Question

Which of the following is CORRECT according to the above? i. The market has been expecting decrease in 3-month LIBOR rate for the past 3

Which of the following is CORRECT according to the above?

i. The market has been expecting decrease in 3-month LIBOR rate for the past 3 months.

ii. If you took a long position in the June Eurodollar futures contract in March 9th, you can fix 3-month LIBOR borrowing rate lower than 0.5%/4.

iii. There has been a sharp increase in expected 3-month LIBOR rates between February and March.

iv. Compared with February and March, there has been a lower level of differences in opinions (April) regarding the 3-month LIBOR rate in June 2020.

A. i and ii

B. i and iii

C. i and iv

D. i, ii and iv

PLEASE HELP ME. THANK YOU SO MUCH!! THIS QUESTION IS COMPLETED.

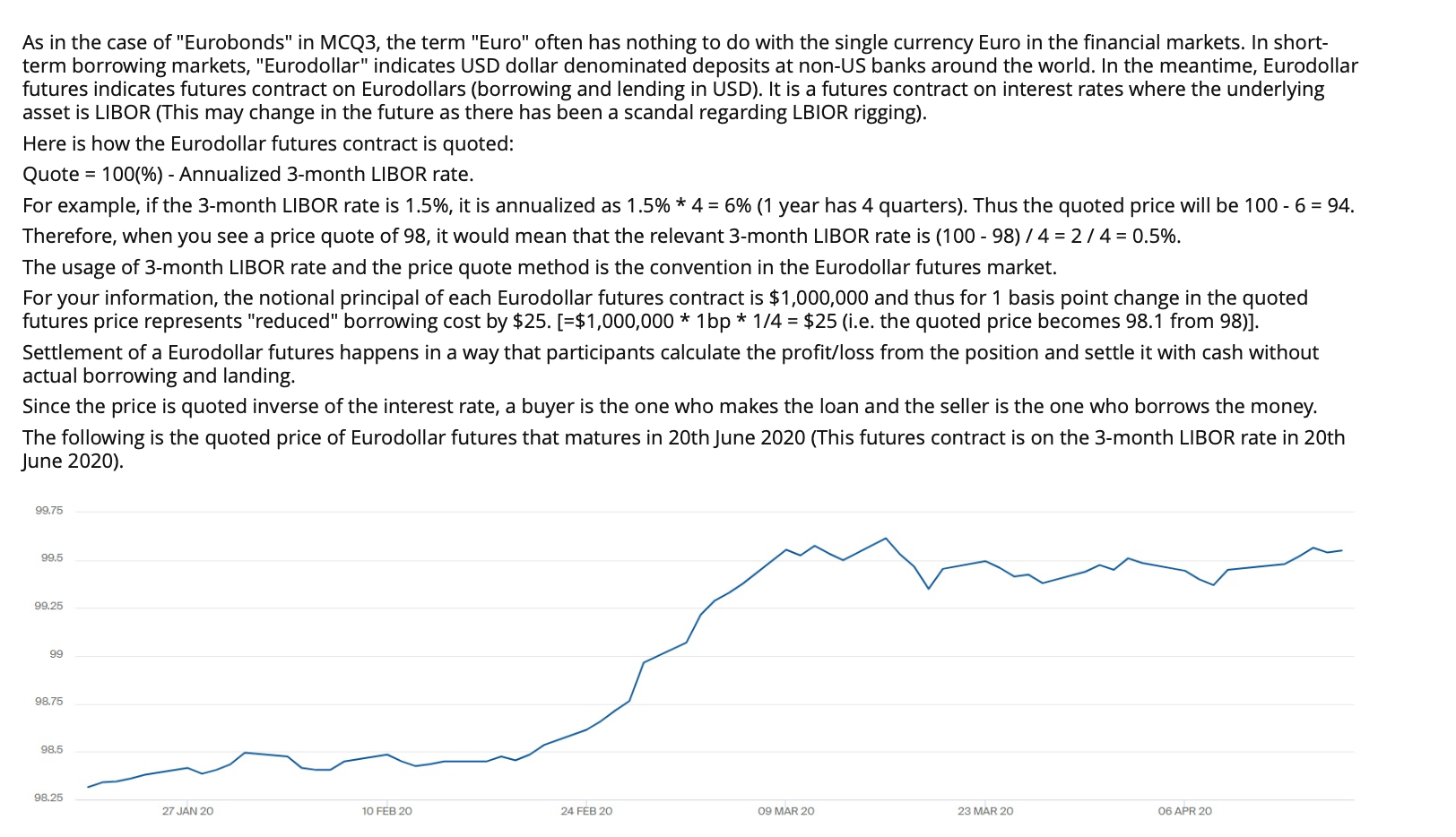

As in the case of "Eurobonds" in MCQ3, the term "Euro" often has nothing to do with the single currency Euro in the financial markets. In short- term borrowing markets, "Eurodollar" indicates USD dollar denominated deposits at non-US banks around the world. In the meantime, Eurodollar futures indicates futures contract on Eurodollars (borrowing and lending in USD). It is a futures contract on interest rates where the underlying asset is LIBOR (This may change in the future as there has been a scandal regarding LBIOR rigging). Here is how the Eurodollar futures contract is quoted: Quote = 100(%) - Annualized 3-month LIBOR rate. For example, if the 3-month LIBOR rate is 1.5%, it is annualized as 1.5% * 4 = 6% (1 year has 4 quarters). Thus the quoted price will be 100 - 6 = 94. Therefore, when you see a price quote of 98, it would mean that the relevant 3-month LIBOR rate is (100-98)/4 = 2/4 = 0.5%. The usage of 3-month LIBOR rate and the price quote method is the convention in the Eurodollar futures market. For your information, the notional principal of each Eurodollar futures contract is $1,000,000 and thus for 1 basis point change in the quoted futures price represents "reduced" borrowing cost by $25. [=$1,000,000 * 1bp * 1/4 = $25 (i.e. the quoted price becomes 98.1 from 98)]. Settlement of a Eurodollar futures happens in a way that participants calculate the profit/loss from the position and settle it with cash without actual borrowing and landing. Since the price is quoted inverse of the interest rate, a buyer is the one who makes the loan and the seller is the one who borrows the money. The following is the quoted price of Eurodollar futures that matures in 20th June 2020 (This futures contract is on the 3-month LIBOR rate in 20th June 2020). 