Answered step by step

Verified Expert Solution

Question

1 Approved Answer

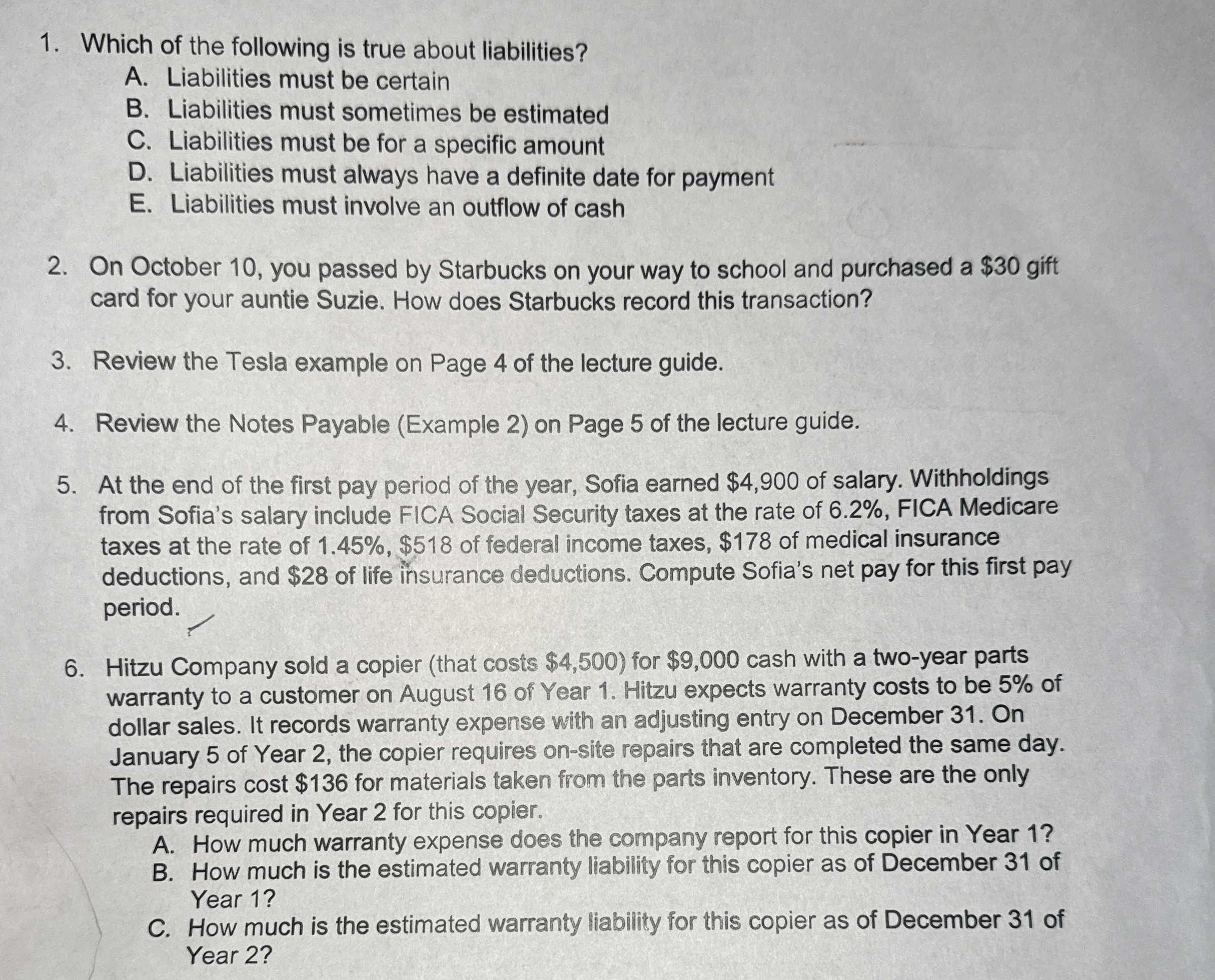

Which of the following is true about liabilities? A . Liabilities must be certain B . Liabilities must sometimes be estimated C . Liabilities must

Which of the following is true about liabilities?

A Liabilities must be certain

B Liabilities must sometimes be estimated

C Liabilities must be for a specific amount

D Liabilities must always have a definite date for payment

E Liabilities must involve an outflow of cash

On October you passed by Starbucks on your way to school and purchased a $ gift

card for your auntie Suzie. How does Starbucks record this transaction?

Review the Tesla example on Page of the lecture guide.

Review the Notes Payable Example on Page of the lecture guide.

At the end of the first pay period of the year, Sofia earned $ of salary. Withholdings

from Sofia's salary include FICA Social Security taxes at the rate of FICA Medicare

taxes at the rate of $ of federal income taxes, $ of medical insurance

deductions, and $ of life insurance deductions. Compute Sofia's net pay for this first pay

period.

Hitzu Company sold a copier that costs $ for $ cash with a twoyear parts

warranty to a customer on August of Year Hitzu expects warranty costs to be of

dollar sales. It records warranty expense with an adjusting entry on December On

January of Year the copier requires onsite repairs that are completed the same day.

The repairs cost $ for materials taken from the parts inventory. These are the only

repairs required in Year for this copier.

A How much warranty expense does the company report for this copier in Year

B How much is the estimated warranty liability for this copier as of December of

Year

C How much is the estimated warranty liability for this copier as of December of

Year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started