Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following clients has the GREATEST need for estate planning based on the information provided below? Janet (23), who prides herself on

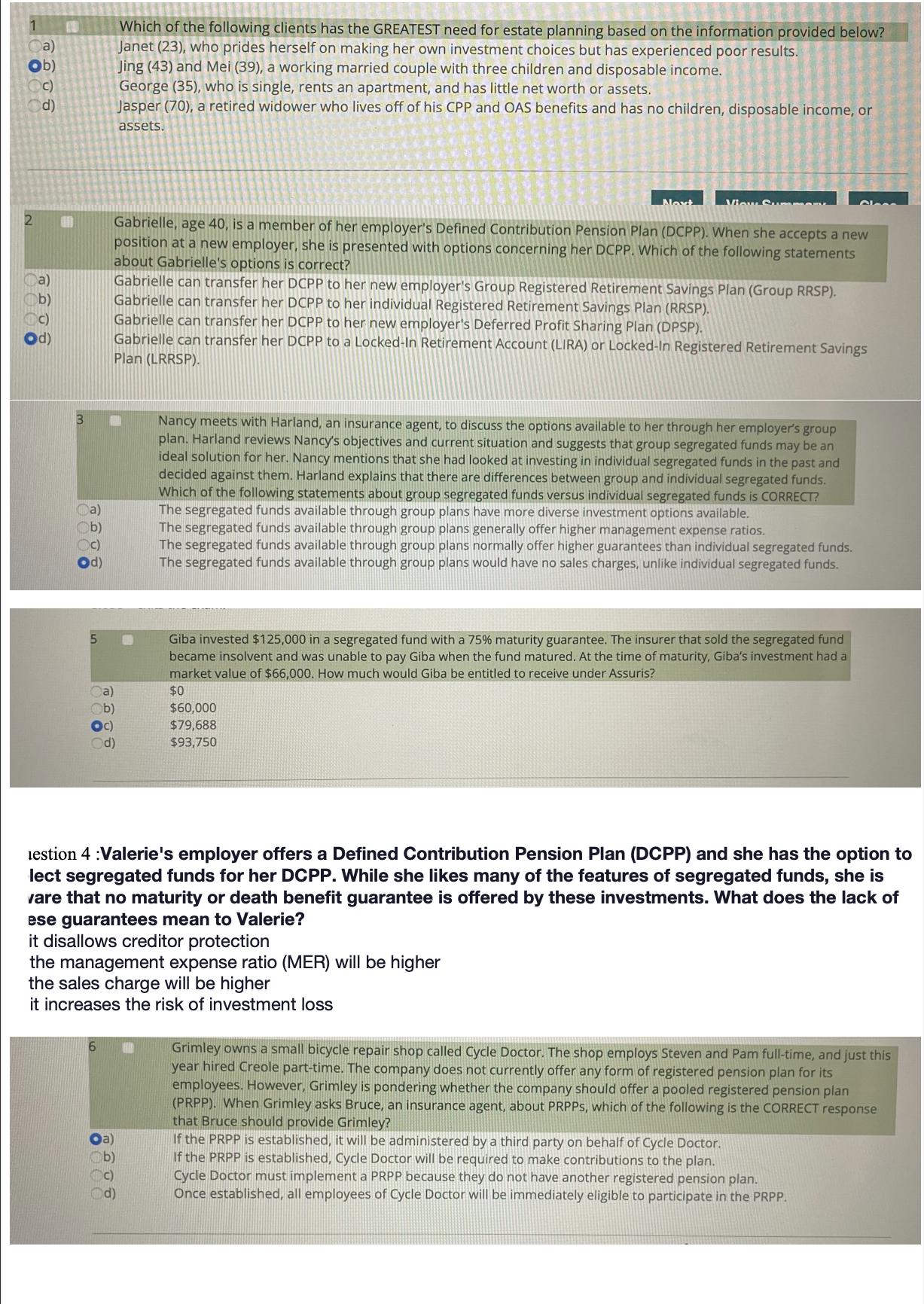

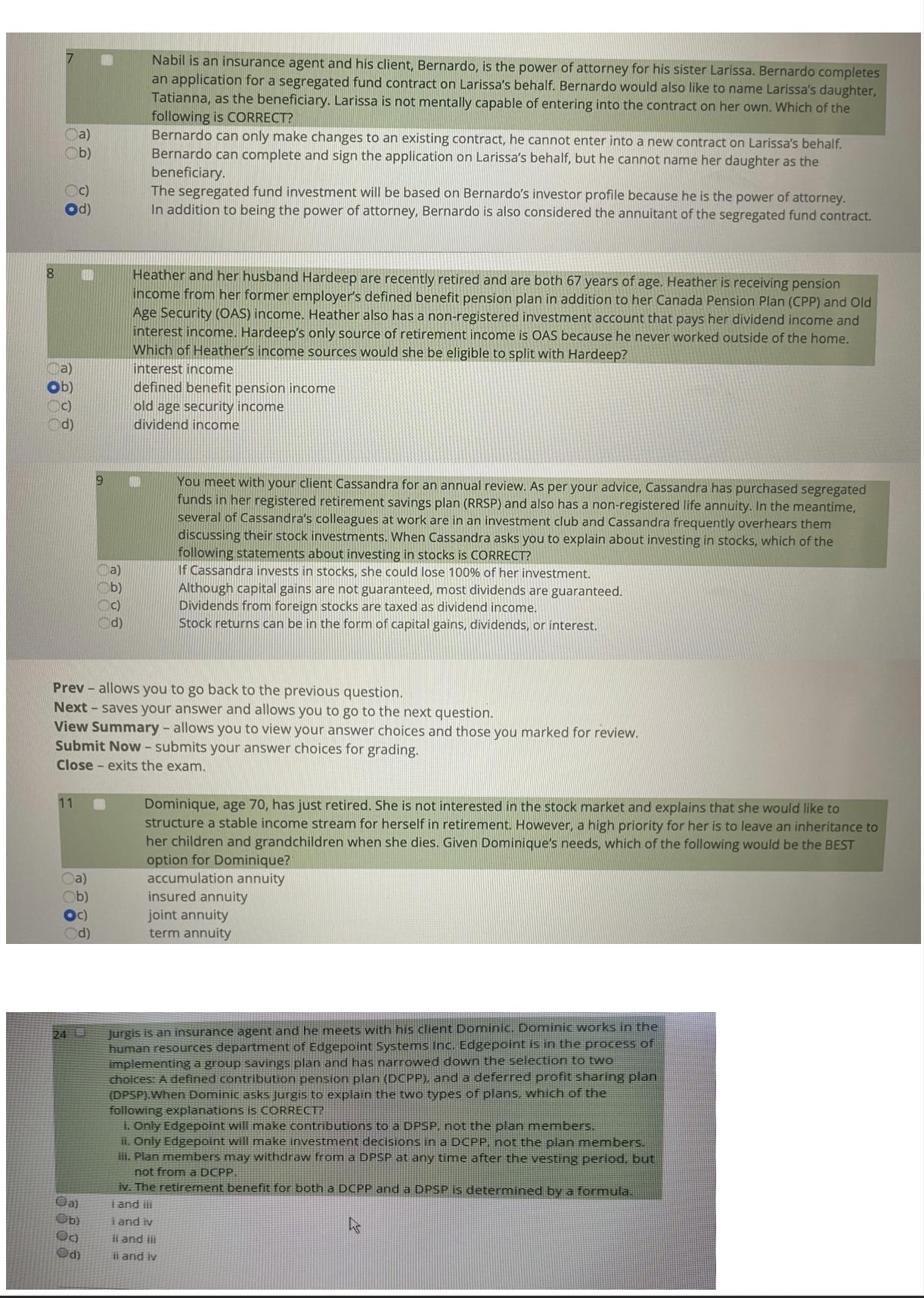

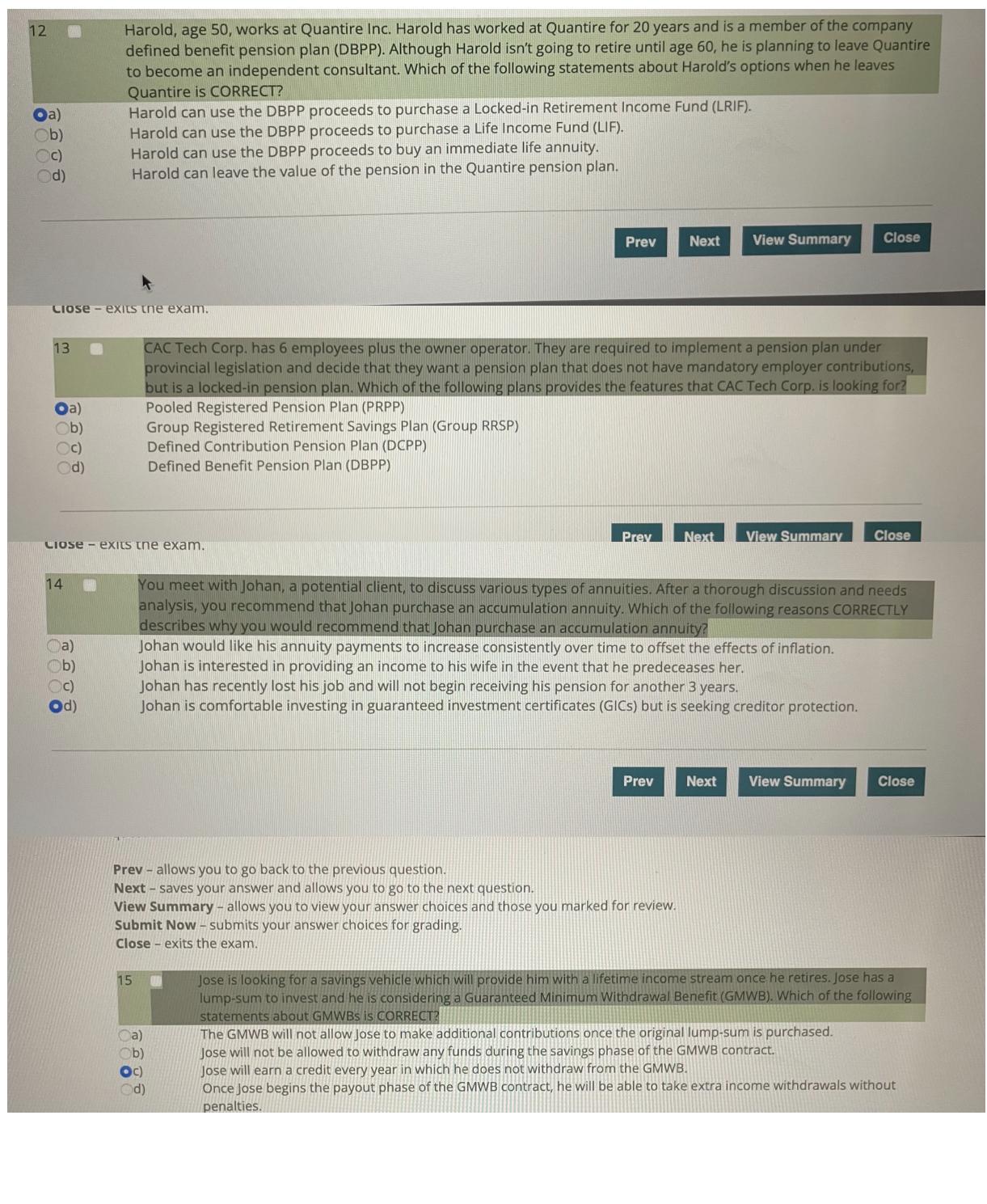

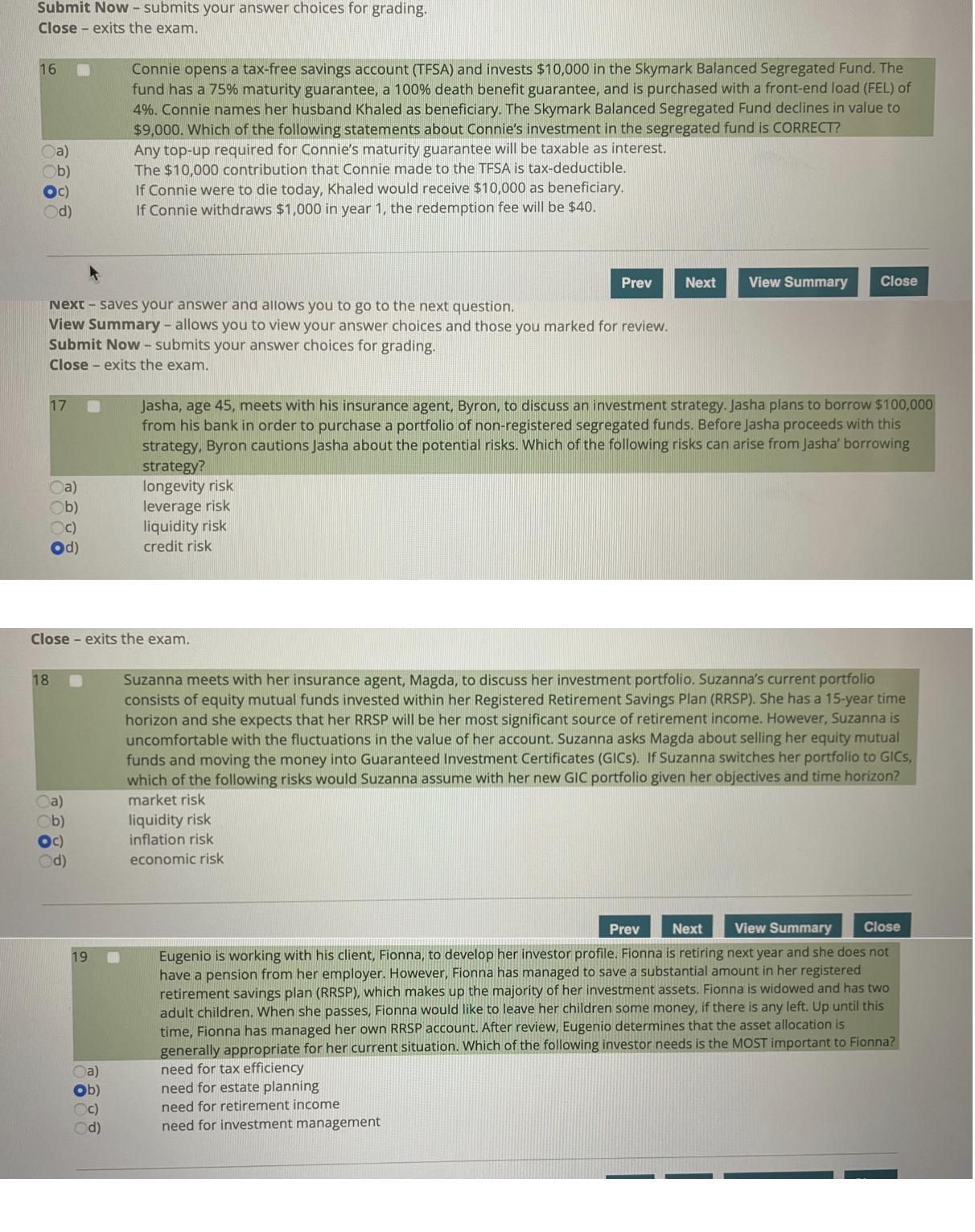

Which of the following clients has the GREATEST need for estate planning based on the information provided below? Janet (23), who prides herself on making her own investment choices but has experienced poor results. Jing (43) and Mei (39), a working married couple with three children and disposable income. George (35), who is single, rents an apartment, and has little net worth or assets. Jasper (70), a retired widower who lives off of his CPP and OAS benefits and has no children, disposable income, or 1 a) Ob) C) assets. Next Viow S Gabrielle, age 40, is a member of her employer's Defined Contribution Pension Plan (DCPP). When she accepts a new position at a new employer, she is presented with options concerning her DCPP. Which of the following statements about Gabrielle's options is correct? Gabrielle can transfer her DCPP to her new employer's Group Registered Retirement Savings Plan (Group RRSP). Gabrielle can transfer her DCPP to her individual Registered Retirement Savings Plan (RRSP). Gabrielle can transfer her DCPP to her new employer's Deferred Profit Sharing Plan (DPSP). Gabrielle can transfer her DCPP to a Locked-In Retirement Account (LIRA) or Locked-In Registered Retirement Savings a) b) C) Od) Plan (LRRSP). Nancy meets with Harland, an insurance agent, to discuss the options available to her through her employer's group plan. Harland reviews Nancy's objectives and current situation and suggests that group segregated funds may be an ideal solution for her. Nancy mentions that she had looked at investing in individual segregated funds in the past and decided against them. Harland explains that there are differences between group and individual segregated funds. Which of the following statements about group segregated funds versus individual segregated funds is CORRECT? The segregated funds available through group plans have more diverse investment options available. The segregated funds available through group plans generally offer higher management expense ratios. The segregated funds available through group plans normally offer higher guarantees than individual segregated funds. The segregated funds available through group plans would have no sales charges, unlike individual segregated funds. Ob) Oc) Od) Giba invested$125,000 in a segregated fund with a 75% maturity guarantee. The insurer that sold the segregated fund became insolvent and was unable to pay Giba when the fund matured. At the time of maturity, Giba's investment had a market value of $66,000. How