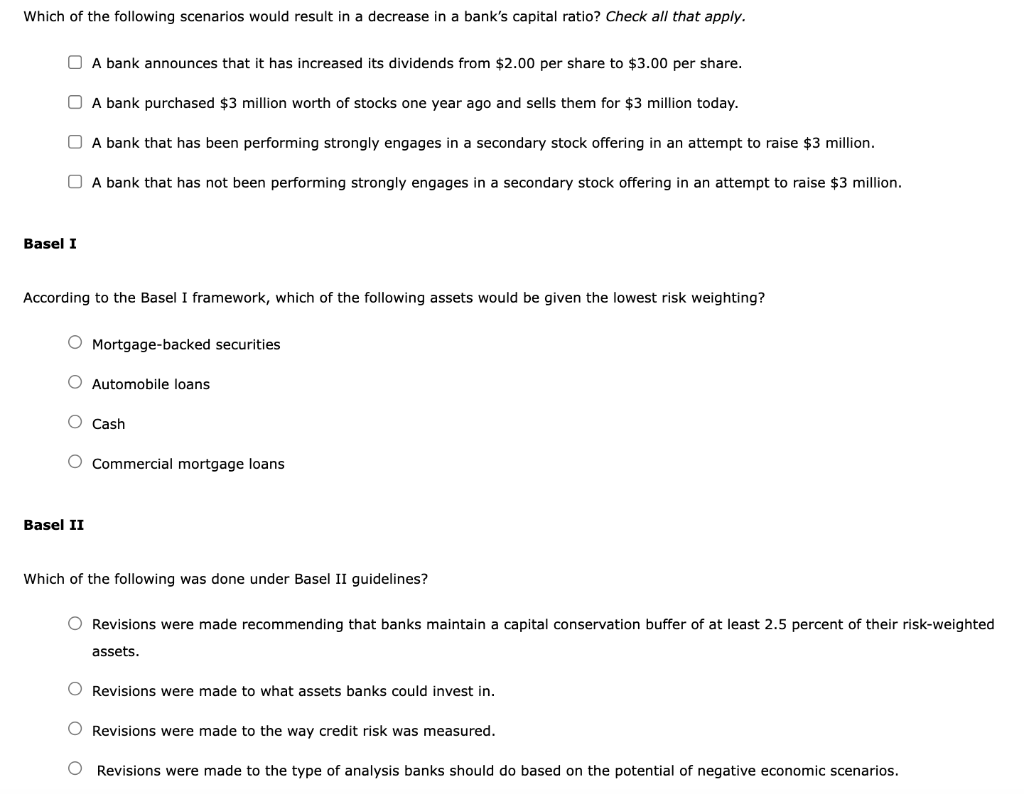

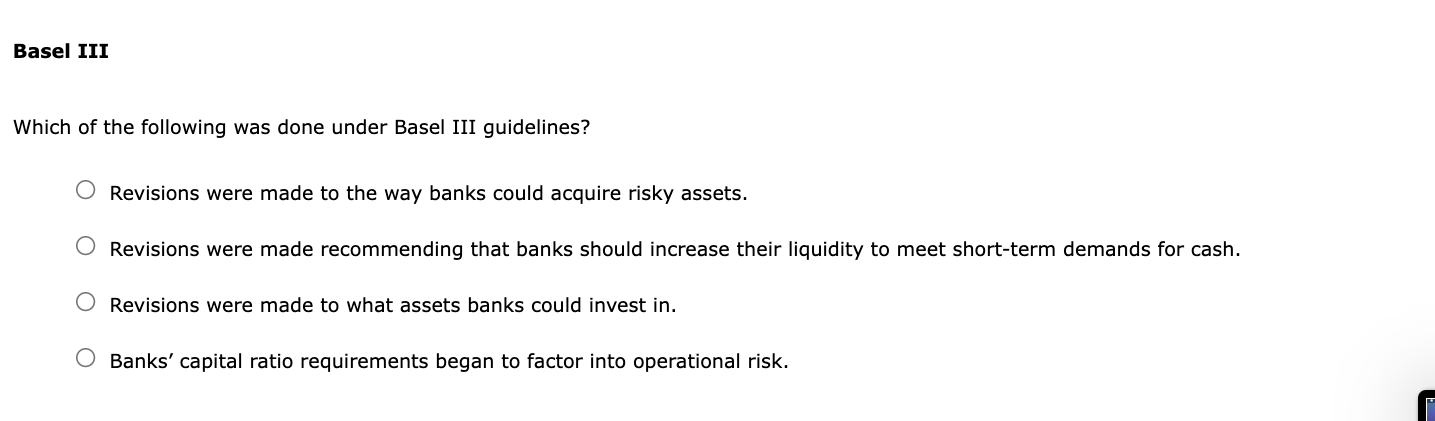

Which of the following scenarios would result in a decrease in a bank's capital ratio? Check all that apply. A bank announces that it has increased its dividends from $2.00 per share to $3.00 per share. A bank purchased $3 million worth of stocks one year ago and sells them for $3 million today. A bank that has been performing strongly engages in a secondary stock offering in an attempt to raise $3 million. A bank that has not been performing strongly engages in a secondary stock offering in an attempt to raise $3 million. Basel I According to the Basel I framework, which of the following assets would be given the lowest risk weighting? O Mortgage-backed securities O Automobile loans O Cash O Commercial mortgage loans Basel II Which of the following was done under Basel II guidelines? O Revisions were made recommending that banks maintain a capital conservation buffer of at least 2.5 percent of their risk-weighted assets. O Revisions were made to what assets banks could invest in. O Revisions were made to the way credit risk was measured. O Revisions were made to the type of analysis banks should do based on the potential of negative economic scenarios. Basel III Which of the following was done under Basel III guidelines? O Revisions were made to the way banks could acquire risky assets. O Revisions were made recommending that banks should increase their liquidity to meet short-term demands for cash. O Revisions were made to what assets banks could invest in. O Banks' capital ratio requirements began to factor into operational risk. Which of the following scenarios would result in a decrease in a bank's capital ratio? Check all that apply. A bank announces that it has increased its dividends from $2.00 per share to $3.00 per share. A bank purchased $3 million worth of stocks one year ago and sells them for $3 million today. A bank that has been performing strongly engages in a secondary stock offering in an attempt to raise $3 million. A bank that has not been performing strongly engages in a secondary stock offering in an attempt to raise $3 million. Basel I According to the Basel I framework, which of the following assets would be given the lowest risk weighting? O Mortgage-backed securities O Automobile loans O Cash O Commercial mortgage loans Basel II Which of the following was done under Basel II guidelines? O Revisions were made recommending that banks maintain a capital conservation buffer of at least 2.5 percent of their risk-weighted assets. O Revisions were made to what assets banks could invest in. O Revisions were made to the way credit risk was measured. O Revisions were made to the type of analysis banks should do based on the potential of negative economic scenarios. Basel III Which of the following was done under Basel III guidelines? O Revisions were made to the way banks could acquire risky assets. O Revisions were made recommending that banks should increase their liquidity to meet short-term demands for cash. O Revisions were made to what assets banks could invest in. O Banks' capital ratio requirements began to factor into operational risk