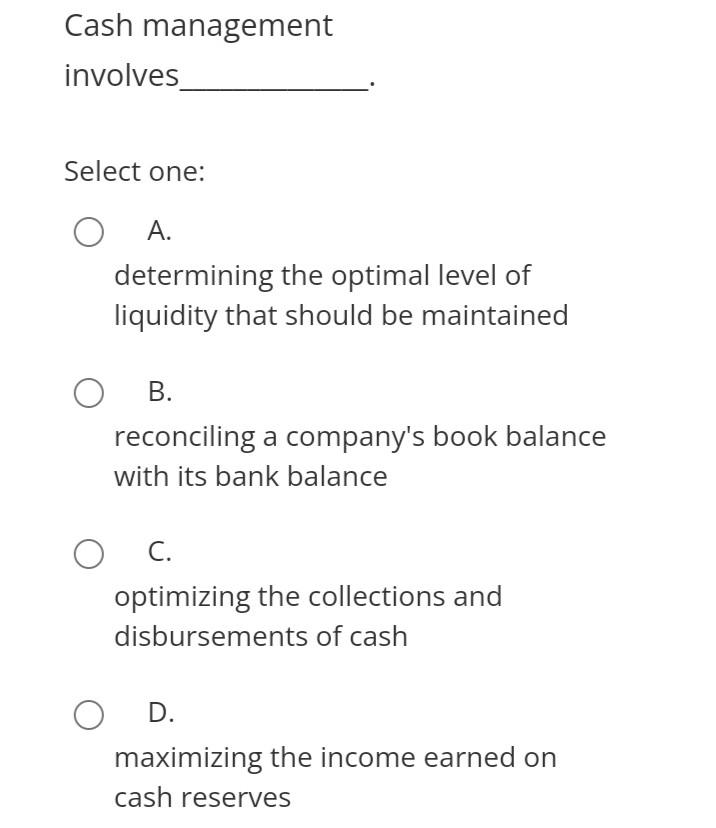

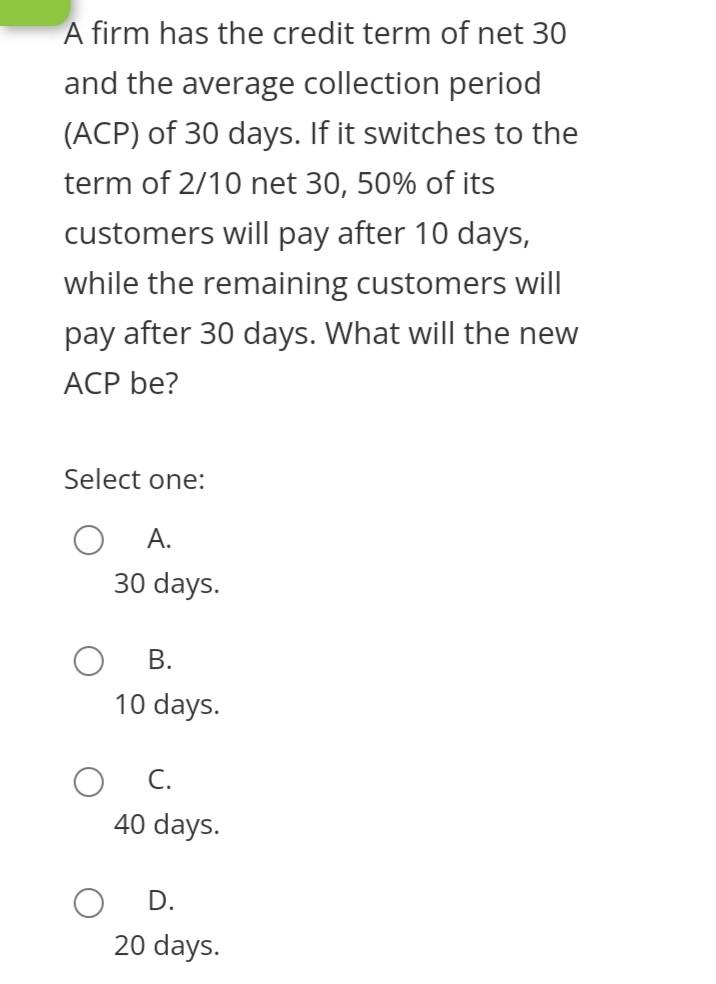

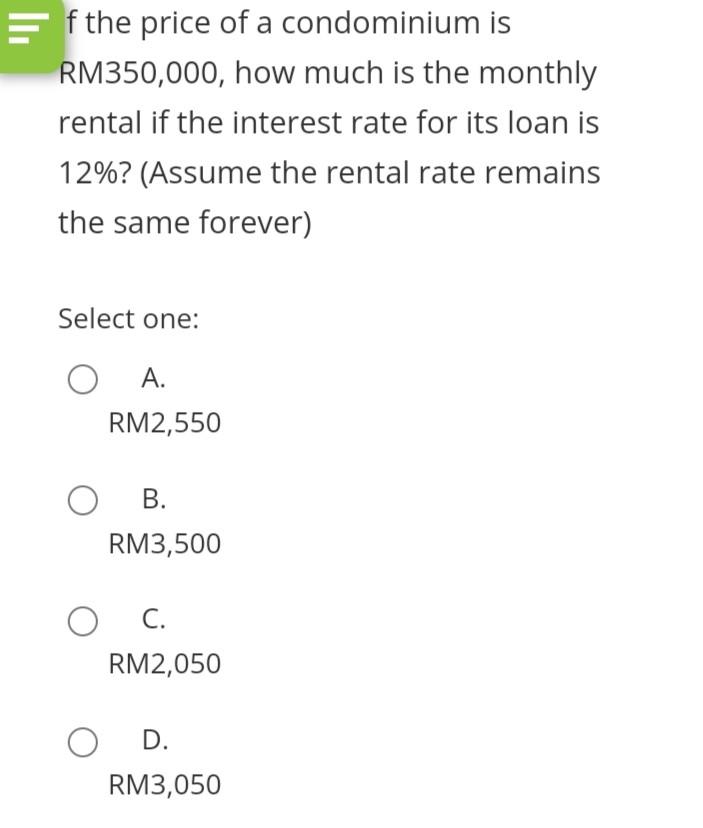

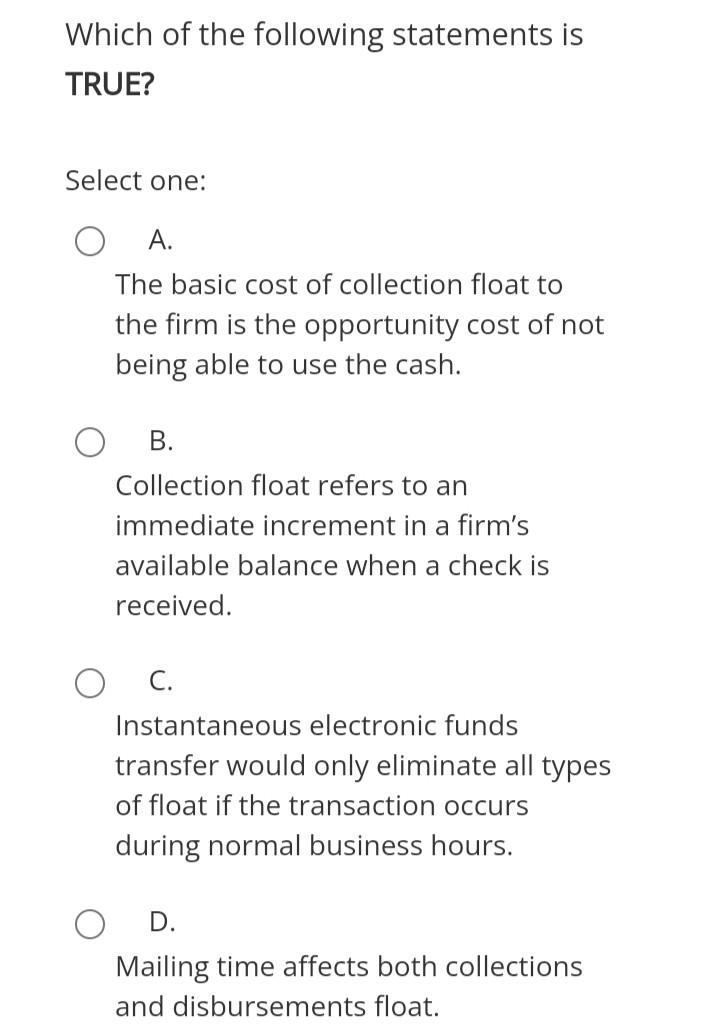

Which of the following are the likely factors causing a company's low accounts receivable turnover? I. Poor collection efforts. II. Low price of product. III. Customers in financial distress. IV. Delays in customer payments. Select one: A. I, II only. B. I, II, III only. C. II, III, IV only. D. I, III, IV only. Select one: A. determining the optimal level of liquidity that should be maintained B. reconciling a company's book balance with its bank balance C. optimizing the collections and disbursements of cash D. maximizing the income earned on cash reserves A firm has the credit term of net 30 and the average collection period (ACP) of 30 days. If it switches to the term of 2/10 net 30,50% of its customers will pay after 10 days, while the remaining customers will pay after 30 days. What will the new ACP be? Select one: A. 30 days. B. 10 days. C. 40 days. D. 20 days. f the price of a condominium is RM350,000, how much is the monthly rental if the interest rate for its loan is 12% ? (Assume the rental rate remains the same forever) Select one: A. RM2,550 B. RM3,500 C. RM2,050 D. RM3,050 Which of the following statements is TRUE? Select one: A. The basic cost of collection float to the firm is the opportunity cost of not being able to use the cash. B. Collection float refers to an immediate increment in a firm's available balance when a check is received. C. Instantaneous electronic funds transfer would only eliminate all types of float if the transaction occurs during normal business hours. D. Mailing time affects both collections and disbursements float

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started