much would Giba be entitled to receive under Assuris? Oa) $0 Ob) $60,000 Oc) $79,688 Od) $93,750 iestion 4 :Valerie's employer offers a Defined Contribution Pension Plan (DCPP) and she has the option to lect segregated funds for her DCPP. While she likes many of the features of segregated funds, she is vare that no maturity or death benefit guarantee is offered by these investments. What does the lack of ese guarantees mean to Valerie? it disallows creditor protection the management expense ratio (MER) will be higher the sales charge will be higher it increases the risk of investment loss Grimley owns a small bicycle repair shop called Cycle Doctor. The shop employs Steven and Pam full-time, and just this year hired Creole part-time. The company does not currently offer any form of registered pension plan for its employees. However, Grimley is pondering whether the company should offer a pooled registered pension plan (PRPP). When Grimley asks Bruce, an insurance agent, about PRPPS, which of the following is the CORRECT response that Bruce should provide Grimley? If the PRPP is established, it will be administered by a third party on behalf of Cycle Doctor. If the PRPP is established, Cycle Doctor will be required to make contributions to the plan. Cycle Doctor must implement a PRPP because they do not have another registered pension plan. Once established, all employees of Cycle Doctor will be immediately eligible to participate in the PRPP. a) Ob) Cc) Od) Nabil is an insurance agent and his client, Bernardo, is the power of attorney for his sister Larissa. Bernardo completes an application for a segregated fund contract on Larissa's behalf. Bernardo would also like to name Larissa's daughter, Tatianna, as the beneficiary. Larissa is not mentally capable of entering into the contract on her own. Which of the following is CORRECT? Bernardo can only make changes to an existing contract, he cannot enter into a new contract on Larissa's behalf. Bernardo can complete and sign the application on Larissa's behalf, but he cannot name her daughter as the beneficiary. The segregated fund investment will be based on Bernardo's investor profile because he is the power of attorney. In addition to being the power of attorney, Bernardo is also considered the annuitant of the segregated fund contract. Oa) Ob) Cc) Od) 8. Heather and her husband Hardeep are recently retired and are both 67 years of age. Heather is receiving pension income from her former employer's defined benefit pension plan in addition to her Canada Pension Plan (CPP) and Old Age Security (OAS) income. Heather also has a non-registered investment account that pays her dividend income and interest income. Hardeep's only source of retirement income is OAS because he never worked outside of the home. Which of Heather's income sources would she be eligible to split with