Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following statements is incorrect regarding tax planning opportunities for qualifying stock redemptions? 4. A corporation that uses installment obligations to finance

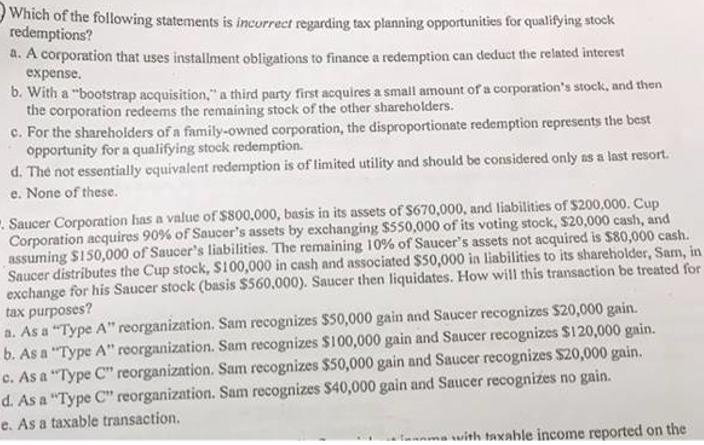

Which of the following statements is incorrect regarding tax planning opportunities for qualifying stock redemptions? 4. A corporation that uses installment obligations to finance a redemption can deduct the related interest expense. b. With a "bootstrap acquisition," a third party first acquires a small amount of a corporation's stock, and then the corporation redeems the remaining stock of the other shareholders. c. For the shareholders of a family-owned corporation, the disproportionate redemption represents the best opportunity for a qualifying stock redemption. d. The not essentially equivalent redemption is of limited utility and should be considered only as a last resort. e. None of these. Saucer Corporation has a value of $800,000, basis in its assets of $670,000, and liabilities of $200,000. Cup Corporation acquires 90% of Saucer's assets by exchanging $550,000 of its voting stock, $20,000 cash, and assuming $150,000 of Saucer's liabilities. The remaining 10% of Saucer's assets not acquired is $80,000 cash. Saucer distributes the Cup stock, $100,000 in cash and associated $50,000 in liabilities to its shareholder, Sam, in exchange for his Saucer stock (basis $560,000). Saucer then liquidates. How will this transaction be treated for tax purposes? a. As a "Type A" reorganization. Sam recognizes $50,000 gain and Saucer recognizes $20,000 gain. b. As a "Type A" reorganization. Sam recognizes $100,000 gain and Saucer recognizes $120,000 gain. c. As a "Type C" reorganization. Sam recognizes $50,000 gain and Saucer recognizes $20,000 gain. d. As a "Type C" reorganization. Sam recognizes $40,000 gain and Saucer recognizes no gain. e. As a taxable transaction. ma with taxable income reported on the

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

i For eligible stock redemptions a bootstrap acquisition is not a legitimate tax planning opportunit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started