Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following statement is FALSE? The return on invested capital (ROIC) differs from the return on assets (ROA). First, ROIC is based on

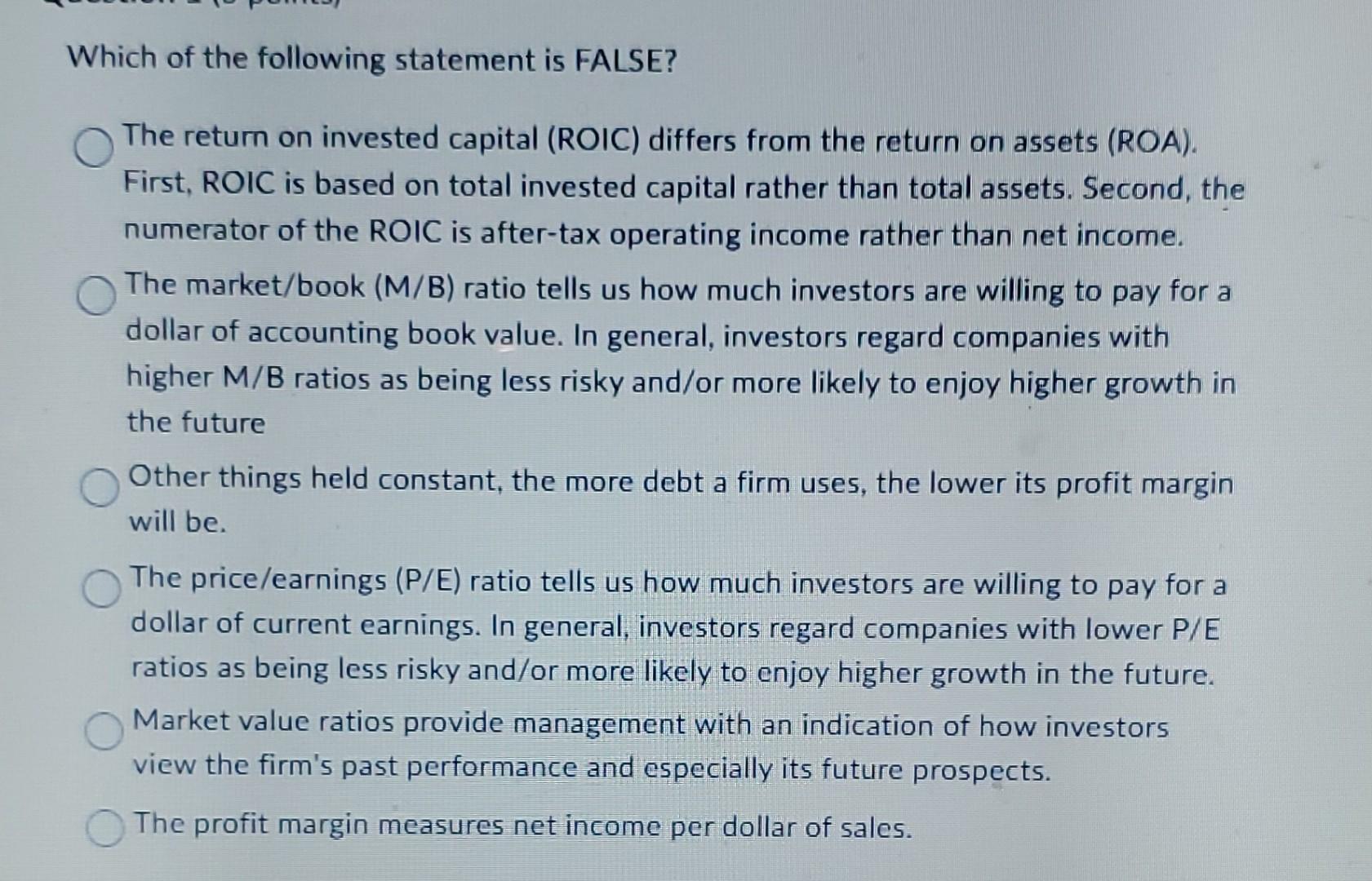

Which of the following statement is FALSE? The return on invested capital (ROIC) differs from the return on assets (ROA). First, ROIC is based on total invested capital rather than total assets. Second, the numerator of the ROIC is after-tax operating income rather than net income. The market/book (M/B) ratio tells us how much investors are willing to pay for a dollar of accounting book value. In general, investors regard companies with higher M/B ratios as being less risky and/or more likely to enjoy higher growth in the future Other things held constant, the more debt a firm uses, the lower its profit margin will be. The price/earnings (P/E) ratio tells us how much investors are willing to pay for a dollar of current earnings. In general, investors regard companies with lower P/E ratios as being less risky and/or more likely to enjoy higher growth in the future. Market value ratios provide management with an indication of how investors view the firm's past performance and especially its future prospects. The profit margin measures net income per dollar of sales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started