Hardeep? a) Ob) interest income C) Od) defined benefit pension income old age security income dividend income You meet with your client Cassandra for an annual review. As per your advice, Cassandra has purchased segregated funds in her registered retirement savings plan (RRSP) and also has a non-registered life annuity. In the meantime, several of Cassandra's colleagues at work are in an investment club and Cassandra frequently overhears them discussing their stock investments. When Cassandra asks you to explain about investing in stocks, which of the following statements about investing in stocks is CORRECT? If Cassandra invests in stocks, she could lose 100% of her investment. a) b) c) Cd) Although capital gains are not guaranteed, most dividends are guaranteed. Dividends from foreign stocks are taxed as dividend income. Stock returns can be in the form of capital gains, dividends, or interest. Prev - allows you to go back to the previous question. Next - saves your answer and allows you to go to the next question. View Summary - allows you to view your answer choices and those you marked for review. Submit Now - submits your answer choices for grading. Close - exits the exam. 11 Dominique, age 70, has just retired. She is not interested in the stock market and explains that she would like to structure a stable income stream for herself in retirement. However, a high priority for her is to leave an inheritance to her children and grandchildren when she dies. Given Dominique's needs, which of the following would be the BEST option for Dominique? accumulation annuity insured annuity joint annuity term annuity Da) Ob) Oc) d) Jurgis is an insurance agent and he meets with his client Dominic. Dominic works in the human resources department of Edgepoint Systems Inc. Edgepoint is in the process of implementing a group savings plan and has narrowed down the selection to two choices: A defined contribution pension plan (DCPP), and a deferred profit sharing plan (DPSP).When Dominic asks Jurgis to explain the two types of plans, which of the following explanations is CORRECT? I. Only Edgepoint will make contributions to a DPSP, not the plan members, il. Only Edgepoint will make investment decisions in a DCPP, not the plan members, ili. Plan members may withdraw from a DPSP at any time after the vesting perlod, but 24 U not from a DCPP. iv. The retirement benefit for both a DCPP and a DPSP is determined bya formula. T and ii Oa) Ob) Tand iv il and ii ii and iv Harold, age 50, works at Quantire Inc. Harold has worked at Quantire for 20 years and is a member of the company defined benefit pension plan (DBPP). Although Harold isn't going to retire until age 60, he is planning to leave Quantire to become an independent consultant. Which of the following statements about Harold's options when he leaves 12 Quantire is CORRECT? Harold can