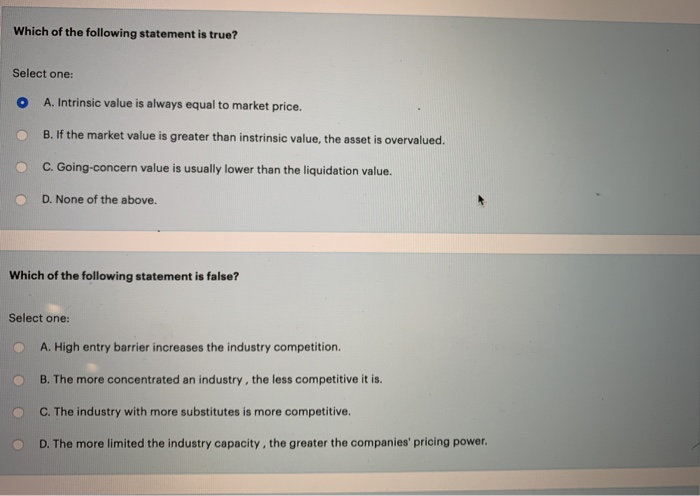

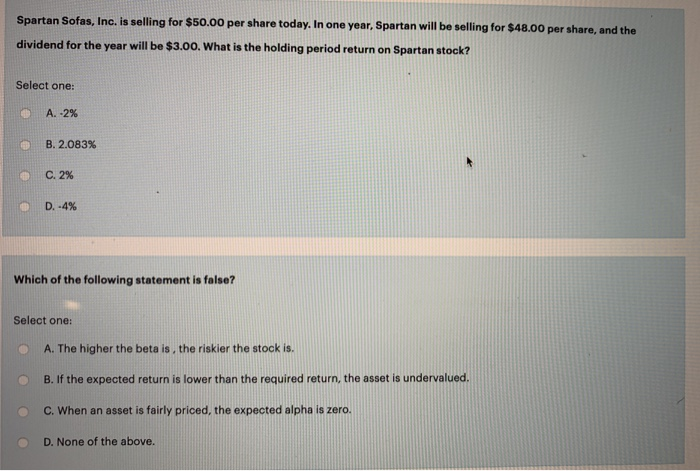

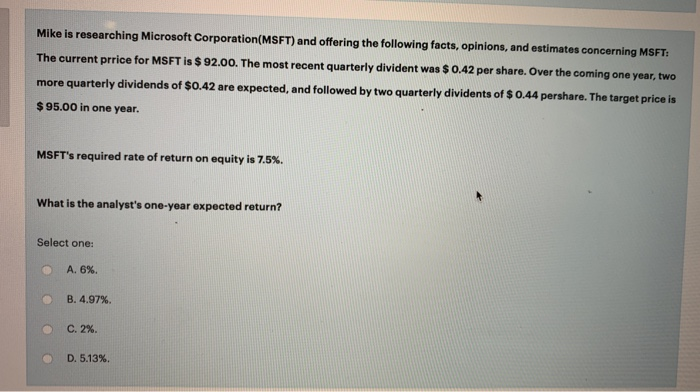

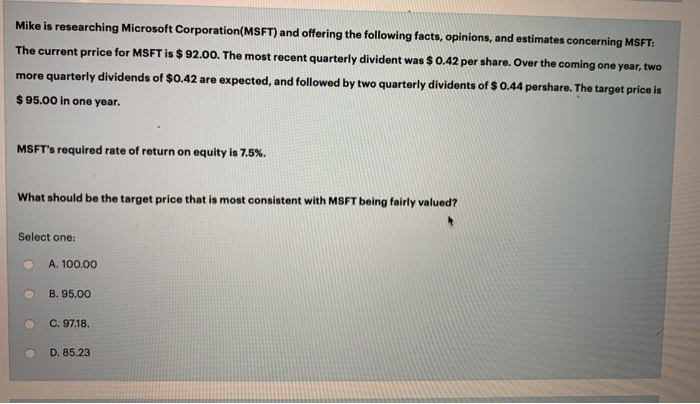

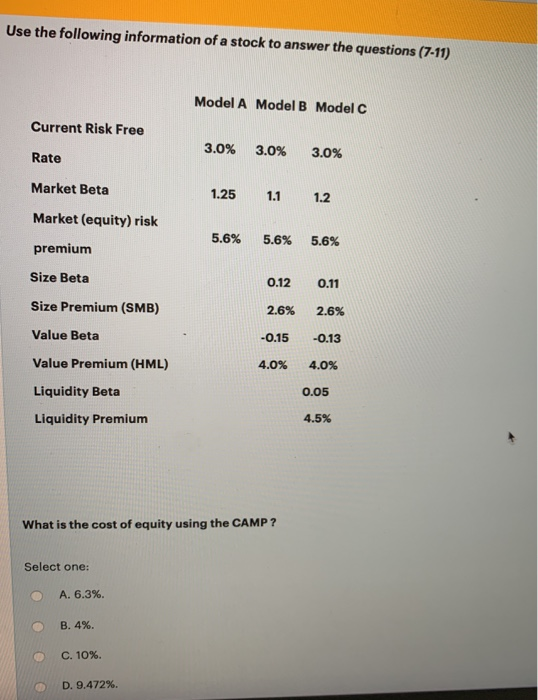

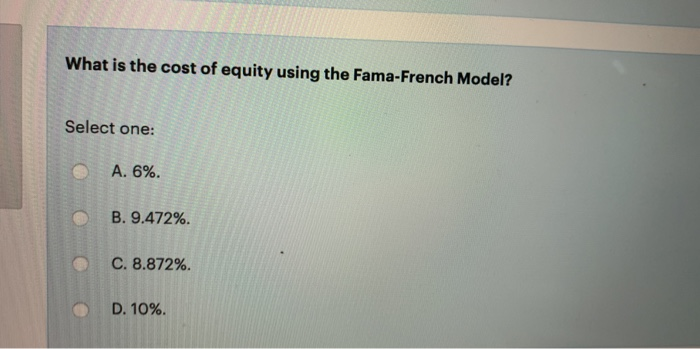

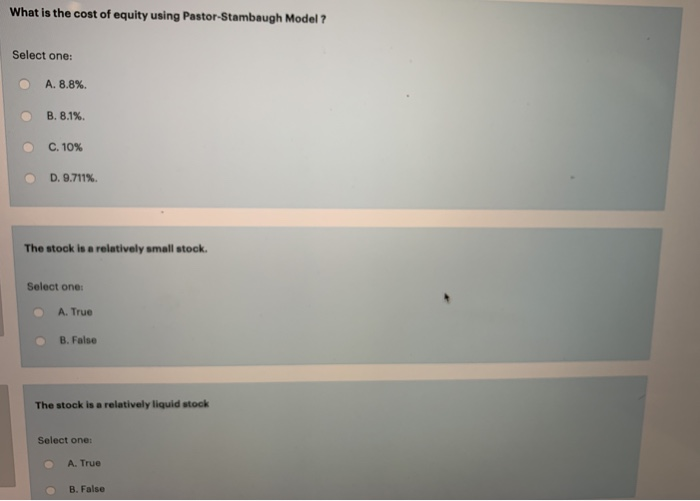

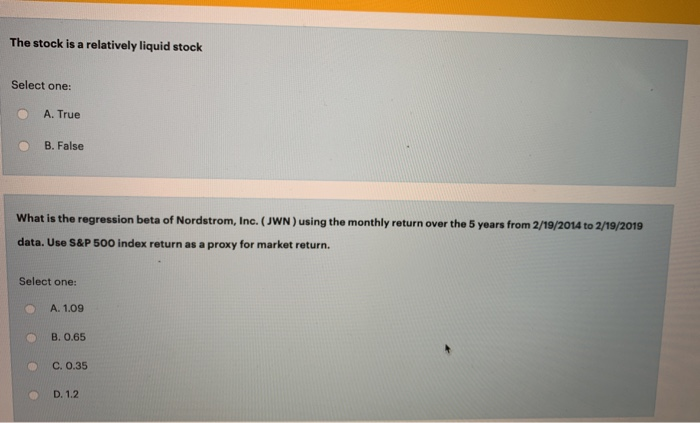

Which of the following statement is true? Select one: O A. Intrinsic value is always equal to market price. O B. If the market value is greater than instrinsic value, the asset is overvalued. O C. Going-concern value is usually lower than the liquidation value. D. None of the above. Which of the following statement is false? Select one: . A. High entry barrier increases the industry competition. B. The more concentrated an industry, the less competitive it is. C. The industry with more substitutes is more competitive. O D. The more limited the industry capacity, the greater the companies' pricing power. Spartan Sofas, Inc. is selling for $50.00 per share today. In one year, Spartan will be selling for $48.00 per share, and the dividend for the year will be $3.00. What is the holding period return on Spartan stock? Select one: A.-2% B. 2.083% C.2% D.-4% Which of the following statement is false? Select one: O A. The higher the beta is, the riskier the stock is. B. If the expected return is lower than the required return, the asset is undervalued C. when an asset is fairly priced, the expected alpha is zero. D. None of the above. Mike is researching Microsoft Corporation(MSFT) and offering the following facts, opinions, and estimates concerning MSFT: The current prrice for MSFT is $ 92.00. The most recent quarterly divident was s 042 per share. Over the coming one year, two more quarterly dividends of $0.42 are expected, and followed by two quarterly dividents of $ 0.44 pershare. The target price is $95.00 in one year MSFT's required rate of return on equity is 7.5%. What is the analyst's one-year expected return? Select one: , 6%. B. 4.97%. . 