Question

Which of the following conditions must be met in order to classify an asset as held for sale? (i) The asset is expected to be

Which of the following conditions must be met in order to classify an asset as held for sale? (i) The asset is expected to be sold within 12 months (ii) The asset will definitely be sold (iii) The asset is available for immediate sale in its present condition (iv) The asset is due to be marketed in the next month A (i), (ii) and (iii) B (i), (iii) and (iv) C (i) and (iii) D (ii) and (iv) 2. Cool Plc issued a three year 5% convertible bond on 1 July 2015. The bond has a Nominal value of 250,000. The market rate of interest applicable to non-convertible bonds is 7%. The present value of 1 payable at the end of the year, based on rates of 5% and 7% is as follows: End of year 5% 7% 1 2 3 0.95 0.93 0.91 0.87 0.86 0.82 What is the value of the equity component of the convertible bond issued by Cool Plc as at 1 July 2015? A nil B 5,000 C 15,000 D 12,250 3. Which of the following require restatement and retrospective application in the financial statements? (i) The discovery of a material error (ii) A change in accounting policy (iii) A change in accounting estimate A All of them B (i) and (ii) C (ii) and (iii) D (i) and (iii) 23 4. Walliams had 2,000,000 50p shares in issue on 1 January 2014. On 1 May 2014, Walliams issued 500,000 shares at their market value of 1.20 each. On 1 August 2014, Walliams made a bonus issue of 1 share for every 5 in issue What is the weighted average number of shares to use in Walliams Basic Earnings Per Share calculation for the year ended 31 December 2014? A 2,800,000 B 4,150,000 C 5,000,000 D 5,200,000 5. The following is an extract from the statement of cash flows for XY for the year ended 31 December 2011: m Cash flows from operating activities 950 590 Cash flows from financing activities 120 (1,130) Cash and cash equivalents at start of year 650 (60) Cash flows from investing activities Net cash flow for the year Cash and cash equivalents at end of year Based on the information provided, which one of the following independent statements would be a reasonable conclusion about the financial adaptability of XY for the year to 31 December 2011? A XY is in decline as there is a significant cash outflow in investing activities. B XY has financed a high proportion of its investing activities by utilising its operating cash. C XY must have made a profit in the year, as it has a net cash inflow from operating activities. D XY must be facing serious liquidity problems as its cash and cash equivalents have fallen by 60 million throughout the year. 6. TK operates in the fashion wholesale business and its management team has become increasingly concerned about the liquidity of the entity. It has asked you for your opinion and you have calculated the following ratios to help you with your assessment: 30 June 2013 30 June 2012 77 days 87 days 118 days 2.1:1 1.4:1 Payables payment period Current ratio Quick ratio Receivables collection period 88 days Inventory holding period 128 days 170 days 1.3:1 0.7:1 Which one of the following is NOT a valid statement about the ratios shown above? A The increase in inventory holding period is a significant concern as there is a high risk of obsolescence in the industry. B The deterioration in the ratios shown at the 30 June 2013 year-end could simply be a result of a significant purchase of goods being made on credit terms close to the year-end. C TK are attempting to finance their increased inventory holding period by delaying payments to suppliers. D The significant increase in payables payment period will have caused the cash position to worsen dramatically. 7. Port Co purchased 3,500 of the 10,000 1 equity shares of Stern Co on 1 August 2014 for 6.50 per share. Stern Co's profit after tax for the year ended 31 July 2015 was 7,500. Stern Co paid a dividend of 0.50 per share on 31 December 2014. Indicate the carrying amount of the investment in Stern Co in the consolidated statement of financial position of Port Co as at 31 July 2015 (to the nearest whole ). A 22,750 B 25,375 C 23,625 D 27,125 8. Indicate, whether the following statements regarding calculating the impairment loss of an asset are true or false. (i) Assets should be carried at the lower of their carrying amount and recoverable value. (ii) The recoverable amount is the higher of value in use and fair value less costs of disposal. A (i) True, (ii) True B (i) True, (ii) False C (i) False, (ii) True D (i) False, (ii) False 9. Fuller Co has a current ratio of 1.2:1 which is below the industry average. Fuller Co wants to increase its current ratio by the year end. Which of the following actions, taken before the year end, would lead to an increase in the current ratio? A Return some inventory which had been purchased for cash and obtain a full refund on the cost B Make a bulk purchase of inventory for cash to obtain a large discount C Make an early payment to suppliers, even though the amount is not due D Offer early payment discounts in order to collect receivables more quickly 45 10. Tomas Co has been trading for a number of years and is currently going through a period of expansion. An extract from the statement of cash flows for the year ended 31 December 2017 for Tomas Co is presented as follows: 000 Net cash from operating activities 995 Net cash used in investing activities Net cash used in financing activities (540) (200) Net increase in cash and cash equivalents 255 Cash and cash equivalents at the beginning of the period 200 Cash and cash equivalents at the end of the period 455 Which of the following statements is correct according to the extract of Tomas Cos statement of cash flows? A The company has good working capital management B Net cash generated from financing activities has been used to fund the additions to non-current assets C Net cash generated from operating activities has been used to fund the additions to non-current assets D Existing non-current assets have been sold to cover the cost of the additions to non-current assets 11. IFRS 5 Assets Held for Sale and Discontinued Operations describes a discontinued operation as a component of an entity that has either been disposed of, or is classified as held for sale. Which of the following would NOT meet the criteria for a discontinued operation? A Restructuring of a business segment B Subsidiary acquired exclusively with a view to resale C Part of a co-ordinated plan to dispose of a geographical area of operations D Disposal of a separate major line of business or geographical area of operations 12. On 21 April 2009, prior to the authorisation of the financial statements, for the year ended 31 March 2009, the internal audit department of XCO discovered a fraud by an employee who had been making payments to a fictitious supplier during the year. The fraud amounted to 790,000, which is considered to be material. How should the fraud be treated in the financial statements for the year ended 31 March 2009 in accordance with IAS 10 Events After the Reporting Date? A Disclosed as a non-adjusting event B Identified as a non-adjusting event, but resulting in adjustment because the going concern status of XCO is affected C Ignored as the discovery was after the reporting date D Treated as an adjusting event in the financial statements.6 2012 figure 13. The issued share capital of Rozi, a public listed company, at 30 September 2008 was 90 million, made up of shares of 50 pence each. On 1 February 2009 Rozi made a fully subscribed rights issue of one new share for every four held at a price of 2.40 per share. The market price of the equity shares immediately before the issue was 3.90. The profit after tax for the year ended 30 September 2009 was 32 million. What is the basic earnings per share figure for the year ended 30 September 2009? A 15.2 pence B 14.9 pence C 14.2 pence D 13.5 pence 14. Which of the following meet the definition of a financial asset in accordance with IFRS 9 Financial Instruments? (1) An equity instrument of another entity. (2) A contract to exchange financial instruments with another entity under conditions which are potentially favourable. (3) A contract to exchange financial instruments with another entity under conditions which are potentially unfavourable. (4) Cash. A (1) and (2) only B (1), (2) and (4) C (1), (3) and (4) D (4) only

