Answered step by step

Verified Expert Solution

Question

1 Approved Answer

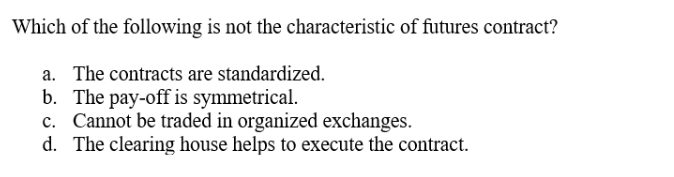

Which of the following is not the characteristic of futures contract? a. The contracts are standardized. b. The pay-off is symmetrical. c. Cannot be traded

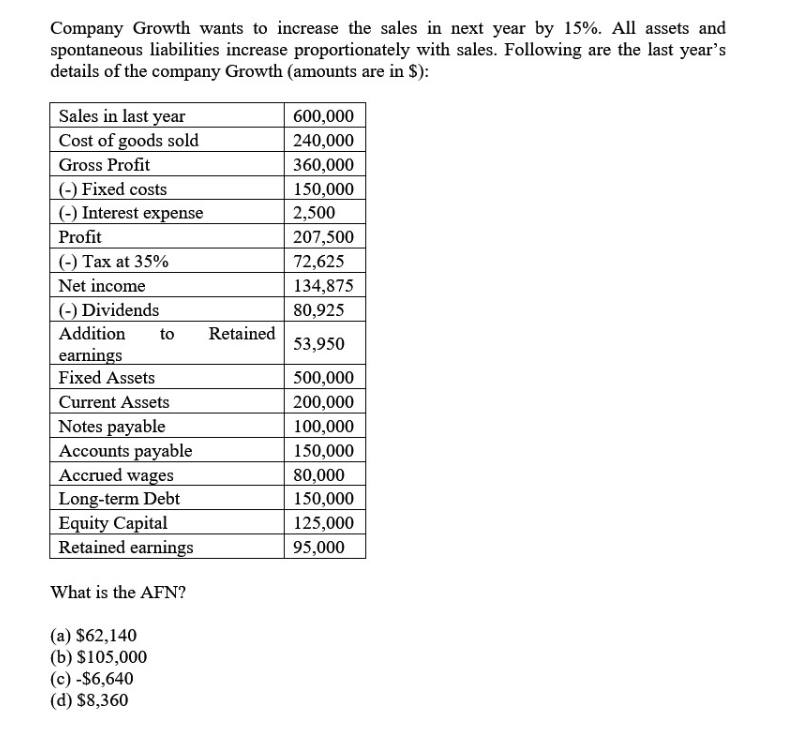

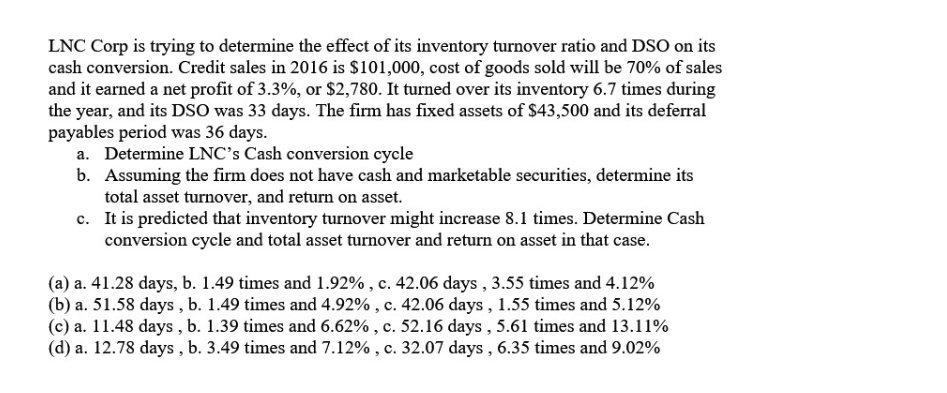

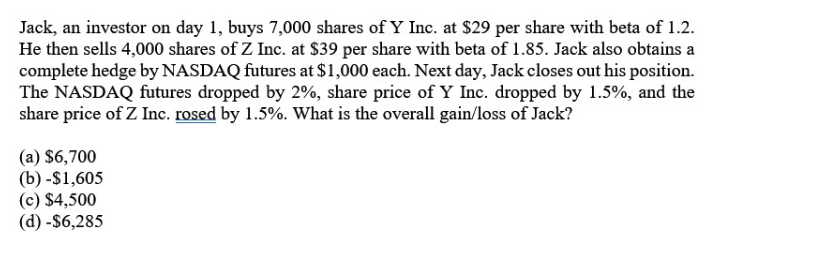

Which of the following is not the characteristic of futures contract? a. The contracts are standardized. b. The pay-off is symmetrical. c. Cannot be traded in organized exchanges. d. The clearing house helps to execute the contract. Company Growth wants to increase the sales in next year by 15%. All assets and spontaneous liabilities increase proportionately with sales. Following are the last year's details of the company Growth (amounts are in \$): What is the AFN? (a) $62,140 (b) $105,000 (c) $6,640 (d) $8,360 LNC Corp is trying to determine the effect of its inventory turnover ratio and DSO on its cash conversion. Credit sales in 2016 is $101,000, cost of goods sold will be 70% of sales and it earned a net profit of 3.3%, or $2,780. It turned over its inventory 6.7 times during the year, and its DSO was 33 days. The firm has fixed assets of $43,500 and its deferral payables period was 36 days. a. Determine LNC's Cash conversion cycle b. Assuming the firm does not have cash and marketable securities, determine its total asset turnover, and return on asset. c. It is predicted that inventory turnover might increase 8.1 times. Determine Cash conversion cycle and total asset turnover and return on asset in that case. (a) a. 41.28 days, b. 1.49 times and 1.92%, c. 42.06 days , 3.55 times and 4.12% (b) a. 51.58 days , b. 1.49 times and 4.92%, c. 42.06 days , 1.55 times and 5.12% (c) a. 11.48 days , b. 1.39 times and 6.62%, c. 52.16 days , 5.61 times and 13.11% (d) a. 12.78 days , b. 3.49 times and 7.12%, c. 32.07 days , 6.35 times and 9.02% Jack, an investor on day 1 , buys 7,000 shares of Y Inc. at $29 per share with beta of 1.2. He then sells 4,000 shares of Z Inc. at $39 per share with beta of 1.85 . Jack also obtains a complete hedge by NASDAQ futures at $1,000 each. Next day, Jack closes out his position. The NASDAQ futures dropped by 2%, share price of Y Inc. dropped by 1.5%, and the share price of Z Inc. rosed by 1.5%. What is the overall gain/loss of Jack? (a) $6,700 (b) $1,605 (c) $4,500 (d) $6,285

