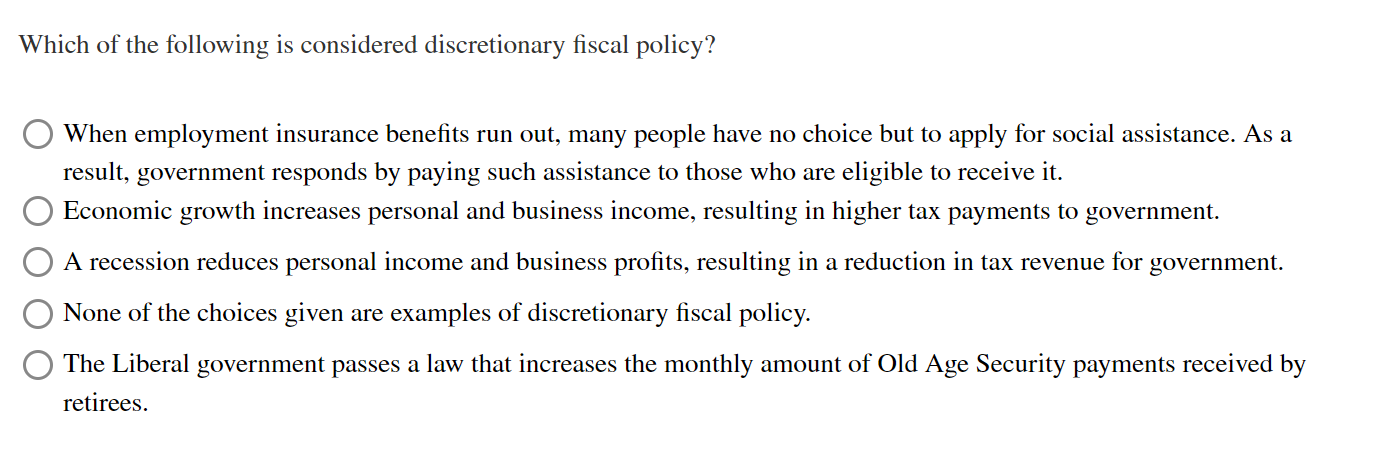

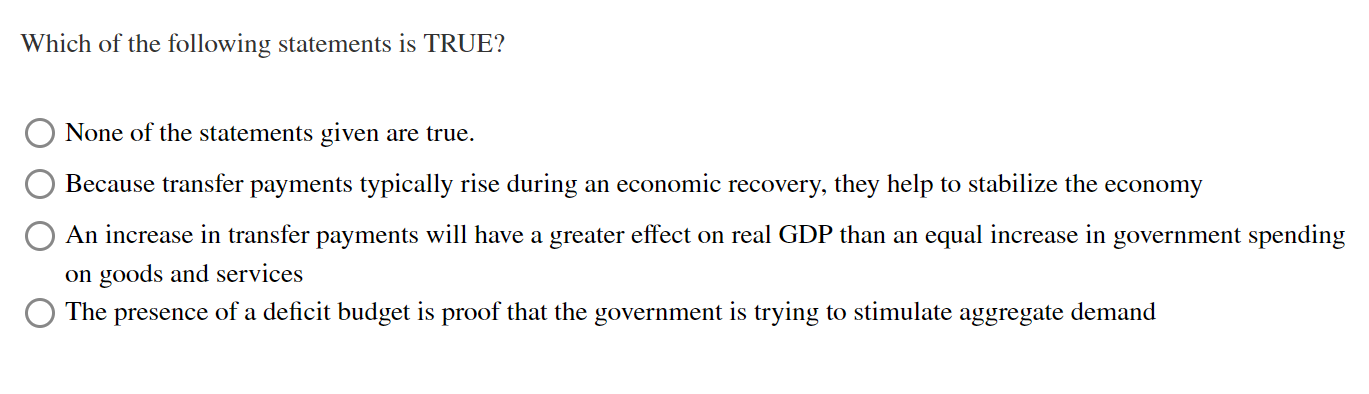

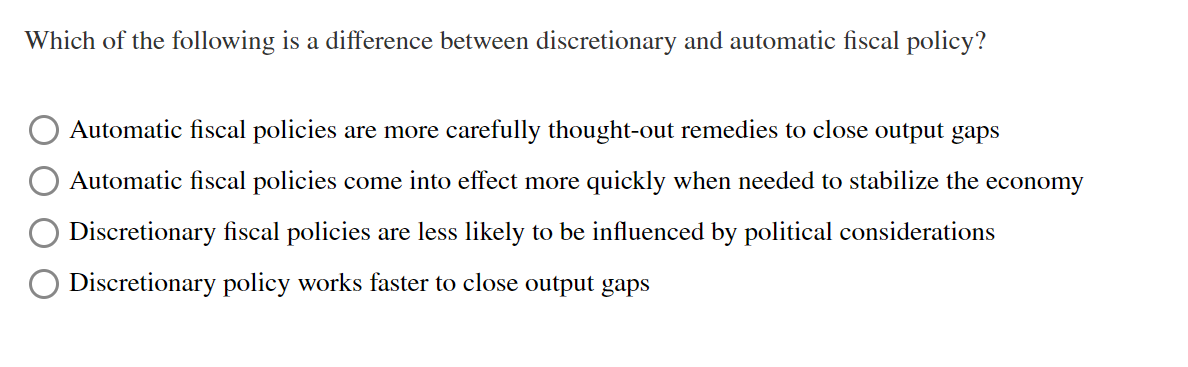

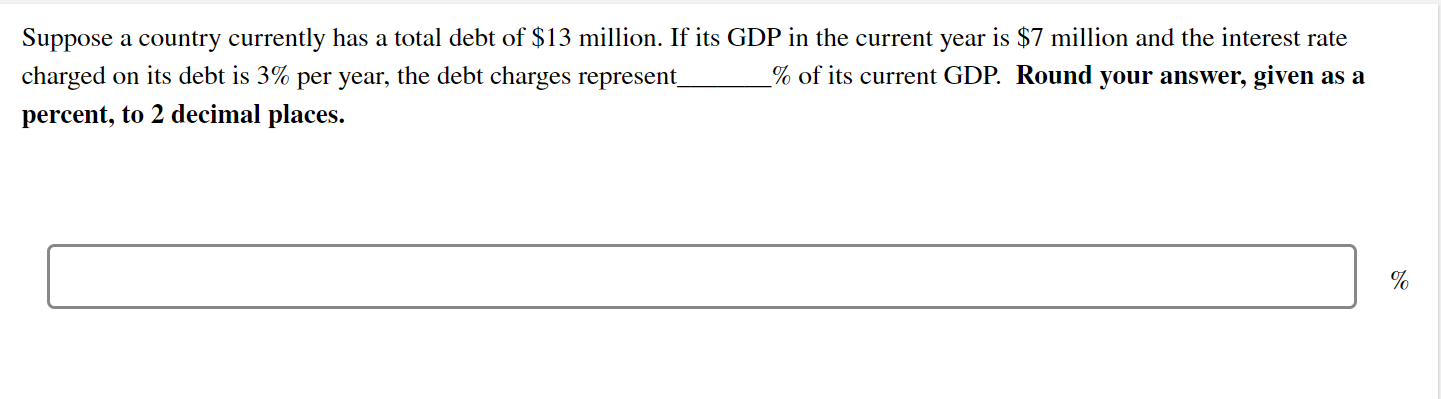

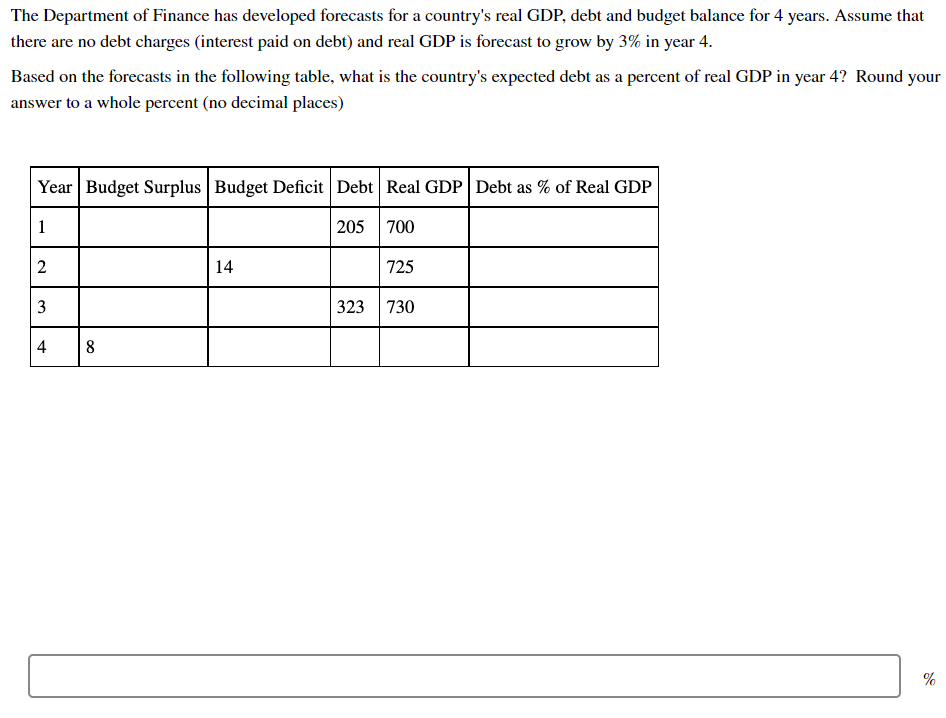

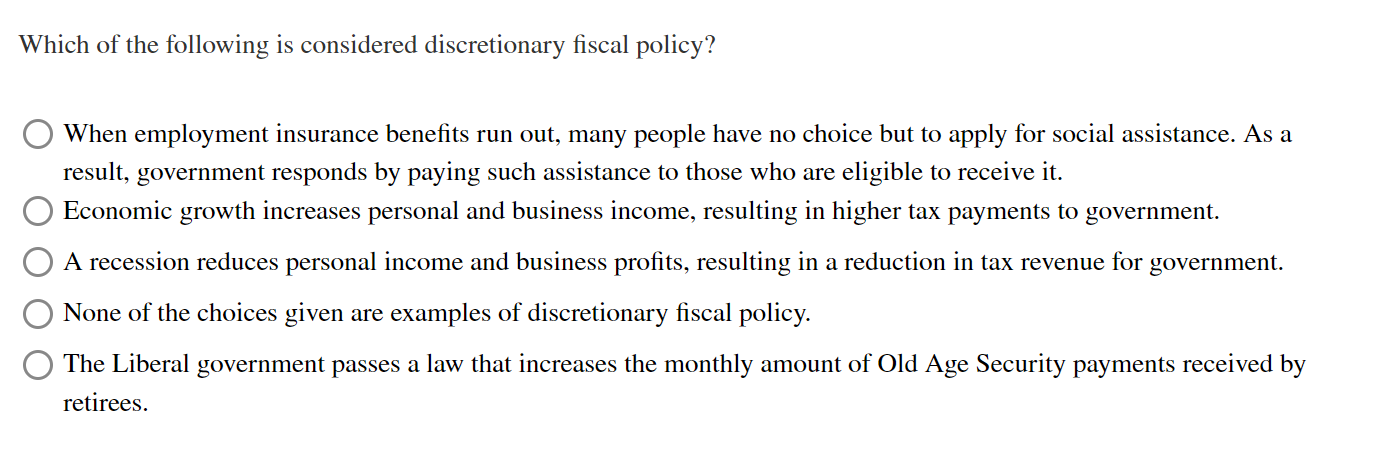

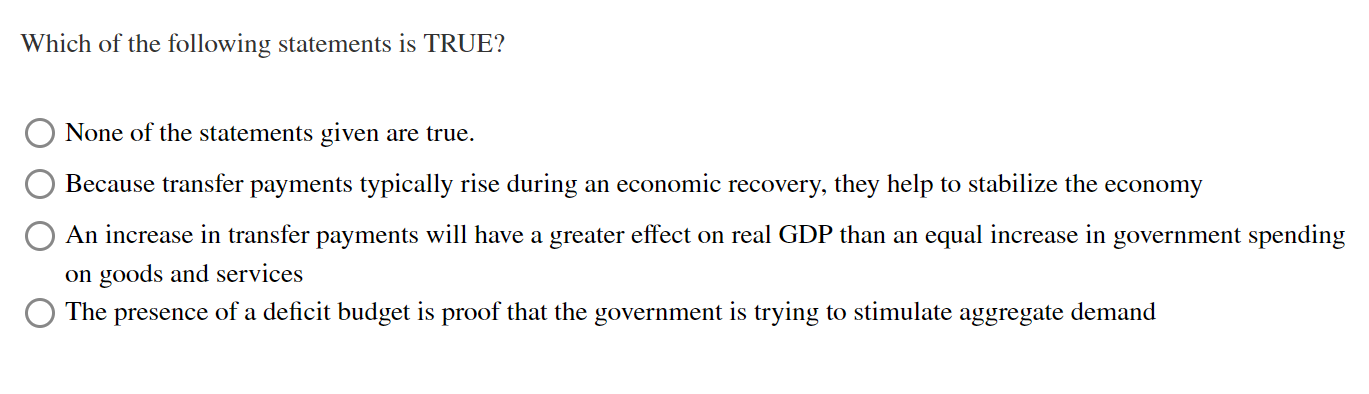

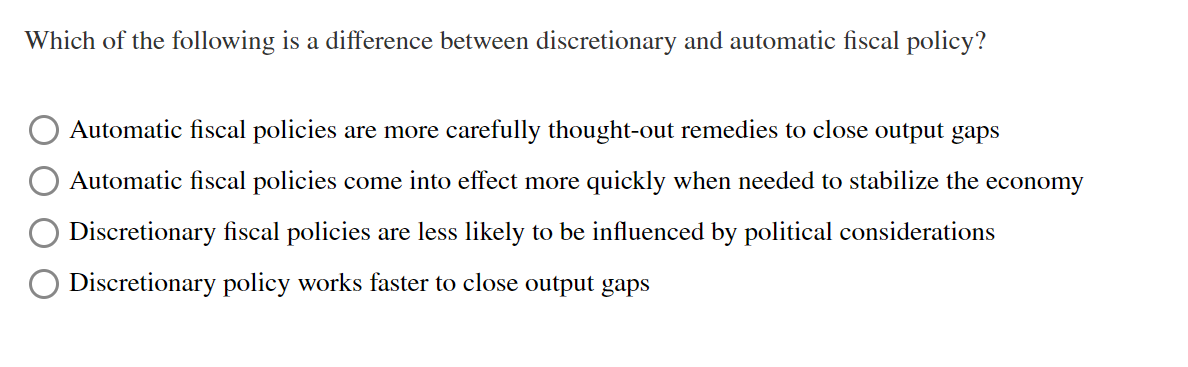

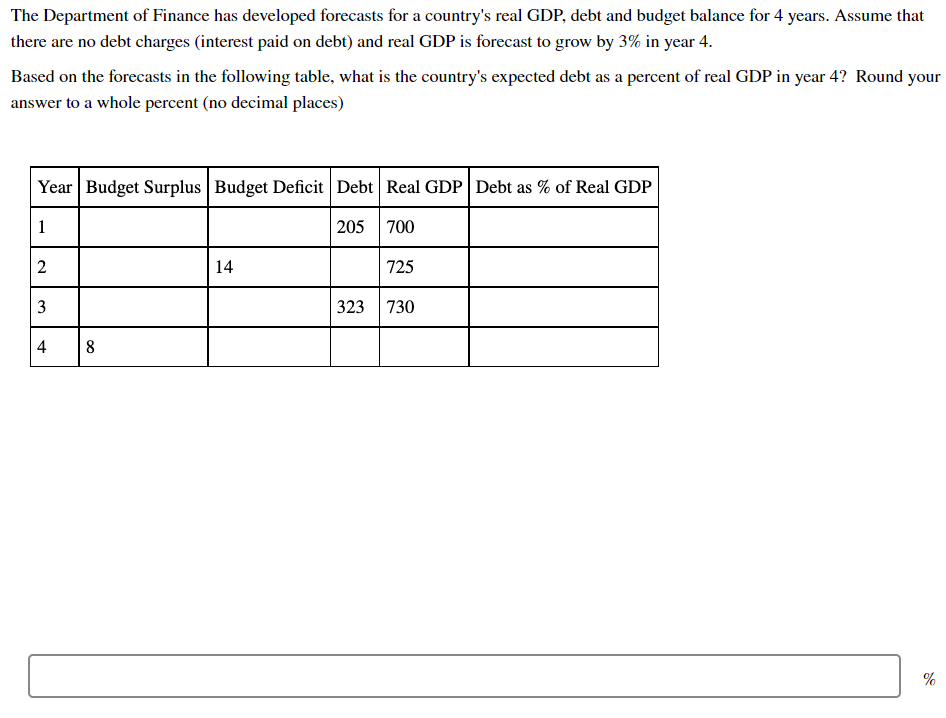

Which of the following is considered discretionary fiscal policy? When employment insurance benefits run out, many people have no choice but to apply for social assistance. As a result, government responds by paying such assistance to those who are eligible to receive it. Economic growth