Answered step by step

Verified Expert Solution

Question

1 Approved Answer

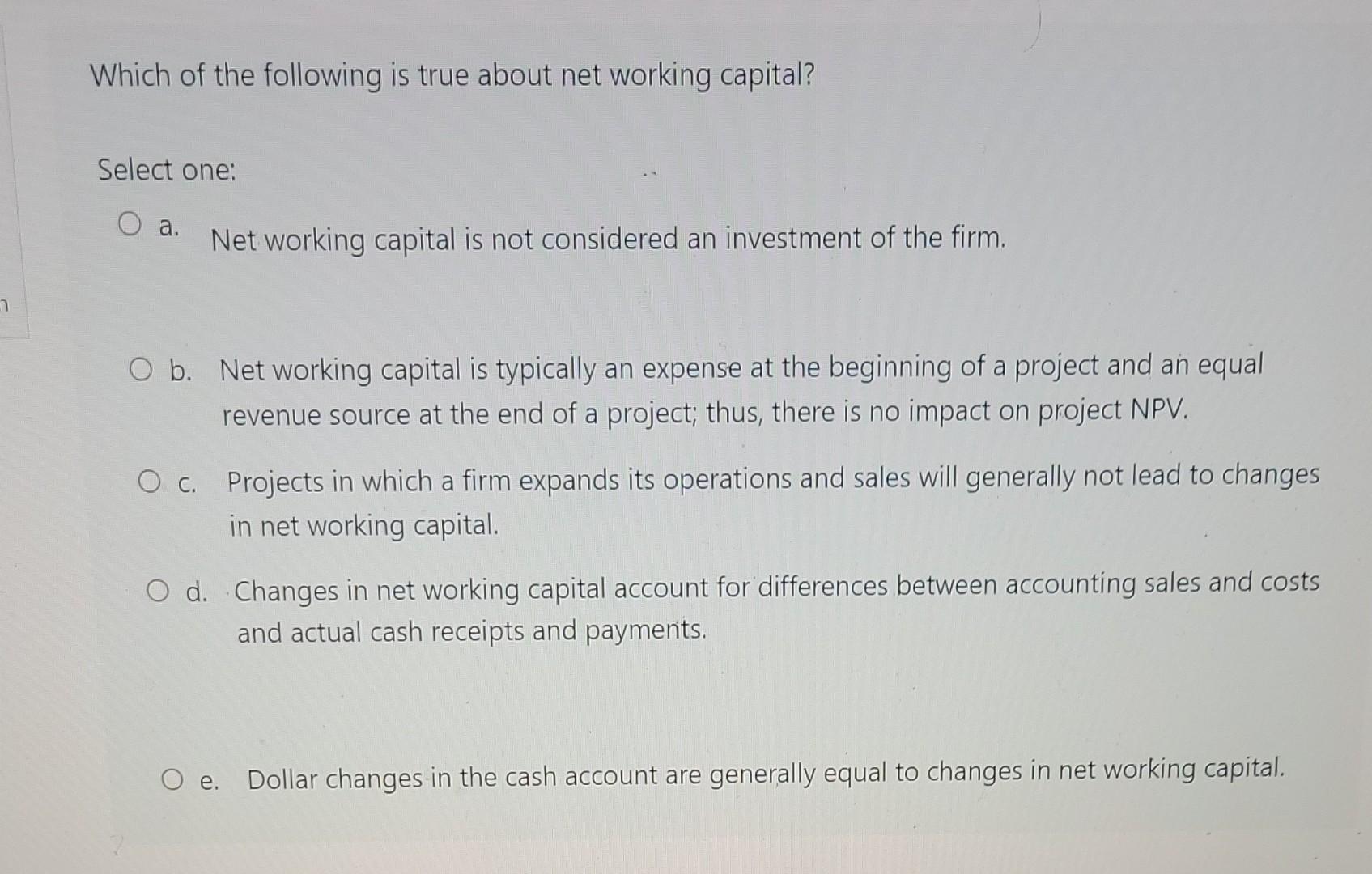

Which of the following is true about net working capital? Select one: O a. Net working capital is not considered an investment of the firm.