use the DBPP proceeds to purchase a Locked-in Retirement Income Fund (LRIF). Harold can use the DBPP proceeds to purchase a Life Income Fund (LIF). Harold can use the DBPP proceeds to buy an immediate life annuity. Harold can leave the value of the pension in the Quantire pension plan. Oa) Ob) C) d) Prev Next View Summary Close LIose - EXILS tne exam. CAC Tech Corp. has 6 employees plus the owner operator. They are required to implement a pension plan under provincial legislation and decide that they want a pension plan that does not have mandatory employer contributions, but is a locked-in pension plan. Which of the following plans provides the features that CAC Tech Corp. is looking for? Pooled Registered Pension Plan (PRPP) Group Registered Retirement Savings Plan (Group RRSP) Defined Contribution Pension Plan (DCPP) Defined Benefit Pension Plan (DBPP) 13 Oa) Ob) Oc) Od) Prey Next View Summary Close LIose - exits tne exam. 14 Oa) Ob) Oc) Od) You meet with Johan, a potential client, to discuss various types of annuities. After a thorough discussion and needs analysis, you recommend that Johan purchase an accumulation annuity. Which of the following reasons CORRECTLY describes why you would recommend that Johan purchase an accumulation annuity? Johan would like his annuity payments to increase consistently over time to offset the effects of inflation. Johan is interested in providing an income to his wife in the event that he predeceases her. Johan has recently lost his job and will not begin receiving his pension for another 3 years. Johan is comfortable investing in guaranteed investment certificates (GICS) but is seeking creditor protection. Prev Next View Summary Close Prev - allows you to go back to the previous question. Next - saves your answer and allows you to go to the next question. View Summary - allows you to view your answer choices and those you marked for review. Submit Now - submits your answer choices for grading. Close - exits the exam. Jose is looking for a savings vehicle which will provide him with a lifetime income stream once he retires. Jose has a lump-sum to invest and he is considering a Guaranteed Minimum Withdrawal Benefit (GMWB). Which of the following statements about GMWBS is CORRECT? The GMWB will not allow Jose to make additional contributions once the original lump-sum is purchased. Jose will not be allowed to withdraw any funds during the savings phase of the GMWB contract. 