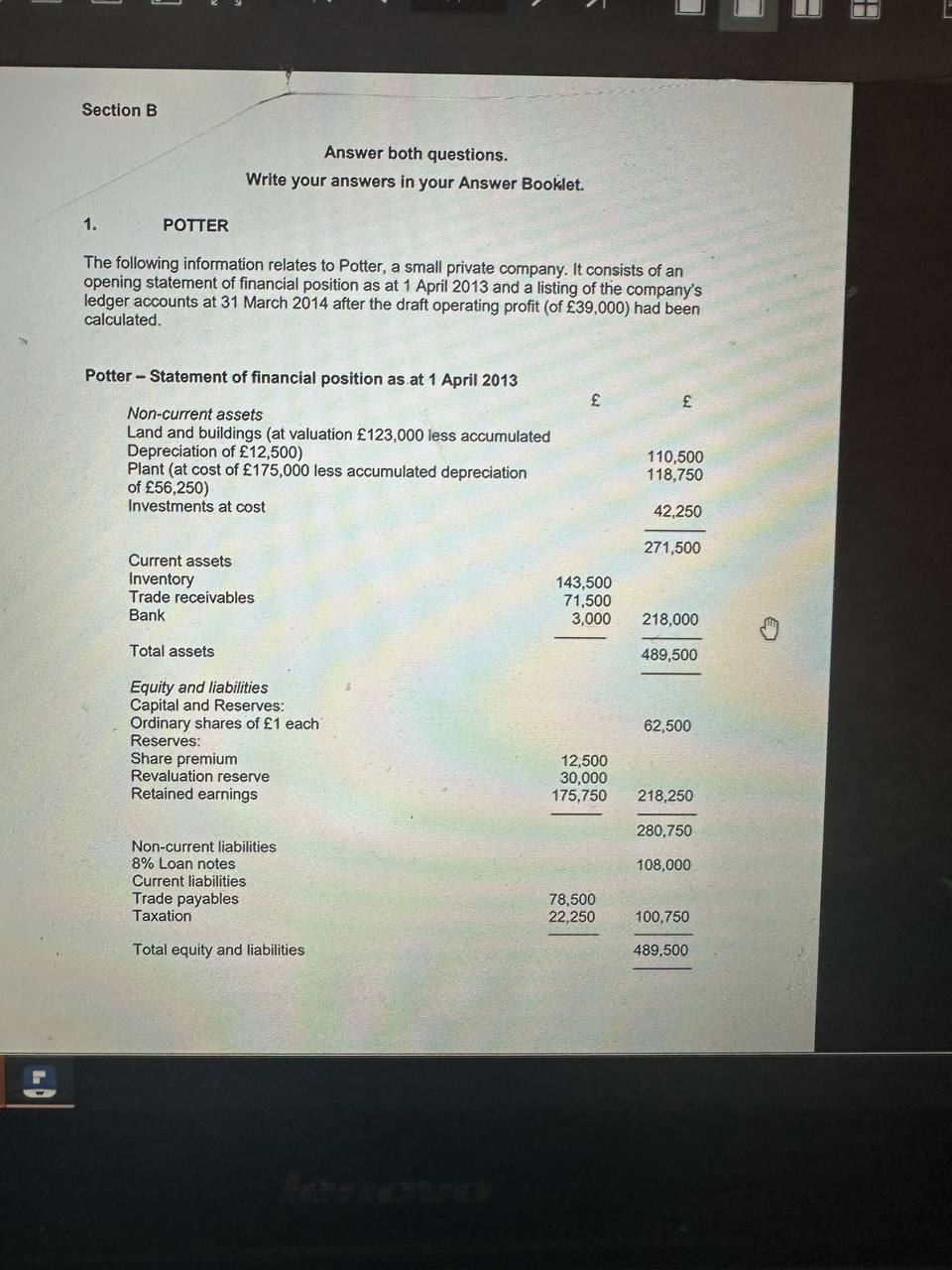

section b

on photo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started