Answered step by step

Verified Expert Solution

Question

1 Approved Answer

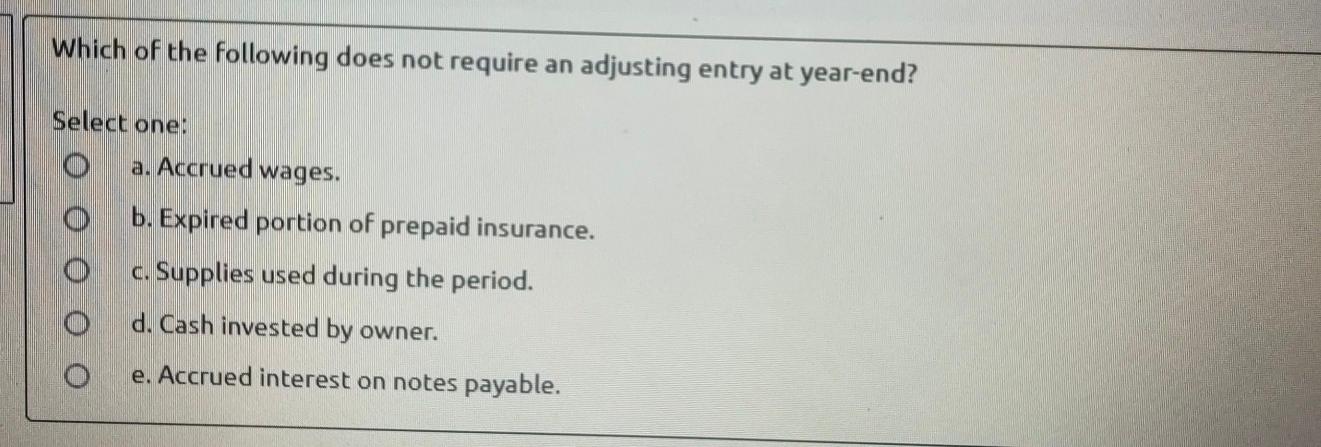

Which of the following does not require an adjusting entry at year-end? Select one: o a. Accrued wages. O b. Expired portion of prepaid insurance.