15 a) Ob) Oc) Od) Jose will earn a credit every year in which he does not withdraw from the GMWB. Once Jose begins the payout phase of the GMWB contract, he will be able to take extra income withdrawals without penalties. Submit Now - submits your answer choices for grading. Close - exits the exam. Connie opens a tax-free savings account (TFSA) and invests $10,000 in the Skymark Balanced Segregated Fund. The fund has a 75% maturity guarantee, a 100% death benefit guarantee, and is purchased with a front-end load (FEL) of 4%. Connie names her husband Khaled as beneficiary. The Skymark Balanced Segregated Fund declines in value to $9,000. Which of the following statements about Connie's investment in the segregated fund is CORRECT? Any top-up required for Connie's maturity guarantee will be taxable as interest. The $10,000 contribution that Connie made to the TFSA is tax-deductible. If Connie were to die today, Khaled would receive $10,000 as beneficiary. If Connie withdraws $1,000 in year 1, the redemption fee will be $40. 16 Oa) b) Oc) Od) Prev Next View Summary Close Next - saves your answer and allows you to go to the next question. View Summary - allows you to view your answer choices and those you marked for review. Submit Now - submits your answer choices for grading. Close - exits the exam. Jasha, age 45, meets with his insurance agent, Byron, to discuss an investment strategy. Jasha plans to borrow $100,000 from his bank in order to purchase a portfolio of non-registered segregated funds. Before Jasha proceeds with this strategy, Byron cautions Jasha about the potential risks. Which of the following risks can arise from Jasha' borrowing strategy? longevity risk leverage risk liquidity risk credit risk 17 Oa) Ob) Oc) Od) Close - exits the exam. Suzanna meets with her insurance agent, Magda, to discuss her investment portfolio. Suzanna's current portfolio consists of equity mutual funds invested within her Registered Retirement Savings Plan (RRSP). She has a 15-year time horizon and she expects that her RRSP will be her most significant source of retirement income. However, Suzanna is uncomfortable with the fluctuations in the value of her account. Suzanna asks Magda about selling her equity mutual funds and moving the money into Guaranteed Investment Certificates (GICS). If Suzanna switches her portfolio to GICS, which of the following risks would Suzanna assume with her new GIC portfolio given her objectives and time horizon? 18 market risk Oa) b) Oc) Od) liquidity risk inflation risk economic risk Prev Next View Summary Close Eugenio is working with his client, Fionna, to develop her investor profile. Fionna is retiring next year and she does not have a pension from her employer. However, Fionna has managed to save a substantial amount in her registered retirement savings plan (RRSP), which makes up the majority of her investment assets. Fionna is widowed and has two adult children. When she passes, Fionna would like to leave her children some money, if there is any left. Up until this time, Fionna has managed her own RRSP account. After review, Eugenio determines that the asset allocation is generally appropriate for her current situation. Which of the following investor needs is the MOST important to Fionna? 