Answered step by step

Verified Expert Solution

Question

1 Approved Answer

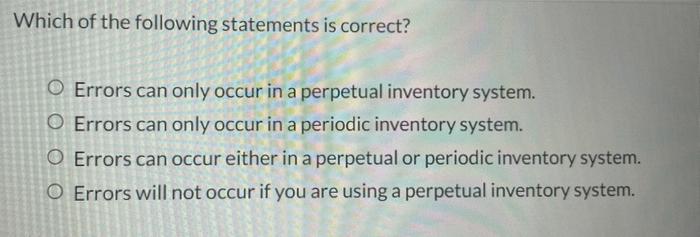

Which of the following statements is correct? O Errors can only occur in a perpetual inventory system. O Errors can only occur in a periodic

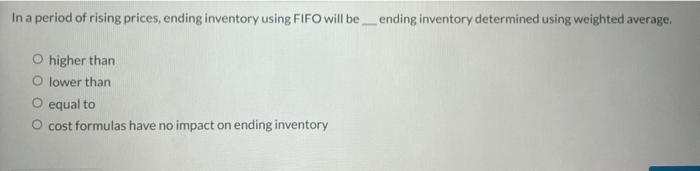

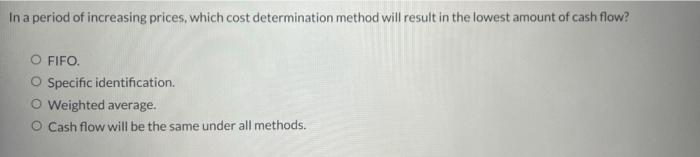

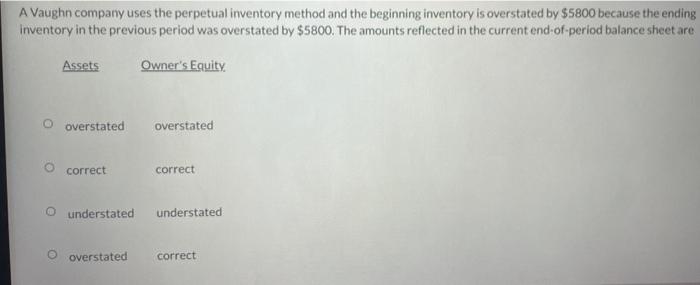

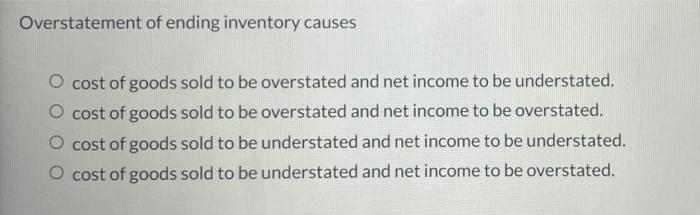

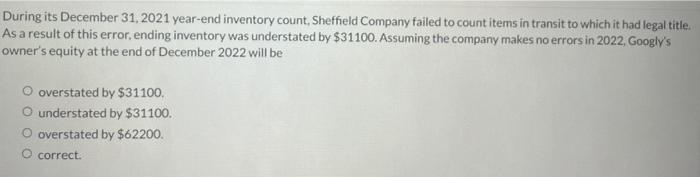

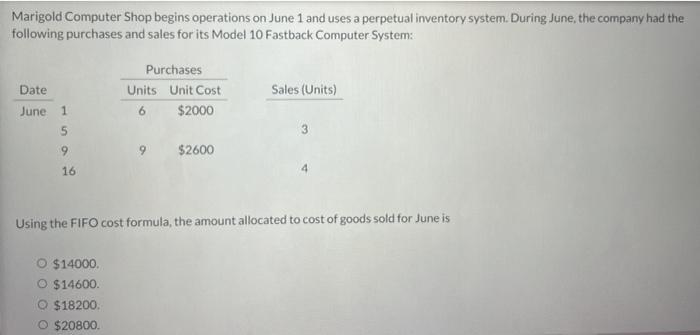

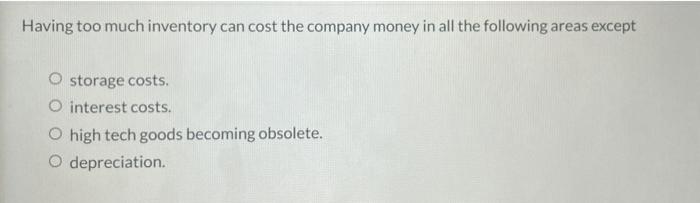

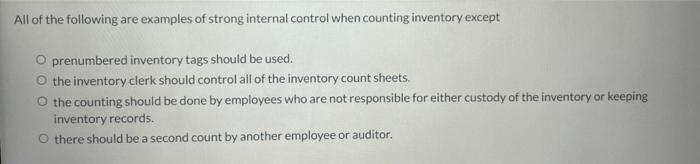

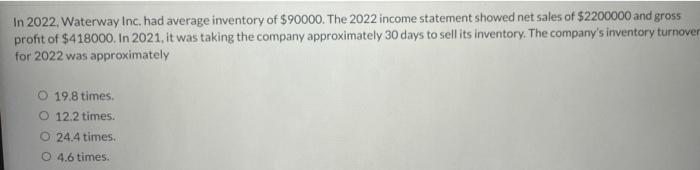

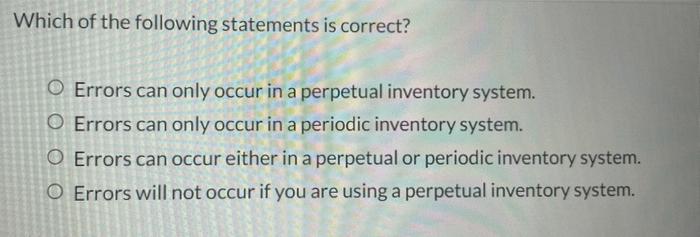

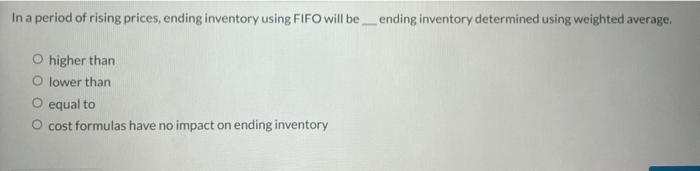

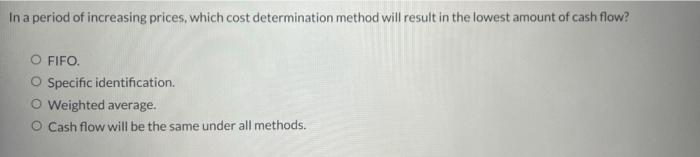

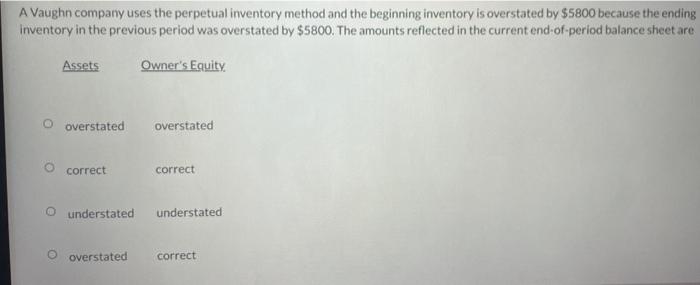

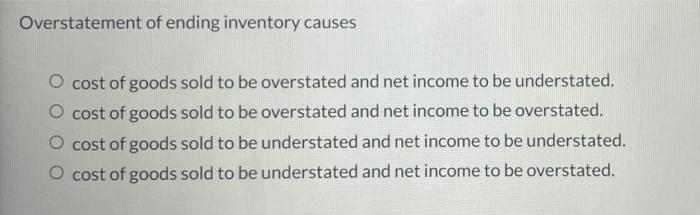

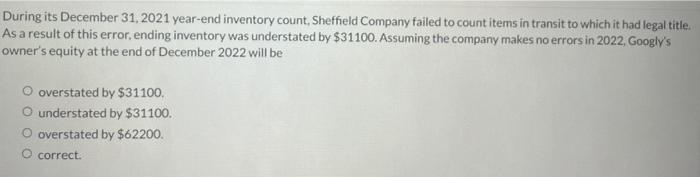

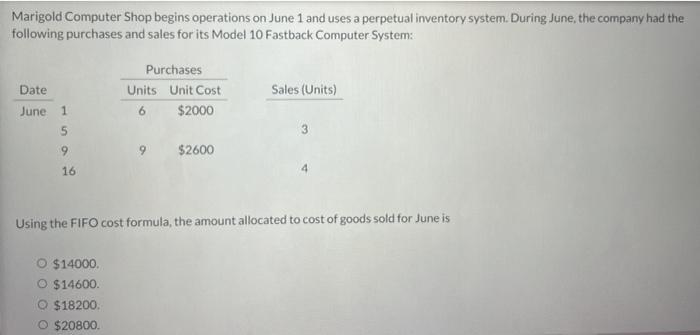

Which of the following statements is correct? O Errors can only occur in a perpetual inventory system. O Errors can only occur in a periodic inventory system. O Errors can occur either in a perpetual or periodic inventory system. O Errors will not occur if you are using a perpetual inventory system. In a period of rising prices, ending inventory using FIFO will be_ending inventory determined using weighted average. O higher than O lower than O equal to O cost formulas have no impact on ending inventory In a period of increasing prices, which cost determination method will result in the lowest amount of cash flow? O FIFO. O Specific identification. O Weighted average. O Cash flow will be the same under all methods. A Vaughn company uses the perpetual inventory method and the beginning inventory is overstated by $5800 because the ending inventory in the previous period was overstated by $5800. The amounts reflected in the current end-of-period balance sheet are Assets Owner's Equity overstated overstated correct correct o understated understated overstated correct Overstatement of ending inventory causes O cost of goods sold to be overstated and net income to be understated. O cost of goods sold to be overstated and net income to be overstated. O cost of goods sold to be understated and net income to be understated. O cost of goods sold to be understated and net income to be overstated. During its December 31, 2021 year-end inventory