Answered step by step

Verified Expert Solution

Question

1 Approved Answer

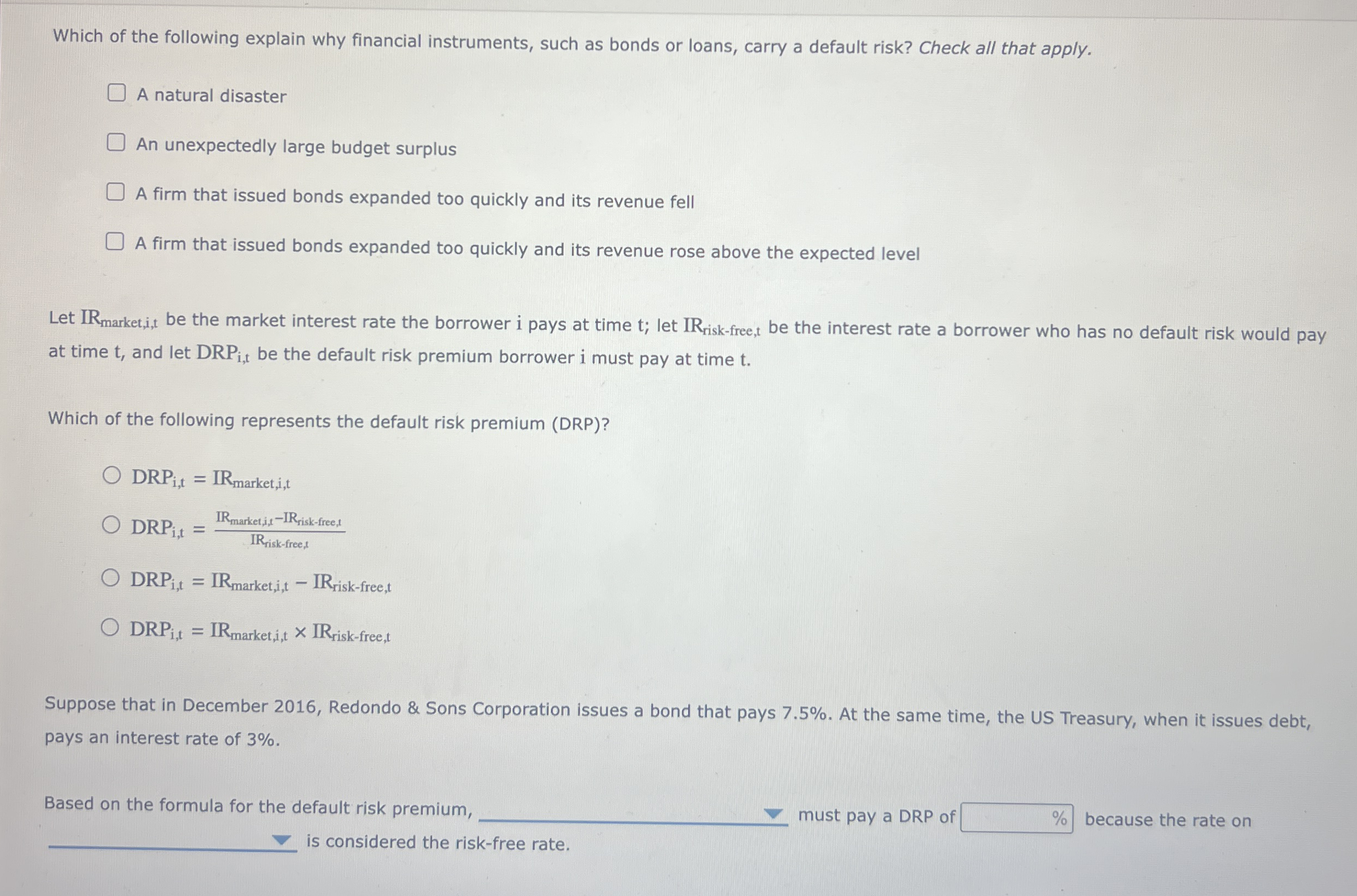

Which of the following explain why financial instruments, such as bonds or loans, carry a default risk? Check all that apply. A natural disaster An

Which of the following explain why financial instruments, such as bonds or loans, carry a default risk? Check all that apply.

A natural disaster

An unexpectedly large budget surplus

A firm that issued bonds expanded too quickly and its revenue fell

A firm that issued bonds expanded too quickly and its revenue rose above the expected level

Let be the market interest rate the borrower i pays at time ; let be the interest rate a borrower who has no default risk would pay

at time and let be the default risk premium borrower i must pay at time

Which of the following represents the default risk premium DRP

I

Suppose that in December Redondo & Sons Corporation issues a bond that pays At the same time, the US Treasury, when it issues debt,

pays an interest rate of

Based on the formula for the default risk premium,

must pay a DRP of

because the rate on

is considered the riskfree rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started