19 need for tax efficiency need for estate planning Oa) Ob) Cc) need for retirement income Od) need for investment management Kachina reviews her client Laird's existing investments. She notices that all of his investments are concentrated in long- term investments or investments with long durations to maturity. Laird is planning on buying a house soon, within the next 2 to 3 months. He will need approximately $50,0000 from his investments to put towards the down payment on the house and additional amounts to cover other costs including legal fees and land transfer costs.. Which of the following BEST describes what Laird should do given his planned home purchase? He should purchase an immediate life annuity. He should purchase some highly liquid investments. He should purchase an accumulation annuity. He should keep his investments as they are. 20 Prev Next View Summary Close 21 You meet with your client, Yolanda, for an investment discussion. After completing your analysis, you recommend that Yolanda purchase a single life prescribed annuity. Yolanda accepts your advice and proceeds with the purchase. Which of the following statements about Yolanda's investment is CORRECT? i. Yolanda must begin receiving payments on or before December 31 of next year. ii. Yolanda can name herself or her spouse as annuitant. iii. The annuity payments can be indexed over time to offset the effects of inflation. iv. Every annuity payment will contain a level amount of interest and principal. i and ii i and iv Oa) Ob) Oc) ii and ii Od) ii and iv CIose - exits the exam. Esai, age 76, owns a segregated fund contract from the Maple Leaf Insurance Company. 10 years ago, Esai invested $95,000 in the segregated fund. Upon maturity, it is now valued at $55,000. The contract has a 75% maturity guarantee and 100% death benefit guarantee. However, the Maple Leaf Insurance Company has gone bankrupt and can no longer honour its guarantees. In this case, how much will Esai receive under the terms of his contract? 22 Oa) Ob) $60,000.00 $60,562.50 $71,250.00 Od) $80,750.00 Prev Next View Summary Close Next - saves your answer and allows you to go to the next question. View Summary - allows you to view your answer choices and those you marked for review. Submit Now - submits your answer choices for grading. Close - exits the exam. Trina purchases a US government bond, denominated in US dollars. The bond is issued in Canada and she purchases it through her investment dealer in Toronto, Ontario. The bond has a $25,000 face value and a 3% coupon rate. Which of 23 the following statements about Trina's investment are CORRECT? i. Trina owns a Eurobond. ii. Trina will receive semi-annual payments of $750. iii. Trina's coupon payments are taxed more favourably than a GIC. iv. Trina will have a capital gain if she sells the bond for more than $25,000. i and iii i and iv Oa) ii