Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following statements is FALSE? e) When we combine many stocks in a large portfolio, the firm-specific risks for each stock will average

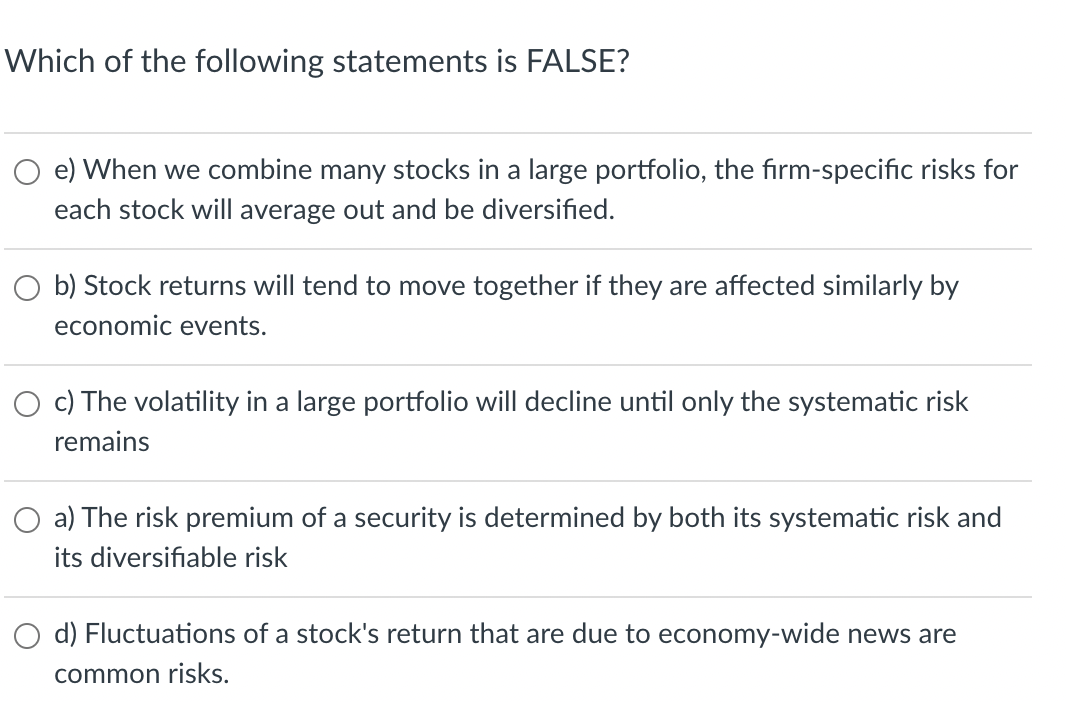

Which of the following statements is FALSE? e) When we combine many stocks in a large portfolio, the firm-specific risks for each stock will average out and be diversified. b) Stock returns will tend to move together if they are affected similarly by economic events. c) The volatility in a large portfolio will decline until only the systematic risk remains a) The risk premium of a security is determined by both its systematic risk and its diversifiable risk d) Fluctuations of a stock's return that are due to economy-wide news are common risks

Which of the following statements is FALSE? e) When we combine many stocks in a large portfolio, the firm-specific risks for each stock will average out and be diversified. b) Stock returns will tend to move together if they are affected similarly by economic events. c) The volatility in a large portfolio will decline until only the systematic risk remains a) The risk premium of a security is determined by both its systematic risk and its diversifiable risk d) Fluctuations of a stock's return that are due to economy-wide news are common risks Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started