increases personal and business income, resulting in higher tax payments to government. A recession reduces personal income and business profits, resulting in a reduction in tax revenue for government. None of the choices given are examples of discretionary fiscal policy. The Liberal government passes a law that increases the monthly amount of Old Age Security payments received by retirees. Which of the following statements is TRUE? None of the statements given are true. Because transfer payments typically rise during an economic recovery, they help to stabilize the economy An increase in transfer payments will have a greater effect on real GDP than an equal increase in government spending on goods and services The presence of a deficit budget is proof that the government is trying to stimulate aggregate demand Which of the following is a difference between discretionary and automatic fiscal policy? Automatic fiscal policies are more carefully thought-out remedies to close output gaps Automatic fiscal policies come into effect more quickly when needed to stabilize the economy Discretionary fiscal policies are less likely to be influenced by political considerations Discretionary policy works faster to close output gaps Suppose a country currently has a total debt of $13 million. If its GDP in the current year is $7 million and the interest rate charged on its debt is 3% per year, the debt charges represent_ % of its current GDP. Round your answer, given as a percent, to 2 decimal places. % The Department of Finance has developed forecasts for a country's real GDP, debt and budget balance for 4 years. Assume that there are no debt charges (interest paid on debt) and real GDP is forecast to grow by 3% in year 4. Based on the forecasts in the following table, what is the country's expected debt as a percent of real GDP in year 4? Round your answer to a whole percent (no decimal places) Year Budget Surplus Budget Deficit Debt Real GDP Debt as % of Real GDP 1 205 700 2 14 725 3 323 730 4 8 %