count, Sheffield Company failed to count items in transit to which it had legal title As a result of this error, ending inventory was understated by $31100. Assuming the company makes no errors in 2022Googly's owner's equity at the end of December 2022 will be overstated by $31100 understated by $31100. O overstated by $62200. O correct. Marigold Computer Shop begins operations on June 1 and uses a perpetual inventory system. During June, the company had the following purchases and sales for its Model 10 Fastback Computer Systems Date Purchases Units Unit Cost 6 $2000 Sales (Units) June 1 5 3 9 9 $2600 16 Using the FIFO cost formula, the amount allocated to cost of goods sold for June is O $14000 O $14600 O $18200 O $20800. Having too much inventory can cost the company money in all the following areas except O storage costs O interest costs. O high tech goods becoming obsolete. O depreciation. All of the following are examples of strong internal control when counting inventory except O prenumbered inventory tags should be used. the inventory clerk should control all of the inventory count sheets the counting should be done by employees who are not responsible for either custody of the inventory or keeping inventory records. Othere should be a second count by another employee or auditor. In 2022, Waterway Inc. had average inventory of $90000. The 2022 income statement showed net sales of $2200000 and gross profit of $418000. In 2021. it was taking the company approximately 30 days to sell its inventory. The company's inventory turnover for 2022 was approximately O 19.8 times. O 12.2 times. 24.4 times. 0 4.6 times

Which of the following statements is correct? O Errors can only occur in a perpetual inventory system. O Errors can only occur in a periodic inventory system. O Errors can occur either in a perpetual or periodic inventory system. O Errors will not occur if you are using a perpetual inventory system. In a period of rising prices, ending inventory using FIFO will be_ending inventory determined using weighted average. O higher than O lower than O equal to O cost formulas have no impact on ending inventory In a period of increasing prices, which cost determination method will result in the lowest amount of cash flow? O FIFO. O Specific identification. O Weighted average. O Cash flow will be the same under all methods. A Vaughn company uses the perpetual