Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following situations describe a hedger with exposure to basis risk? A portfolio manager for a large - cap growth fund knows he

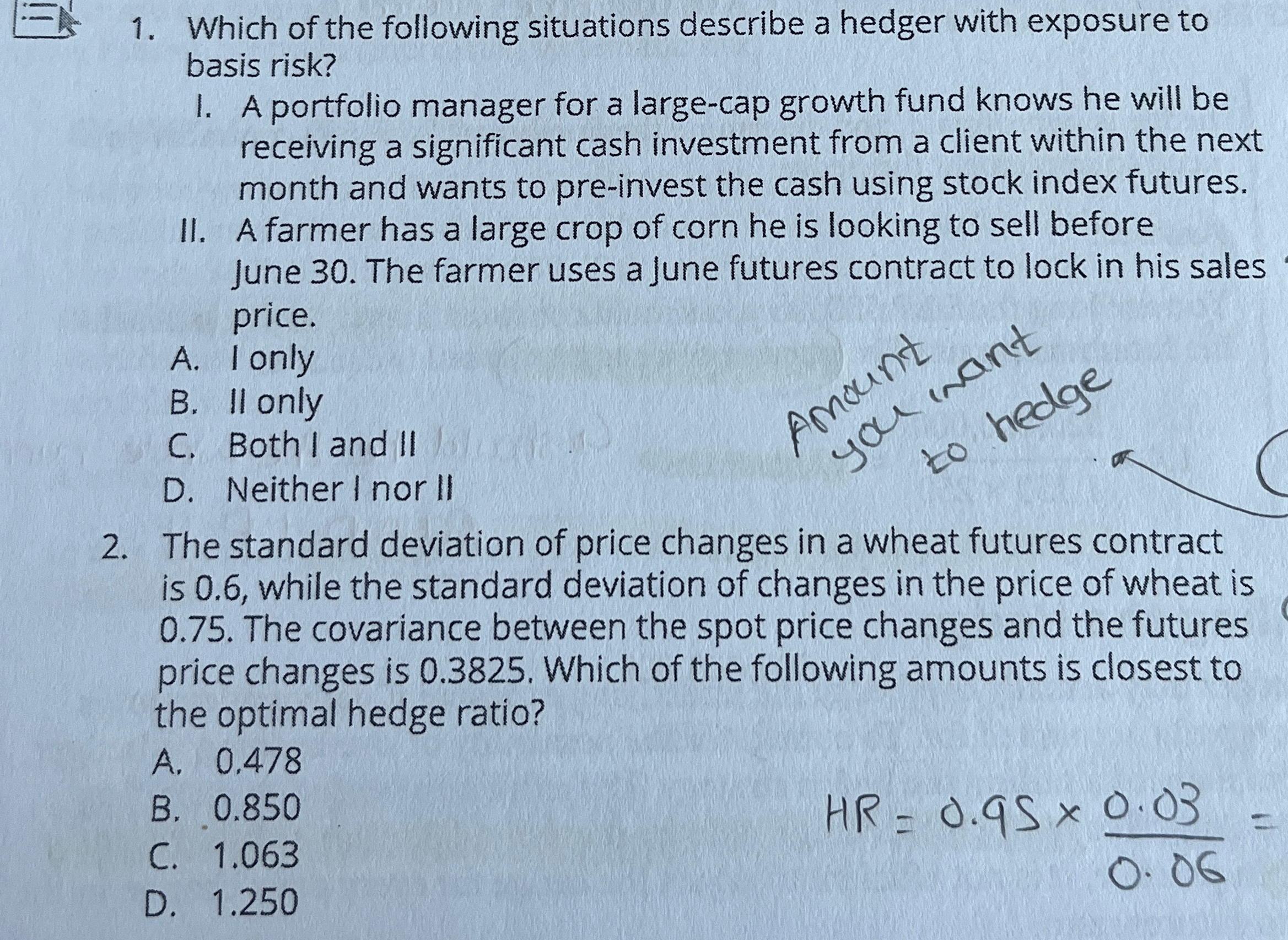

Which of the following situations describe a hedger with exposure to basis risk?

A portfolio manager for a largecap growth fund knows he will be receiving a significant cash investment from a client within the next month and wants to preinvest the cash using stock index futures.

II A farmer has a large crop of corn he is looking to sell before June The farmer uses a June futures contract to lock in his sales price.

A I only

B II only

C Both I and II

D Neither I nor II

The standard deviation of price changes in a wheat futures contract is while the standard deviation of changes in the price of wheat is The covariance between the spot price changes and the futures price changes is Which of the following amounts is closest to the optimal hedge ratio?

A

B

C

D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started