2%. D. 5.13%. 0 Mike is researching Microsoft Corporation(MSFT) and offering the following facts, opinions, and estimates concerning MSFT The current price for MSFT is $ 92.00. The most recent quarterly divident was $ 0.42 per share. Over the coming one year, two more quarterly dividends of $0.42 are expected, and followed by two quarterly dividents of $ 0.44 pershare. The target price is $95.00 in one year. MSFT's required rate of return on equity is 7.5%. What should be the target price that is most consistent with MSFT being fairly valued? Select one: A. 100.00 O B. 95.00 . 97.18. O D. 85.23 Use the following information of a stock to answer the questions (7-11) Model A Model B Model C Current Risk Free Rate Market Beta Market (equity) risk premiumm Size Beta Size Premium (SMB) Value Beta Value Premium (HML) Liquidity Beta Liquidity Premium 3.0% 3.0% 3.0% 1.25 1.1 12 5.6% 5.6% 5.6% 0.12 0.11 2.6% 2.6% 0.15-0.13 4.0% 4.0% 0.05 4.5% What is the cost of equity using the CAMP? Select one: A. 6.3%. B. 4%. C. 10%. D. 9.472%. What is the cost of equity using the Fama-French Model? Select one: A. 6%. B. 9.472%. C. 8.872%. D. 10%. What is the cost of equity using Pastor-Stambaugh Model Select one: A. 8.8%. C. 10% D. 9.711%. The stock is a relatively small stock Select one A. True B. False The stock is a relatively liquid stock Select one: A. True B. False The stock is a relatively liquid stock Select one: A. True O B. False What is the regression beta of Nordstrom, Inc. (JWN) using the monthly return over the 5 years from 2/19/2014 to 2/19/2019 data. Use S&P 500 index return as a proxy for market return. Select one A. 1.09 B. 0.65 C. 0.35 D. 1.2