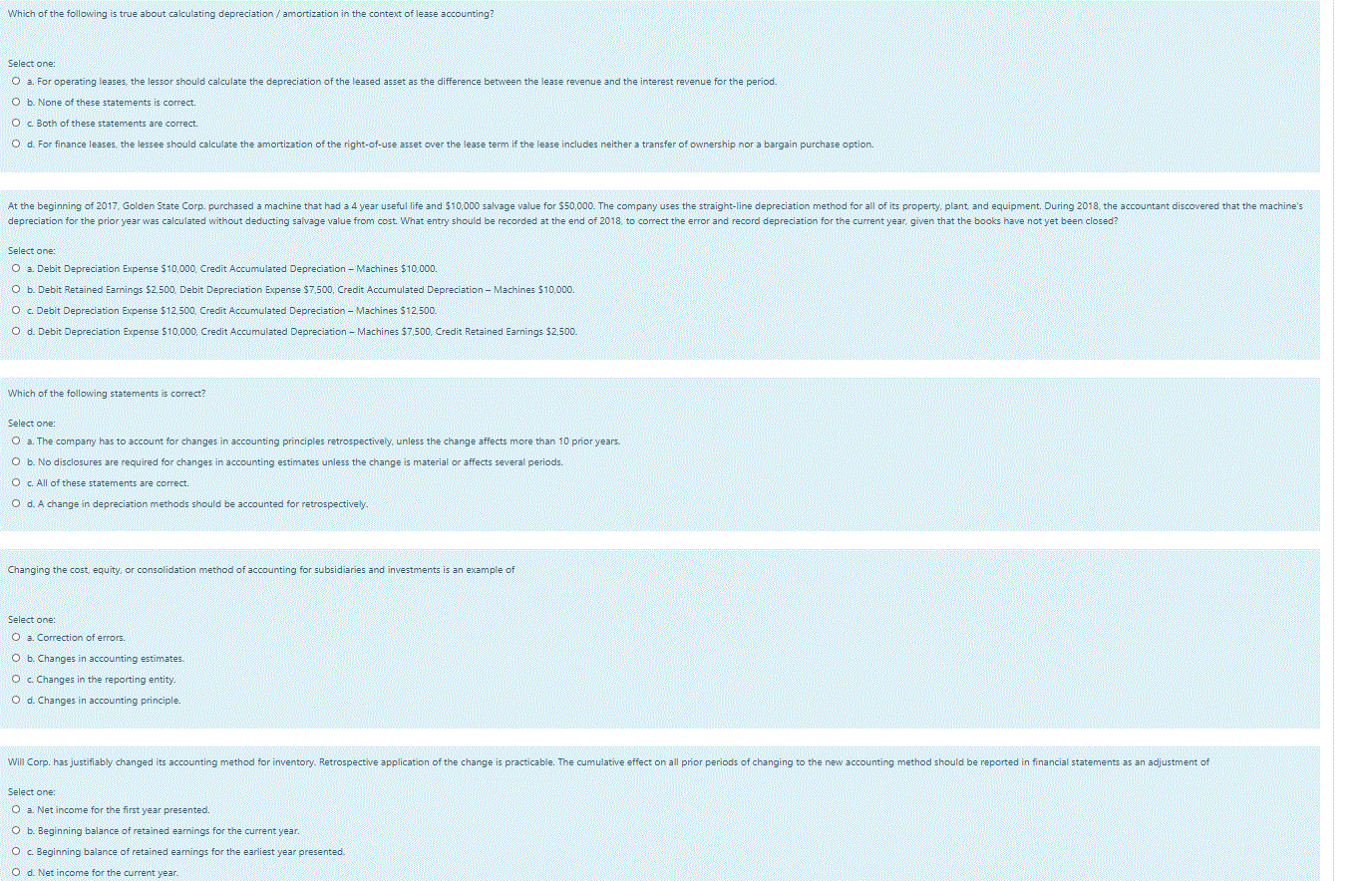

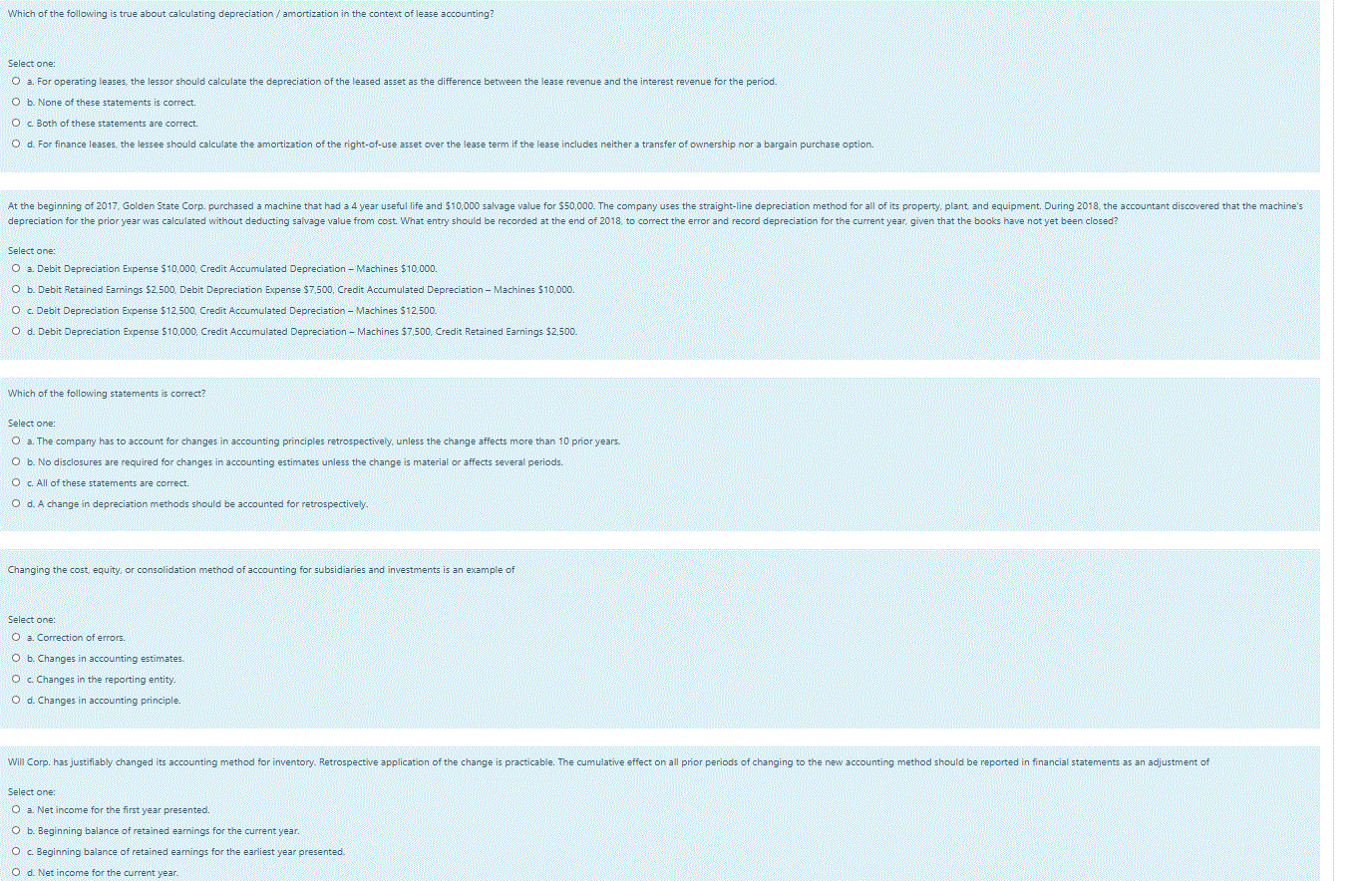

Which of the following is true about calculating depreciation / amortization in the context of lease accounting? Select one: O a. For operating leases the lessor should calculate the depreciation of the leased asset as the difference between the lease revenue and the interest revenue for the period. O b. None of these statements is correct. O Both of these statements are correct. O d. For finance leases, the lessee should calculate the amortization of the right-of-use asset over the lease term if the lease includes neither a transfer of ownership nor a bargain purchase option. At the beginning of 2017. Golden State Corp. purchased a machine that had a 4 year useful life and $10,000 salvage value for $50,000. The company uses the straight-line depreciation method for all of its property, plant and equipment. During 2018 the accountant discovered that the machine's depreciation for the prior year was calculated without deducting salvage value from cost. What entry should be recorded at the end of 2018, to correct the error and record depreciation for the current year, given that the books have not yet been closed? Select one: O a Debit Depreciation Expense $10,000 Credit Accumulated Depreciation - Machines $10,000. O b. Debit Retained Earnings $2,500 Debit Depreciation Expense $7.500, Credit Accumulated Depreciation - Machines $10,000. O c Debit Depreciation Expense $12.500, Credit Accumulated Depreciation - Machines $12,500. O d. Debit Depreciation Expense $10,000, Credit Accumulated Depreciation - Machines $7,500 Credit Retained Earnings $2,500. Which of the following statements is correct? Select one: O a. The company has to account for changes in accounting principles retrospectively, unless the change affects more than 10 prior years. O b. No disclosures are required for