Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following statements is incorrect regarding Active and Passive Investment strategies? Active investment strategy will most likely will have a higher standard

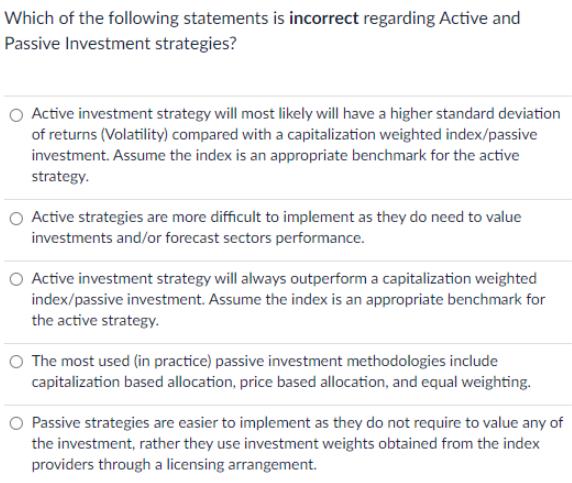

Which of the following statements is incorrect regarding Active and Passive Investment strategies? Active investment strategy will most likely will have a higher standard deviation of returns (Volatility) compared with a capitalization weighted index/passive investment. Assume the index is an appropriate benchmark for the active strategy. O Active strategies are more difficult to implement as they do need to value investments and/or forecast sectors performance. O Active investment strategy will always outperform a capitalization weighted index/passive investment. Assume the index is an appropriate benchmark for the active strategy. The most used (in practice) passive investment methodologies include capitalization based allocation, price based allocation, and equal weighting. O Passive strategies are easier to implement as they do not require to value any of the investment, rather they use investment weights obtained from the index providers through a licensing arrangement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The incorrect st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started