99.75 99.5 99.25 98.75 98.5 98.25 27 JAN 20 10 FEB 20 24 FEB 20 09 MAR 20 23 MAR 20 06 APR 20 As in the case of "Eurobonds" in MCQ3, the term "Euro" often has nothing to do with the single currency Euro in the financial markets. In short- term borrowing markets, "Eurodollar" indicates USD dollar denominated deposits at non-US banks around the world. In the meantime, Eurodollar futures indicates futures contract on Eurodollars (borrowing and lending in USD). It is a futures contract on interest rates where the underlying asset is LIBOR (This may change in the future as there has been a scandal regarding LBIOR rigging). Here is how the Eurodollar futures contract is quoted: Quote = 100(%) - Annualized 3-month LIBOR rate. For example, if the 3-month LIBOR rate is 1.5%, it is annualized as 1.5% * 4 = 6% (1 year has 4 quarters). Thus the quoted price will be 100 - 6 = 94. Therefore, when you see a price quote of 98, it would mean that the relevant 3-month LIBOR rate is (100-98)/4 = 2/4 = 0.5%. The usage of 3-month LIBOR rate and the price quote method is the convention in the Eurodollar futures market. For your information, the notional principal of each Eurodollar futures contract is $1,000,000 and thus for 1 basis point change in the quoted futures price represents "reduced" borrowing cost by $25. [=$1,000,000 * 1bp * 1/4 = $25 (i.e. the quoted price becomes 98.1 from 98)]. Settlement of a Eurodollar futures happens in a way that participants calculate the profit/loss from the position and settle it with cash without actual borrowing and landing. Since the price is quoted inverse of the interest rate, a buyer is the one who makes the loan and the seller is the one who borrows the money. The following is the quoted price of Eurodollar futures that matures in 20th June 2020 (This futures contract is on the 3-month LIBOR rate in 20th June 2020). 99.75 99.5 99.25 98.75 98.5 98.25 27 JAN 20 10 FEB 20 24 FEB 20 09 MAR 20 23 MAR 20 06 APR 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started