changes in accounting estimates unless the change is material or affects several periods. O c. All of these statements are correct. O d. A change in depreciation methods should be accounted for retrospectively Changing the cost equity, or consolidation method of accounting for subsidiaries and investments is an example of Select one: O a Correction of errors. O b. Changes in accounting estimates O c. Changes in the reporting entity O d. Changes in accounting principle. Will Corp. has justifiably changed its accounting method for inventory. Retrospective application of the change is practicable. The cumulative effect on all prior periods of changing to the new accounting method should be reported in financial statements as an adjustment of Select one: O a. Net income for the first year presented. O b. Beginning balance of retained earnings for the current year. O c. Beginning balance of retained earnings for the earliest year presented O d. Net income for the current year Which of the following is true about calculating depreciation / amortization in the context of lease accounting? Select one: O a. For operating leases the lessor should calculate the depreciation of the leased asset as the difference between the lease revenue and the interest revenue for the period. O b. None of these statements is correct. O Both of these statements are correct. O d. For finance leases, the lessee should calculate the amortization of the right-of-use asset over the lease term if the lease includes neither a transfer of ownership nor a bargain purchase option. At the beginning of 2017. Golden State Corp. purchased a machine that had a 4 year useful life and $10,000 salvage value for $50,000. The company uses the straight-line depreciation method for all of its property, plant and equipment. During 2018 the accountant discovered that the machine's depreciation for the prior