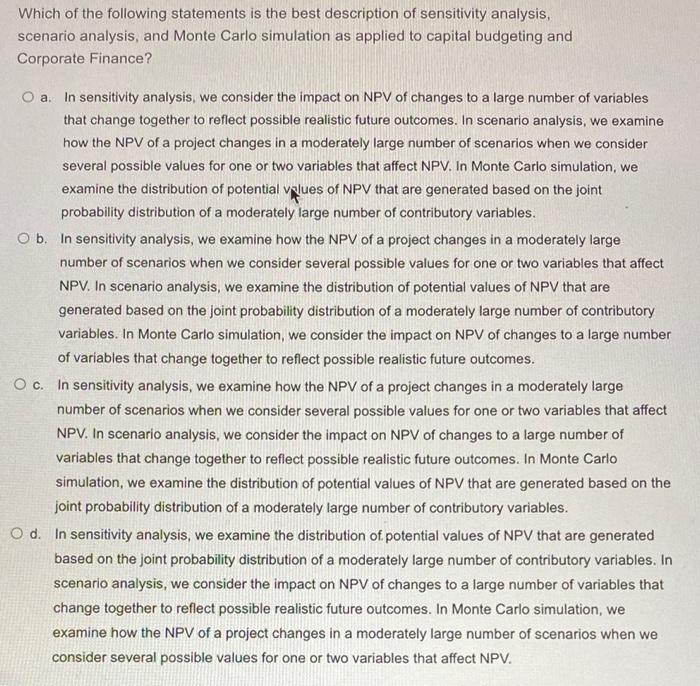

Which of the following statements is the best description of sensitivity analysis, scenario analysis, and Monte Carlo simulation as applied to capital budgeting and Corporate Finance? a. In sensitivity analysis, we consider the impact on NPV of changes to a large number of variables that change together to reflect possible realistic future outcomes. In scenario analysis, we examine how the NPV of a project changes in a moderately large number of scenarios when we consider several possible values for one or two variables that affect NPV. In Monte Carlo simulation, we examine the distribution of potential values of NPV that are generated based on the joint probability distribution of a moderately large number of contributory variables. O b. In sensitivity analysis, we examine how the NPV of a project changes in a moderately large number of scenarios when we consider several possible values for one or two variables that affect NPV. In scenario analysis, we examine the distribution of potential values of NPV that are generated based on the joint probability distribution of a moderately large number of contributory variables. In Monte Carlo simulation, we consider the impact on NPV of changes to a large number of variables that change together to reflect possible realistic future outcomes. O c. In sensitivity analysis, we examine how the NPV of a project changes in a moderately large number of scenarios when we consider several possible values for one or two variables that affect NPV. In scenario analysis, we consider the impact on NPV of changes to a large number of variables that change together to reflect possible realistic future outcomes. In Monte Carlo simulation, we examine the distribution of potential values of NPV that are generated based on the joint probability distribution of a moderately large number of contributory variables. O d. In sensitivity analysis, we examine the distribution of potential values of NPV that are generated based on the joint probability distribution of a moderately large number of contributory variables. In scenario analysis, we consider the impact on NPV of changes to a large number of variables that change together to reflect possible realistic future outcomes. In Monte Carlo simulation, we examine how the NPV of a project changes in a moderately large number of scenarios when we consider several possible values for one or two variables that affect NPV