Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following investments would have the highest future value at the end of 10 years? Assume that the effective annual rate for all

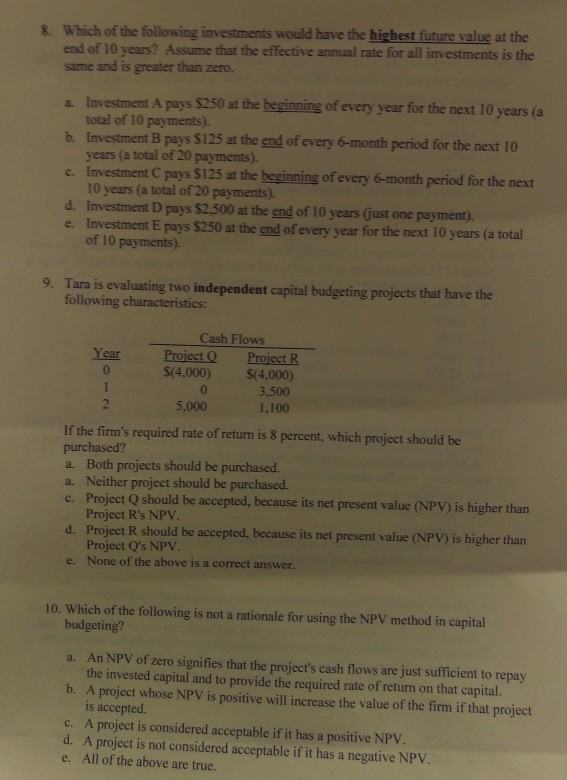

Which of the following investments would have the highest future value at the end of 10 years? Assume that the effective annual rate for all investments is the same and is greater than zero. 8. Investment A pays $250 at the beginning of every year for the next 10 years (a total of 10 payments). years (a total of 20 payments). 10 years (a total of 20 payments). Investment E pays $250 at the end of every year for the next 10 years (a total b. Investment B pays $125 at the end of every 6-month period for the next 10 c. Investment C pays $125 at the beginning of every 6-month period for the next d. Investment D pays $2,500 at the end of 10 years (Gust one payment). e. of 10 payments). Tara is evaluating two independent capital budgeting projects that have the following characteristics: 9. Cash Flows S(4.000)$(4,000) 5.0003,500 Year Project Q Project R 0 1.100 If the firm's required rate of return is 8 percent, which project should be purchased? a. Both projects should be purchased. a. Neither project should be purchased. c. Project Q should be accepted, because its net present value (NPV) is higher than Project R's NPV Project R should be accepted, because its net present value (NPV) is higher than Project Q's NPV None of the above is a correct answer d. e. 10. Which of the following is not a rationale for using the NPV method in capital budgeting An NPV of zero signifies that the project's cash flows are just sufficient to repay the invested capital and to provide the required rate of return on that capital. A project whose NPV is positive will increase the value of the firm if that project is accepted. a. b. c. A project is considered acceptable if it has a positive NPV. d. A project is not considered acceptable if it has a negative NPV e. All of the above are true

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started