Which of the following is not the characteristic of futures contract? a. The contracts are standardized. b. The pay-off is symmetrical. c. Cannot be traded in organized exchanges. d. The clearing house helps to execute the contract. Company Growth wants to increase the sales in next year by 15%. All assets and spontaneous liabilities increase proportionately with sales. Following are the last year's details of the company Growth (amounts are in \$): What is the AFN? (a) $62,140 (b) $105,000 (c) $6,640 (d) $8,360 LNC Corp is trying to determine the effect of its inventory turnover ratio and DSO on its cash conversion. Credit sales in 2016 is $101,000, cost of goods sold will be 70% of sales and it earned a net profit of 3.3%, or $2,780. It turned over its inventory 6.7 times during the year, and its DSO was 33 days. The firm has fixed assets of $43,500 and its deferral payables period was 36 days. a. Determine LNC's Cash conversion cycle b. Assuming the firm does not have cash and marketable securities, determine its total asset turnover, and return on asset. c. It is predicted that inventory turnover might increase 8.1 times. Determine Cash conversion cycle and total asset turnover and return on asset in that case. (a) a. 41.28 days, b. 1.49 times and 1.92%, c. 42.06 days , 3.55 times and 4.12% (b) a. 51.58 days , b. 1.49 times and 4.92%, c. 42.06 days , 1.55 times and 5.12% (c) a. 11.48 days , b. 1.39 times and 6.62%, c. 52.16 days , 5.61 times and 13.11% (d) a. 12.78 days , b. 3.49 times and 7.12%, c. 32.07 days , 6.35 times and 9.02% Jack, an investor on day 1 , buys 7,000 shares of Y Inc. at $29 per share with beta of 1.2. He then sells 4,000 shares of Z Inc. at $39 per share with beta of 1.85 . Jack also obtains a complete hedge by NASDAQ futures at $1,000 each. Next day, Jack closes out his position. The NASDAQ futures dropped by 2%, share price of Y Inc. dropped by 1.5%, and the share price of Z Inc. rosed by 1.5%. What is the overall gain/loss of Jack? (a) $6,700 (b) $1,605 (c) $4,500 (d) $6,285 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started