Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following statement is true? George and Erin divorced 2 0 1 7 , and George is required to pay Erin $ 2

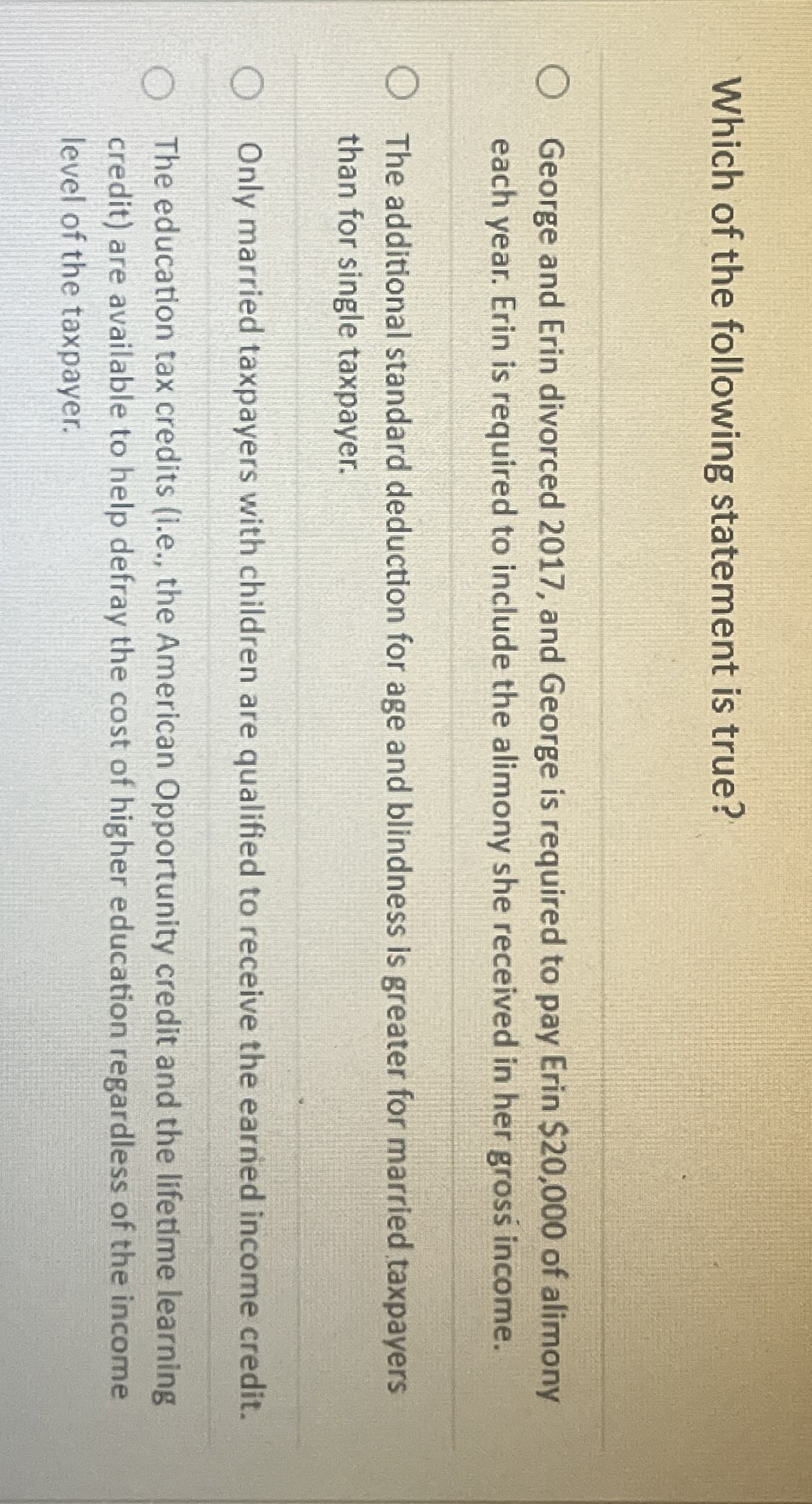

Which of the following statement is true?

George and Erin divorced and George is required to pay Erin $ of alimony

each year. Erin is required to include the alimony she received in her gross income.

The additional standard deduction for age and blindness is greater for married taxpayers

than for single taxpayer.

Only married taxpayers with children are qualified to receive the earned income credit.

The education tax credits ie the American Opportunity credit and the lifetime learning

credit are available to help defray the cost of higher education regardless of the income

level of the taxpayer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started