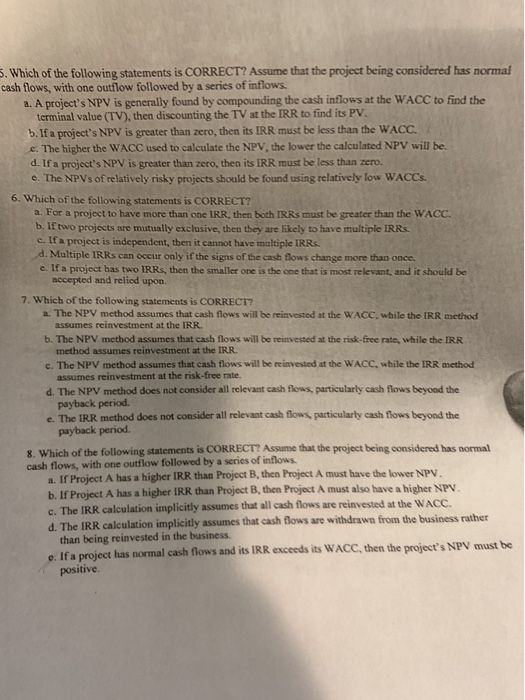

. Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. a. A project's NPV is generally found by compounding the cash inflows at the WACC to find the terminal value (TV), then discounting the TV at the IRR to find its PV b. If a project's NPV is greater than zero, then its IRR must be less than the WACC. &. The higher the WACC used to calculate the NPV, the lower the calculated NPV will be d. If a project's NPV is greater than zero, then its IRR must be less than zero. e. The NPVs of relatively risky projects should be found using relatively low WACCs. 6. Which of the following statements is CORRECT? a. For a project to have more than one IRR, then both IRRs must be greater than the WACC. b. If two projects are mutually exclusive, then they are lkely to have multiple IRRs. c. If a project is independent, then it cannot have maltiple IRRs d. Multiple IRRs can occur only if the signs of the cash flows change more than once. e. If a project has two IRRs, then the smaller one is the one that is most relevant, and it should be accepted and relied upon 7. Which of the following statements is CORRECT? a. The NPV method assumes that cash flows will be reinvested at the WACc, while the IRR method assumes reinvestment at the IRR b. The NPV method assumes that cash flows will be reinvested at the risk-free rate, while the IRR method assumes reinvestment at the IRR c. The NPV method assumes that cash flows will be reinvested at the WACC, while the IRR method assumes reinvestment at the risk-free rate. d. The NPV method does not consider all relevant cash flows, particularly cash flows beyond the payback period. e. The IRR method does not consider all relevant cash flows particularty cash flows beyond the payback period. 8. Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows. a. If Project A has a higher IRR than Project B, then Project A must have the lower NPV. b. If Project A has a higher IRR than Project B, then Project A must also have a higher NPV c. The IRR calculation implicitly assumes that all cash flows are reinvested at the WACC d. The IRR calculation implicitly assumes that cash flows are withdrawn from the business rather than being reinvested in the business has normal cash flows and its IRR exceeds its WACC, then the projeet's NPV must be positive