inventory method and the beginning inventory is overstated by $5800 because the ending inventory in the previous period was overstated by $5800. The amounts reflected in the current end-of-period balance sheet are Assets Owner's Equity overstated overstated correct correct o understated understated overstated correct Overstatement of ending inventory causes O cost of goods sold to be overstated and net income to be understated. O cost of goods sold to be overstated and net income to be overstated. O cost of goods sold to be understated and net income to be understated. O cost of goods sold to be understated and net income to be overstated. During its December 31, 2021 year-end inventory count, Sheffield Company failed to count items in transit to which it had legal title As a result of this error, ending inventory was understated by $31100. Assuming the company makes no errors in 2022Googly's owner's equity at the end of December 2022 will be overstated by $31100 understated by $31100. O overstated by $62200. O correct. Marigold Computer Shop begins operations on June 1 and uses a perpetual inventory system. During June, the company had the following purchases and sales for its Model 10 Fastback Computer Systems Date Purchases Units Unit Cost 6 $2000 Sales (Units) June 1 5 3 9 9 $2600 16 Using the FIFO cost formula, the amount allocated to cost of goods sold for June is O $14000 O $14600 O $18200 O $20800. Having too much inventory can cost the company money in all the following areas except O storage costs O interest costs. O high tech goods becoming obsolete. O depreciation. All of the following are examples of strong internal control when counting inventory except O prenumbered inventory tags should be used. the inventory clerk should control all of the inventory count sheets the counting should be done by employees who are not responsible for either custody of the inventory or keeping inventory records. Othere should be a second count by another employee or auditor. In 2022, Waterway Inc. had average inventory of $90000. The 2022 income statement showed net sales of $2200000 and gross profit of $418000. In 2021. it was taking the company approximately 30 days to sell its inventory. The company's inventory turnover for 2022 was approximately O 19.8 times. O 12.2 times. 24.4 times. 0 4.6 times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started