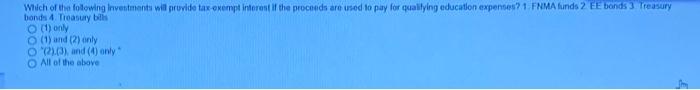

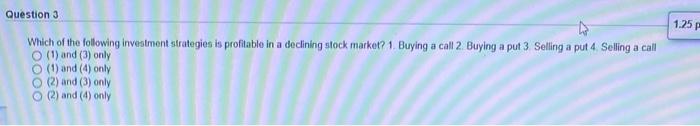

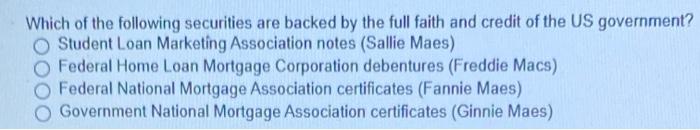

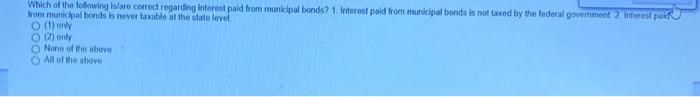

Which of the following Investments will provide tax-exempt interest if the proceeds are used to pay for qualitying education expenses? 1 FMA funds 2 FE bonds 3 Treasury bonds 4 Treasury bills (1) only o () and (2) only O 021.3), and (4) only All of the above Question 3 1.25 Which of the following investment strategies is profitable in a declining stock market? 1 Buying a call 2 Buying a put3 Selling a put 4 Selling a call (1) and (3) only (1) and (4) only O (2) and (3) only o () and (4) only Which of the following securities are backed by the full faith and credit of the US government? Student Loan Marketing Association notes (Sallie Maes) Federal Home Loan Mortgage Corporation debentures (Freddie Macs) Federal National Mortgage Association certificates (Fannie Maes) O Government National Mortgage Association certificates (Ginnie Maes) Which of the following are corred regarding Interest paid from municipal bonda? 1. Interest paid from municipal bonds la not taxed by the federal government 2 Interest par from municipal bonds is never taxable at the state level (1) only (2) only None of the above All of the above Which of the following Investments will provide tax-exempt interest if the proceeds are used to pay for qualitying education expenses? 1 FMA funds 2 FE bonds 3 Treasury bonds 4 Treasury bills (1) only o () and (2) only O 021.3), and (4) only All of the above Question 3 1.25 Which of the following investment strategies is profitable in a declining stock market? 1 Buying a call 2 Buying a put3 Selling a put 4 Selling a call (1) and (3) only (1) and (4) only O (2) and (3) only o () and (4) only Which of the following securities are backed by the full faith and credit of the US government? Student Loan Marketing Association notes (Sallie Maes) Federal Home Loan Mortgage Corporation debentures (Freddie Macs) Federal National Mortgage Association certificates (Fannie Maes) O Government National Mortgage Association certificates (Ginnie Maes) Which of the following are corred regarding Interest paid from municipal bonda? 1. Interest paid from municipal bonds la not taxed by the federal government 2 Interest par from municipal bonds is never taxable at the state level (1) only (2) only None of the above All of the above