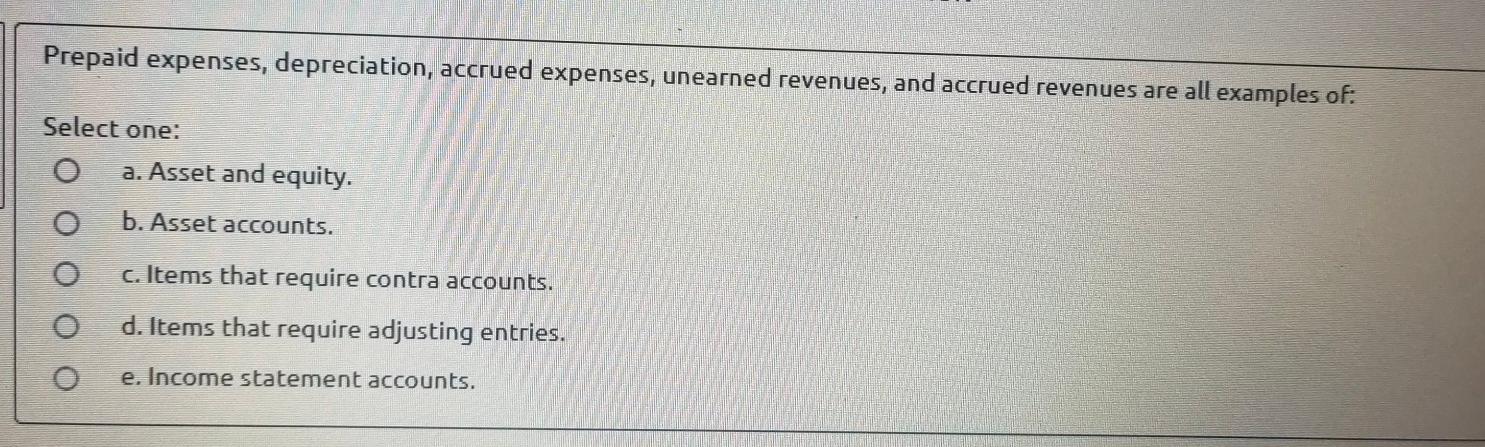

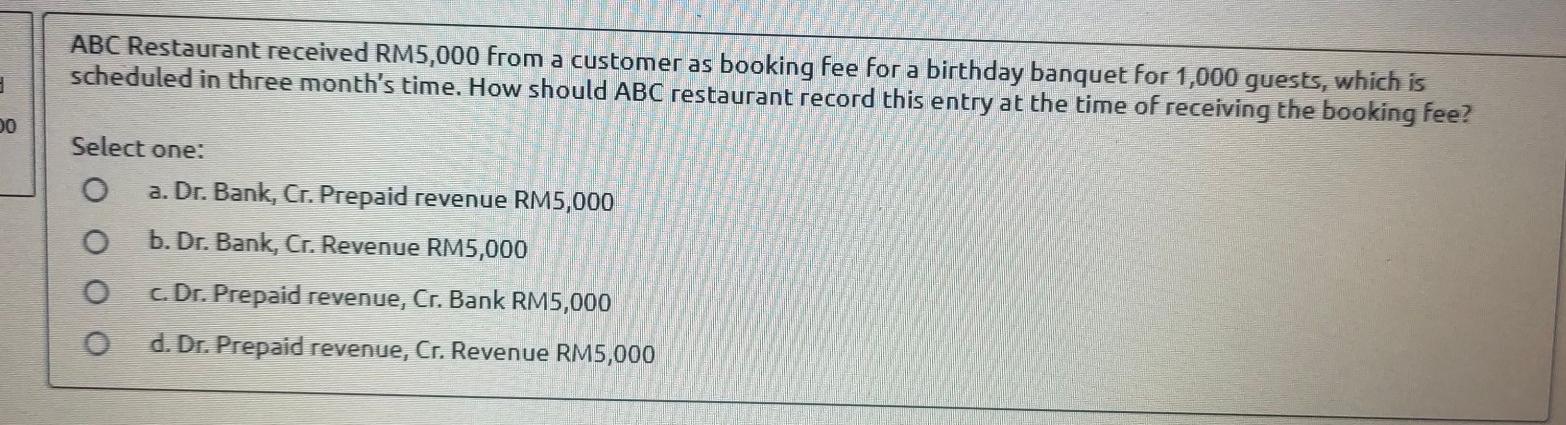

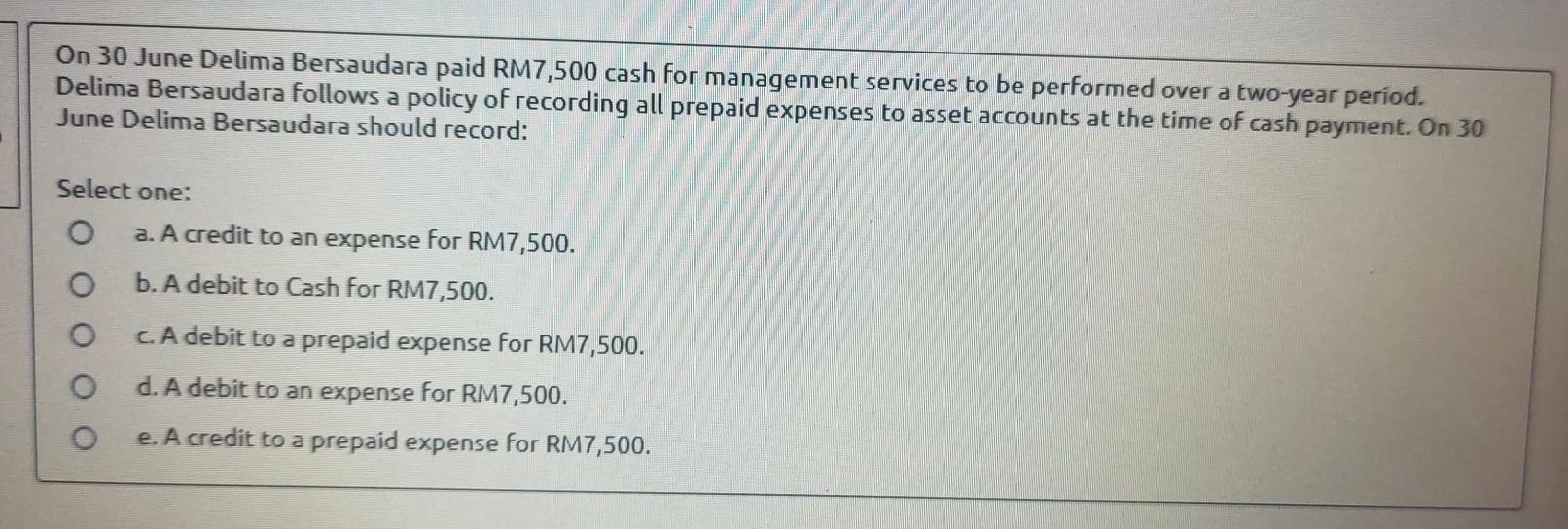

Which of the following does not require an adjusting entry at year-end? Select one: o a. Accrued wages. O b. Expired portion of prepaid insurance. o c. Supplies used during the period. d. Cash invested by owner. e. Accrued interest on notes payable. Prepaid expenses, depreciation, accrued expenses, unearned revenues, and accrued revenues are all examples of: Select one: a. Asset and equity. b. Asset accounts. c. Items that require contra accounts. d. Items that require adjusting entries. e. Income statement accounts. ABC Restaurant received RM5,000 from a customer as booking fee for a birthday banquet for 1,000 guests, which is scheduled in three month's time. How should ABC restaurant record this entry at the time of receiving the booking fee? 0 Select one: O a. Dr. Bank, Cr. Prepaid revenue RM5,000 O b. Dr. Bank, Cr. Revenue RM5,000 O c. Dr. Prepaid revenue, Cr. Bank RM5,000 o d. Dr. Prepaid revenue, Cr. Revenue RM5,000 On 30 June Delima Bersaudara paid RM7,500 cash for management services to be performed over a two-year period. Delima Bersaudara follows a policy of recording all prepaid expenses to asset accounts at the time of cash payment. On 30 June Delima Bersaudara should record: Select one: O a. Acredit to an expense for RM7,500. O b. A debit to Cash for RM7,500. O c. A debit to a prepaid expense for RM7,500. O d. A debit to an expense for RM7,500. O e. A credit to a prepaid expense for RM7,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started