and ii C) Od) ii and iv Prev Next View Summary Close Close - exits the exam, Kyle is an insurance agent and he meets with his client Farbod. Farbod, age 59, is planning to retire next year when he turns 60. Farbod wants to know which government retirement benefits he will be eligible for when he retires. When Farbod asks Kyle about Old Age Security (OAS), which of the following answers is CORRECT? When Farbod becomes eligible for OAS, he will receive the benefits tax-free. Farbod cannot receive OAS payments if he leaves Canada. If Farbod decides to delay retirement, he can receive OAS payments while he is still working. Farbod can begin receiving OAS payments as early as age 60. 24 Prev Next View Summary Close CIose - exits the exam. 25 Oa) Ob) Oc) Od) Rudy deposits $25,000 into a savings account. Rudy doesn't make any deposits or withdrawals from the account, but a year later, his account balance has increased to $25,250. Inflation for the period is 1.5%. Which of the following statements about Rudy's savings account is CORRECT? Rudy's nominal rate of return is -0.50%. Rudy's real rate of return is 1%. Rudy has earned a capital gain of $250. Rudy has a liquid investment. Prev Next View Summary Close 26 You meet with a prospective client, Katarina, for an investment planning discussion. Although Katarina owns several guaranteed investment certificates (GICS), she is very inexperienced when it comes to investing. Katarina is now interested in segregated funds and you discuss the different features and options available with her. When Katarina asks you about the different types of funds available, which of the following would be the CORRECT response that you should provide to her? One of the main concerns associated with real estate equity funds would be liquidity risk. Money market funds typically invest 50% of their assets in cash or cash equivalents. A "fund of funds" is a mirror of an index which is rebalanced to reflect the stocks in the index. Dividend funds use a passive investment strategy to select companies with guaranteed dividends. Oa) Ob) Oc) Od) Prev Next View Summary Close CIUSE - AILS LITE txami. Jean-Pierre has inherited a large sum of money and he meets with his new agent, Claude, to invest. Claude asks Jean- Pierre a number of questions. Claude learns that Jean-Pierre considers charitable giving important and that he believes in the ethical treatment of animals. Which of the following statements correctly describes the conversation between 27 Oa) Ob) Claude and Jean-Pierre? Claude has completed his review for the investor profile and he is ready to make a recommendation. This is a friendly conversation between Claude and Jean-Pierre which is outside the scope of the meeting about investments. Claude has learned about Jean-Pierre's personal values which may affect his investment decisions. This is personal