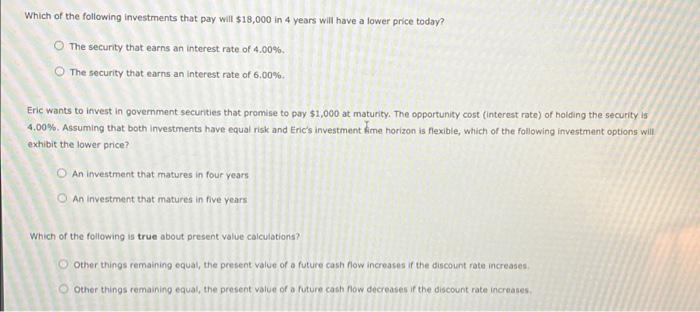

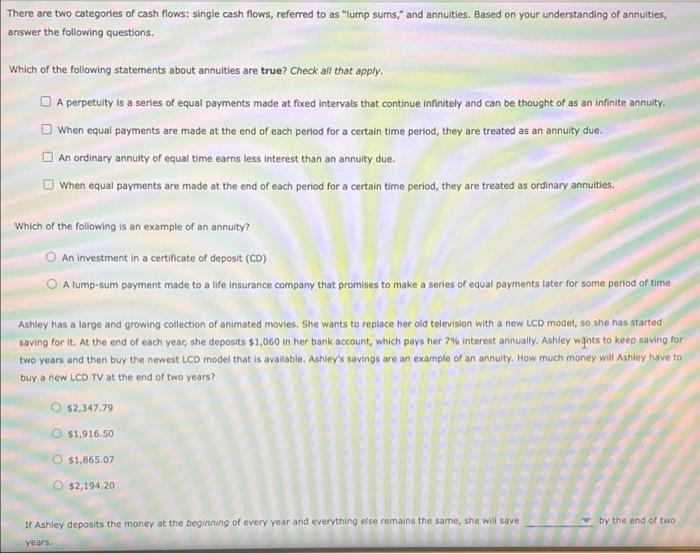

Which of the following investments that pay will $18,000 in 4 years will have a lower price today? The security that earns an interest rate of 4.00%. The security that earns an interest rate of 6.00%. Eric wants to invest in government securities that promise to pay $1,000 at maturity. The opportunity cost interest rate) of holding the security is 4,00%. Assuming that both Investments have equal risk and Eric's investment kime horizon is flexible, which of the following investment options will exhibit the lower price? O An investment that matures in four years An investment that matures in five years Which of the following is true about present value calculations? Other things remaining equal, the present value of a future cash flow increases in the discount rate increases Other things remaining equal, the present value of a future cash now decreases of the discount rate increases There are two categories of cash flows: single cash flows, referred to as "lump sums," and annulties. Based on your understanding of annuities, answer the following questions. Which of the following statements about annuities are true? Check all that apply. A perpetuity is a series of equal payments made at fixed intervals that continue Infinitely and can be thought of as an Infinite annuity. When equal payments are made at the end of each period for a certain time period, they are treated as an annuity due. An ordinary annuity of equal time earns less interest than an annuity due. When equal payments are made at the end of each period for a certain time period, they are treated as ordinary annuities. Which of the following is an example of an annuity? An Investment in a certificate of deposit (CD) A lump-sum payment made to a life Insurance company that promises to make a series of equal payments later for some period of time Ashley has a large and growing collection of animated movies. She wants to replace her old television with a new LCD model, so she has started saving for it. At the end of each year, she deposits $1,060 in her bank account, which pays her 7% interest annually. Ashley wants to keep saving for two years and then buy the newest LCD model that is available. Ashley's savings are an example of an annuity, How much money will Ashley have to buy a new LCD TV at the end of two years? $2,347.79 $1,916.50 O $1,865.07 $2,194.20 If Ashley deposits the money at the beginning of every year and everything else remains the same, she will save by the end of two years