year was calculated without deducting salvage value from cost. What entry should be recorded at the end of 2018, to correct the error and record depreciation for the current year, given that the books have not yet been closed? Select one: O a Debit Depreciation Expense $10,000 Credit Accumulated Depreciation - Machines $10,000. O b. Debit Retained Earnings $2,500 Debit Depreciation Expense $7.500, Credit Accumulated Depreciation - Machines $10,000. O c Debit Depreciation Expense $12.500, Credit Accumulated Depreciation - Machines $12,500. O d. Debit Depreciation Expense $10,000, Credit Accumulated Depreciation - Machines $7,500 Credit Retained Earnings $2,500. Which of the following statements is correct? Select one: O a. The company has to account for changes in accounting principles retrospectively, unless the change affects more than 10 prior years. O b. No disclosures are required for changes in accounting estimates unless the change is material or affects several periods. O c. All of these statements are correct. O d. A change in depreciation methods should be accounted for retrospectively Changing the cost equity, or consolidation method of accounting for subsidiaries and investments is an example of Select one: O a Correction of errors. O b. Changes in accounting estimates O c. Changes in the reporting entity O d. Changes in accounting principle. Will Corp. has justifiably changed its accounting method for inventory. Retrospective application of the change is practicable. The cumulative effect on all prior periods of changing to the new accounting method should be reported in financial statements as an adjustment of Select one: O a. Net income for the first year presented. O b. Beginning balance of retained earnings for the current year. O c. Beginning balance of retained earnings for the earliest year presented O d. Net income for the current year