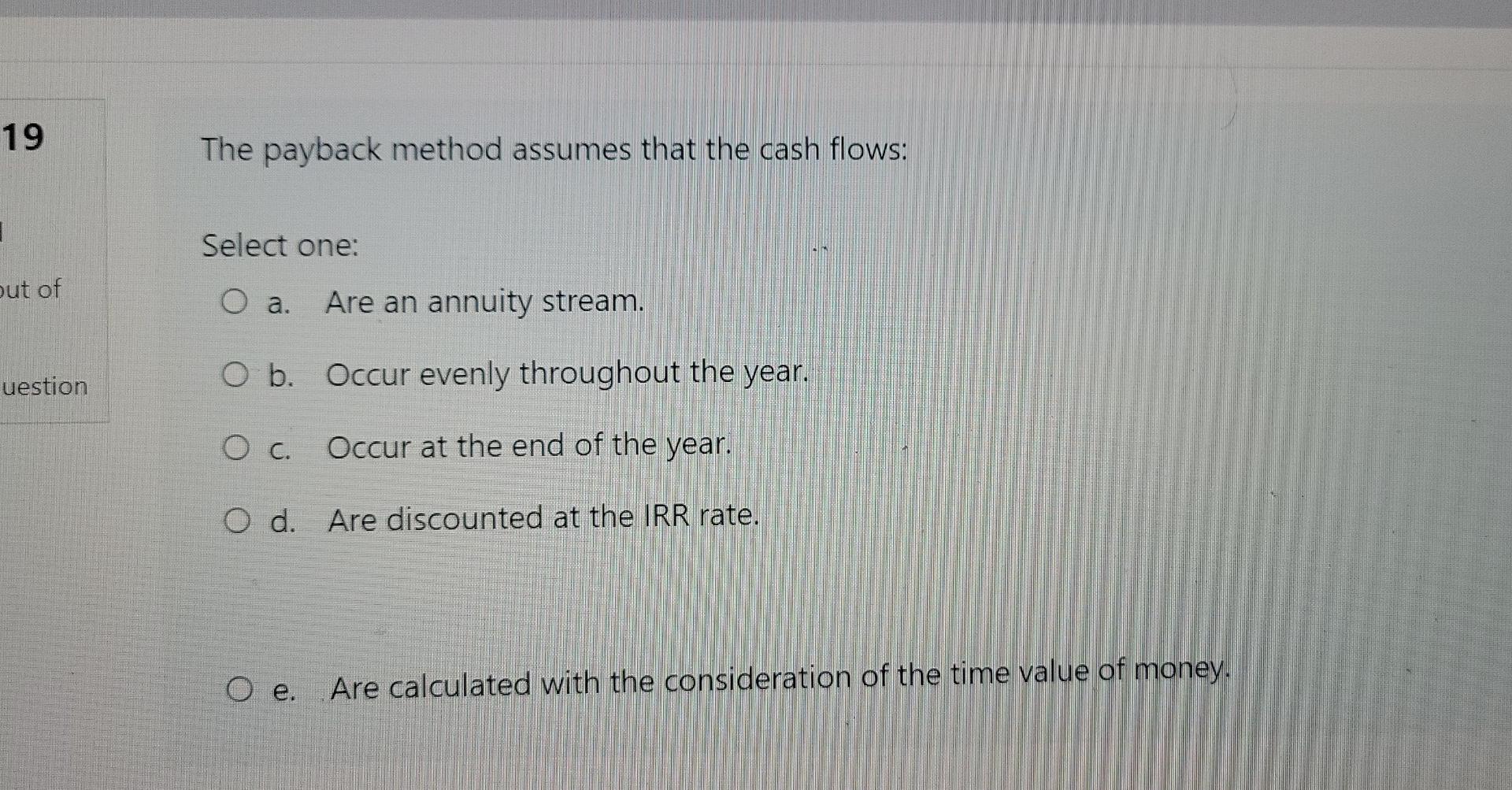

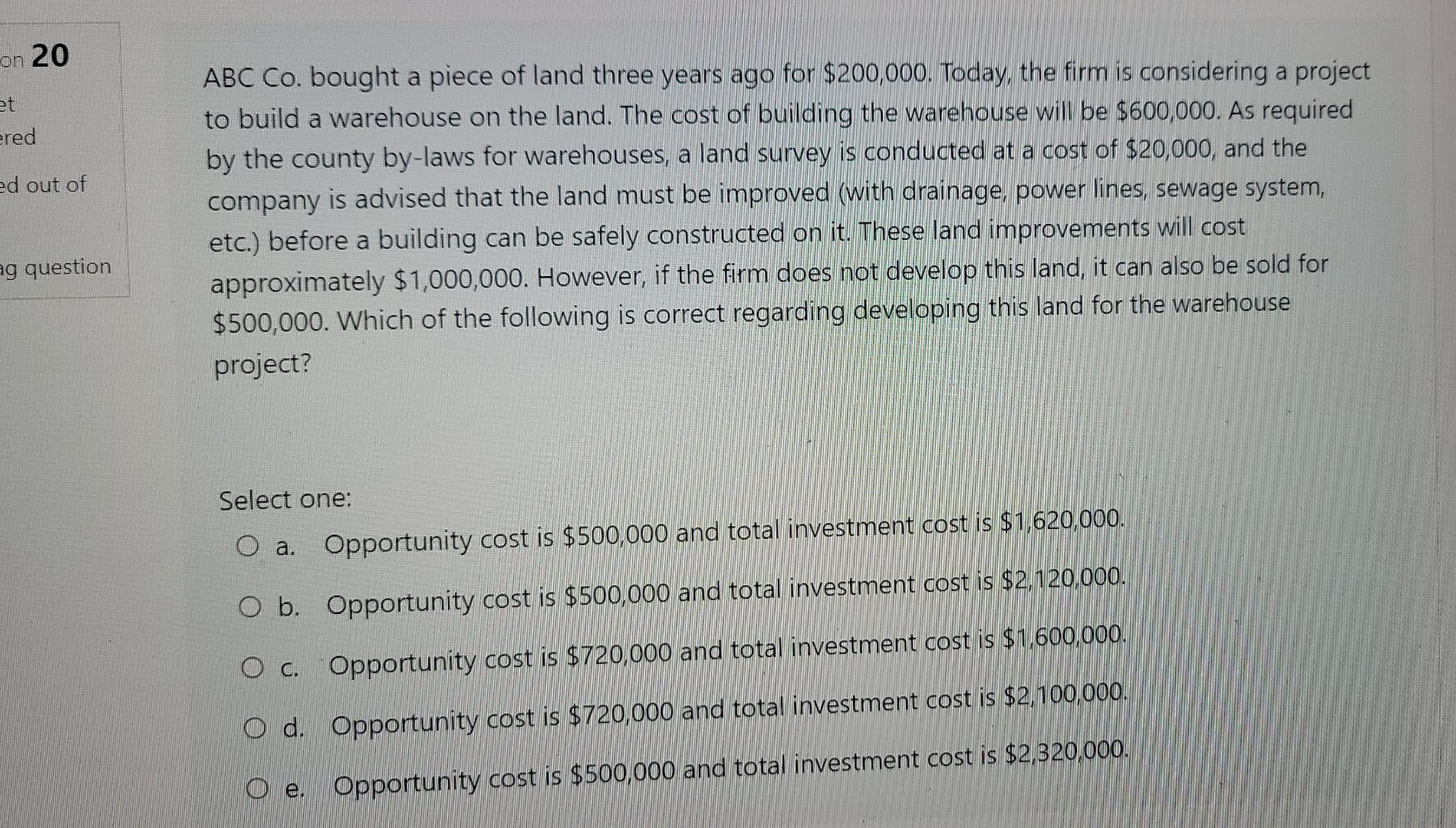

Which of the following is true about net working capital? Select one: O a. Net working capital is not considered an investment of the firm. O b. Net working capital is typically an expense at the beginning of a project and an equal revenue source at the end of a project; thus, there is no impact on project NPV. O c. Projects in which a firm expands its operations and sales will generally not lead to changes in net working capital. O d. Changes in net working capital account for differences between accounting sales and costs and actual cash receipts and payments. O e. Dollar changes in the cash account are generally equal to changes in net working capital. 19 I out of uestion The payback method assumes that the cash flows: Select one: a. Are an annuity stream. O b. Occur evenly throughout the year. O c. Occur at the end of the year. O d. Are discounted at the IRR rate. O e. Are calculated with the consideration of the time value of money. on 20 et ered ed out of ag question ABC Co. bought a piece of land three years ago for $200,000. Today, the firm is considering a project to build a warehouse on the land. The cost of building the warehouse will be $600,000. As required by the county by-laws for warehouses, a land survey is conducted at a cost of $20,000, and the company is advised that the land must be improved (with drainage, power lines, sewage system, etc.) before a building can be safely constructed on it. These land improvements will cost approximately $1,000,000. However, if the firm does not develop this land, it can also be sold for $500,000. Which of the following is correct regarding developing this land for the warehouse project? Select one: O a. Opportunity cost is $500,000 and total investment cost is $1,620,000. O b. Opportunity cost is $500,000 and total investment cost is $2,120,000. O c. Opportunity cost is $720,000 and total investment cost is $1,600,000. $2,100,000. Od. Opportunity cost is $720,000 and total investment cost Opportunity cost is $500,000 and total investment cost is $2,320,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started