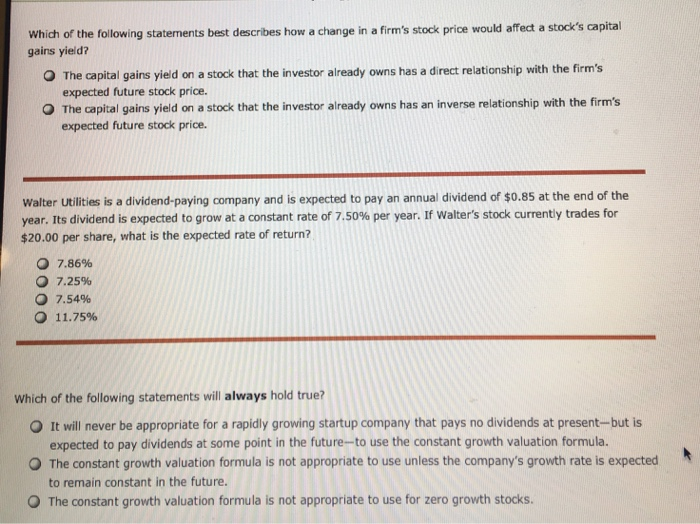

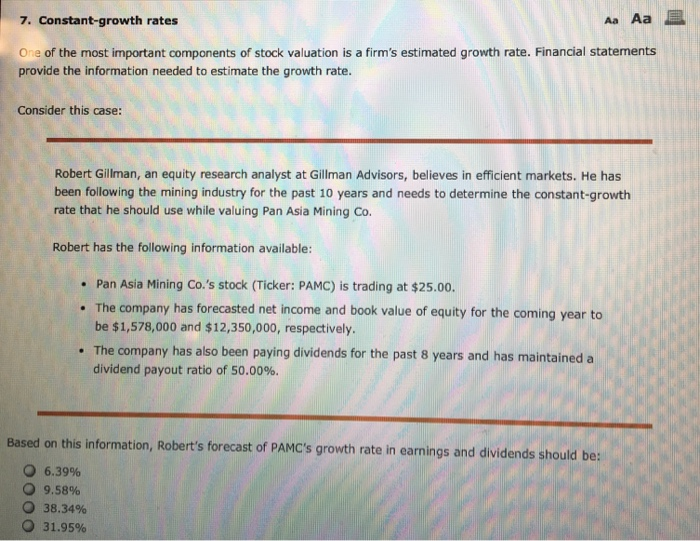

Which of the following statements best describes how a change in a firm's stock price would affect a stock's capital gains yield? O The capital gains yield on a stock that the investor already owns has a direct relationship with the firm's expected future stock price O The capital gains yield on a stock that the investor already owns has an inverse relationship with the firm's expected future stock price. Walter Utilities is a dividend-paying company and is expected to pay an annual dividend of $0.85 at the end of the year. Its dividend is expected to grow at a constant rate of 7.50% per year. If water's stock currently trades for $20.00 per share, what is the expected rate of return? 7.86% 7.25% 7.54% 11.75% Which of the following statements will always hold true? O It will never be appropriate for a rapidly growing startup company that pays no dividends at present-but is expected to pay dividends at some point in the future-to use the constant growth valuation formula. The constant growth valuation formula is not appropriate to use unless the company's growth rate is expected to remain constant in the future. O The constant growth valuation formula is not appropriate to use for zero growth stocks. 7.Constant-growth rates Aa Aa One of the most important components of stock valuation is a firm's estimated growth rate. Financial statements provide the information needed to estimate the growth rate. Consider this case: Robert Gillman, an equity research analyst at Gillman Advisors, believes in efficient markets. He has been following the mining industry for the past 10 years and needs to determine the constant-growth rate that he should use while valuing Pan Asia Mining Co. Robert has the following information available: Pan Asia Mining Co.'s stock (Ticker: PAMC) is trading at $25.00. be $1,578,000 and $12,350,000, respectively. dividend payout ratio of 50.00%. . The company has forecasted net income and book value of equity for the coming year to . The company has also been paying dividends for the past 8 years and has maintained a on this information, Robert's forecast of PAMC's growth rate in earnings and dividends should be: 6.39% 9.58% 38.34% 31.95%