information that Jean-Pierre has shared with Claude which is separate from his attitude toward investing. C) Od) Prev Next View Summary Close Penny receives a bonus from work and meets with her insurance agent, Leonard, to discuss her options for investing. Penny has already contributed the maximum amounts to her Registered Retirement Savings Plan (RRSP) and Tax-Free Savings Account (TFSA). Penny determines that she will need to invest her bonus proceeds into a non-registered account. Penny's time horizon for the investment is 5 years when she would like to use the funds for a down payment on a cottage. Penny considers both a mutual fund and a segregated fund. Which of the following is an advantage of putting her investment in a segregated fund over a mutual fund? maturity guarantee diversification 28 Oa) Ob) Oc) Od) creditor protection variety of funds available Prev Next View Summary Close 30 Jessica works in the human resources department of Artmetrics, a medium-sized software development firm with 500 employees. Artmetrics is considering implementing a group savings plan and has given Jessica the responsibility of evaluating the different types of plans for presentation to the board. Jessica tells the insurance agent, Klaus, that the company wants a plan where both the employer and employees are required to contribute to the plan. Artmetrics also wants a plan that does not place the responsibility for investment decisions within the plan on the employees. Which of the following types of plans would BEST meet Artmetrics' objectives? Defined Contribution Pension Plan (DCPP) Ca) Ob) Defined Benefit Pension Plan (DBPP) Oc) Od) Pooled Registered Pension Plan (PRPP) Deferred Profit Sharing Plan (DPSP) Prev View Summary Close CIose - exits the exam. 29 At the beginning of the year, Lucca purchases 2,000 units of the Apex Growth Segregated Fund at a net asset value per unit (NAVPU) of $14. At the end of the year, the NAVPU has increased to $17 and Lucca receives a tax slip indicating an allocation of a $500 capital gain. Lucca is in a 32% marginal tax rate. Based on this information, which of the following statements is CORRECT? Ca) Ob) OC) Od) Lucca must pay $160 in tax due to his capital gain allocation. Lucca's adjusted cost base (ACB) is now 28,500. If Lucca sells his segregated fund now, he will receive $33,500. To date, Lucca's rate of return is 17.65%. Prev Next View Summary Close

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 George 35 who is single rents an apartment and has little net worth or assets George has little to no assets and because of this he has a greater need for estate planning By having a will or trust i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

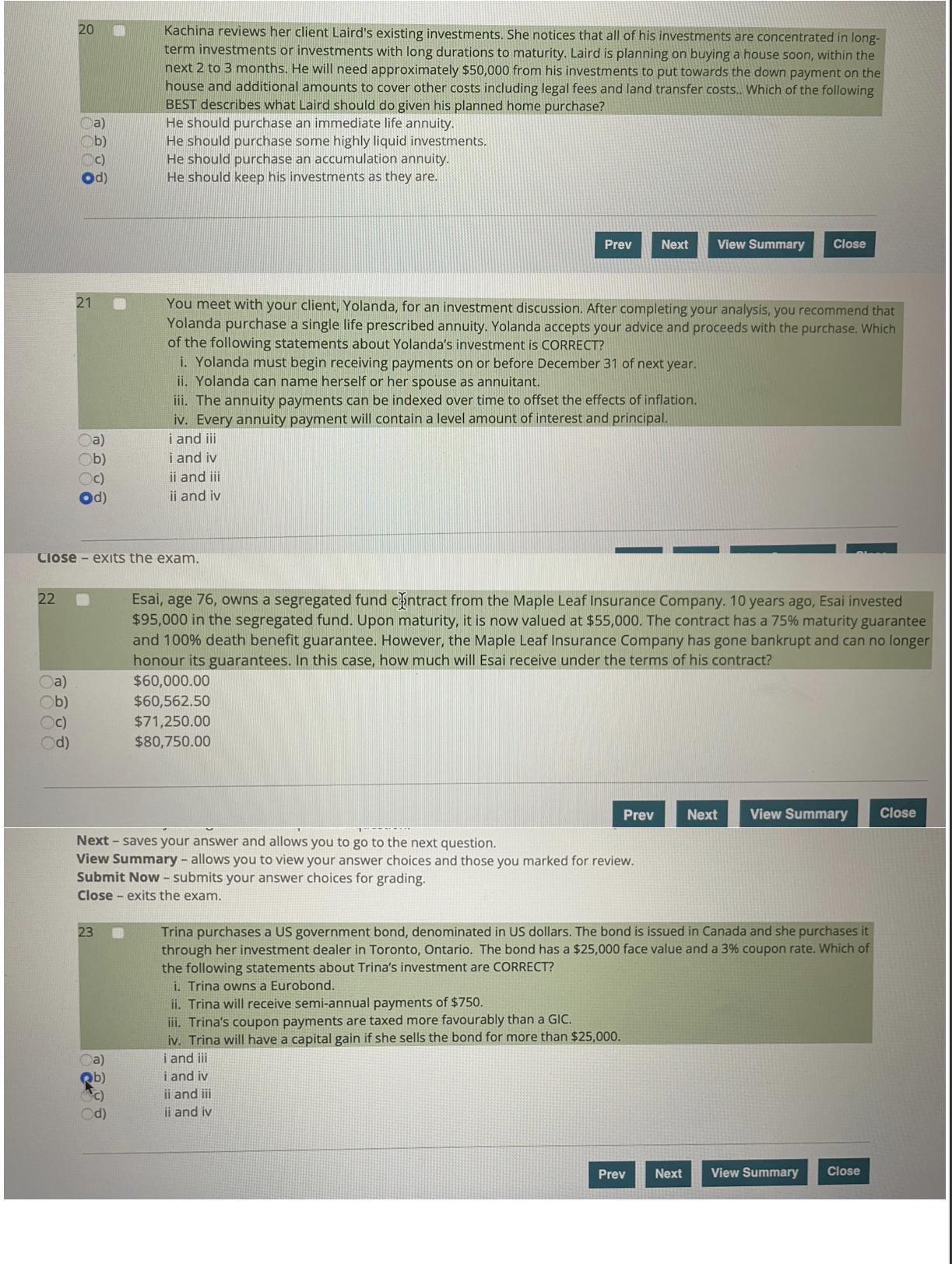

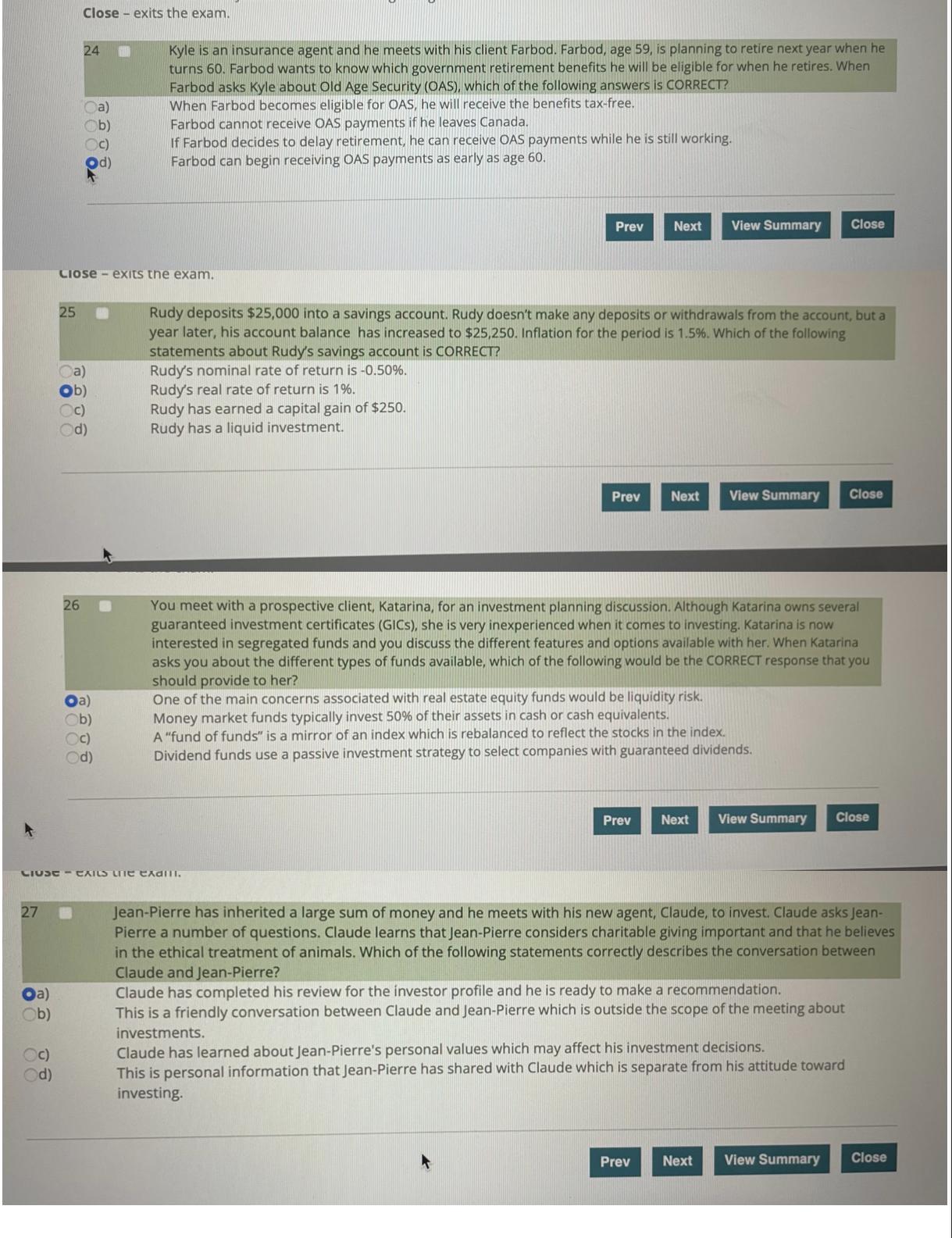

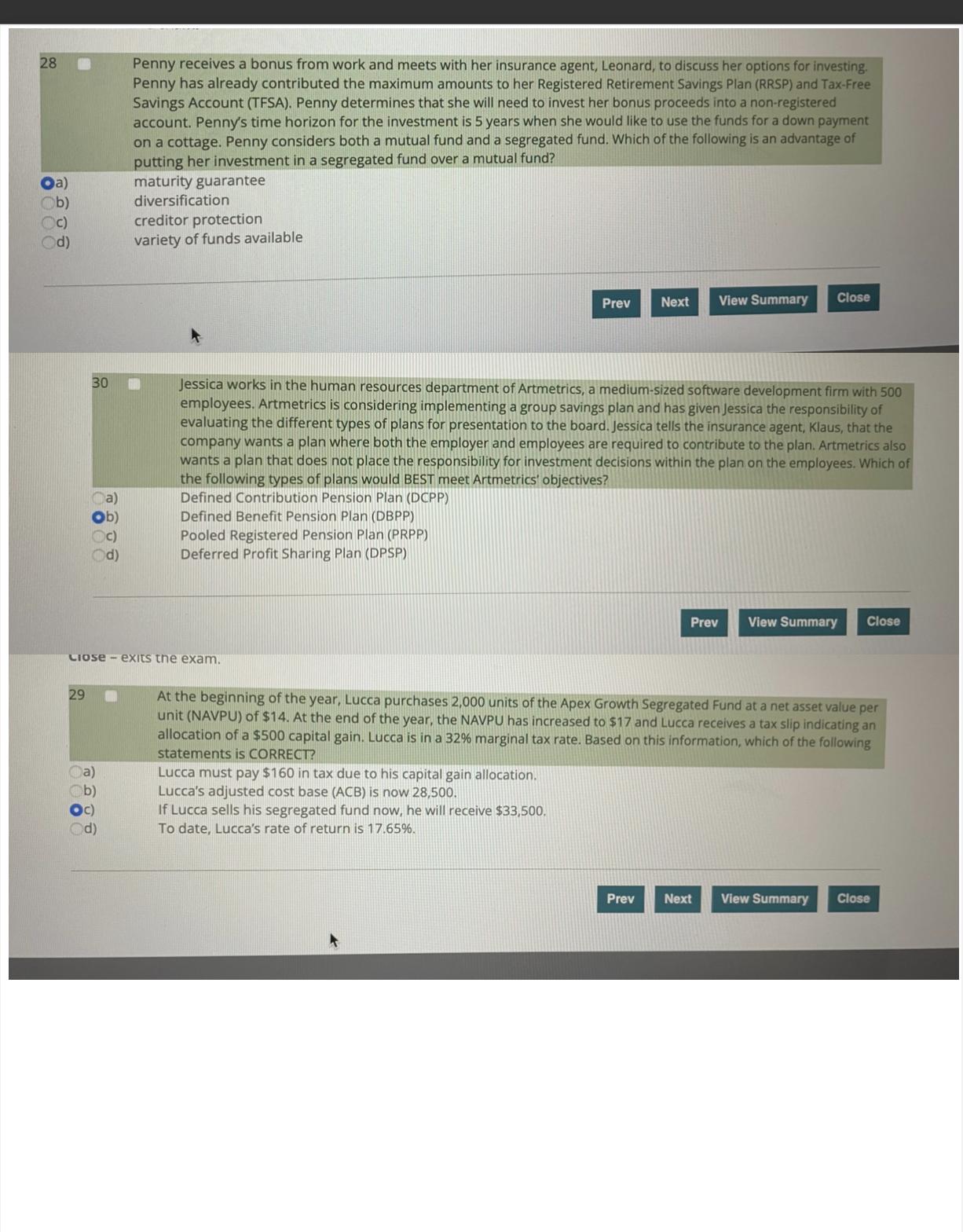

Get Started