Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following factors would NOT be an indicator of an investor's ability to exercise significant influence over the operating and financial policies

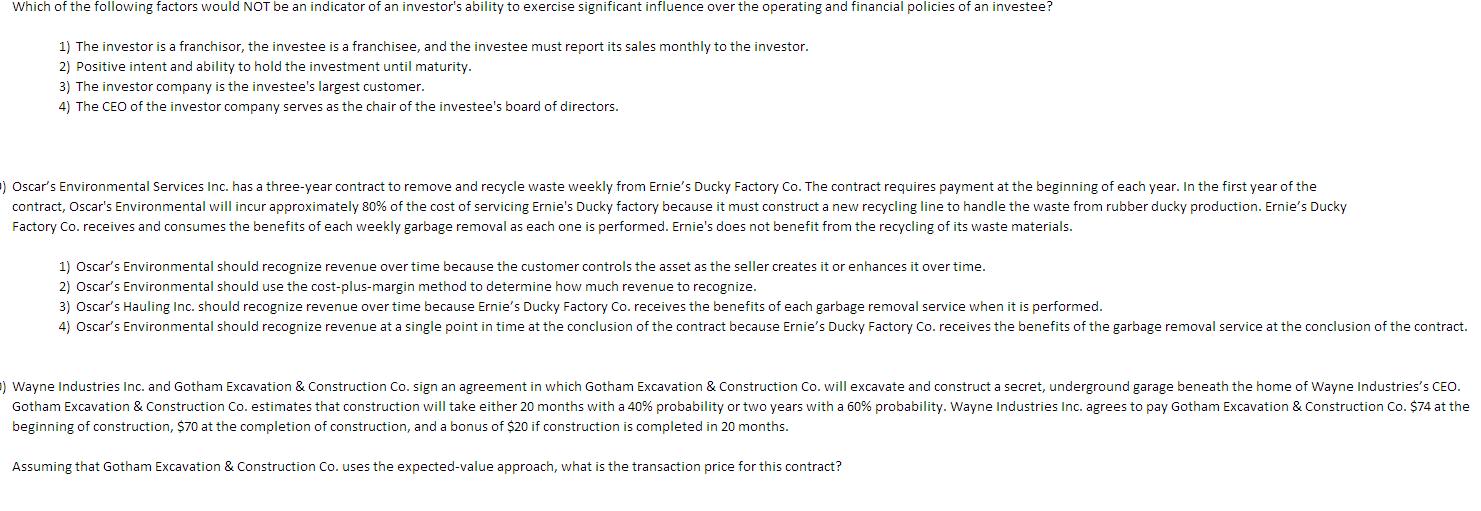

Which of the following factors would NOT be an indicator of an investor's ability to exercise significant influence over the operating and financial policies of an investee? 1) The investor is a franchisor, the investee is a franchisee, and the investee must report its sales monthly to the investor. 2) Positive intent and ability to hold the investment until maturity. 3) The investor company is the investee's largest customer. 4) The CEO of the investor company serves as the chair of the investee's board of directors. ) Oscar's Environmental Services Inc. has a three-year contract to remove and recycle waste weekly from Ernie's Ducky Factory Co. The contract requires payment at the beginning of each year. In the first year of the contract, Oscar's Environmental will incur approximately 80% of the cost of servicing Ernie's Ducky factory because it must construct a new recycling line to handle the waste from rubber ducky production. Ernie's Ducky Factory Co. receives and consumes the benefits of each weekly garbage removal as each one is performed. Ernie's does not benefit from the recycling of its waste materials. 1) Oscar's Environmental should recognize revenue over time because the customer controls the asset as the seller creates it or enhances it over time. 2) Oscar's Environmental should use the cost-plus-margin method to determine how much revenue to recognize. 3) Oscar's Hauling Inc. should recognize revenue over time because Ernie's Ducky Factory Co. receives the benefits of each garbage removal service when it is performed. 4) Oscar's Environmental should recognize revenue at a single point in time at the conclusion of the contract because Ernie's Ducky Factory Co. receives the benefits of the garbage removal service at the conclusion of the contract. ) Wayne Industries Inc. and Gotham Excavation & Construction Co. sign an agreement in which Gotham Excavation & Construction Co. will excavate and construct a secret, underground garage beneath the home of Wayne Industries's CEO. Gotham Excavation & Construction Co. estimates that construction will take either 20 months with a 40% probability or two years with a 60% probability. Wayne Industries Inc. agrees to pay Gotham Excavation & Construction Co. $74 at the beginning of construction, $70 at the completion of construction, and a bonus of $20 if construction is completed in 20 months. Assuming that Gotham Excavation & Construction Co. uses the expected-value approach, what is the transaction price for this contract?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Positive intend and ability to hold the investment until maturity Explanation Positive intend mean...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started